That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive.

Is Interactive Brokers right for you?

In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. Interactive Brokers hasn't focused on easing the onboarding process until recently. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find.

How Interactive Brokers fees compare with competitors?

The company has also added IBot, an AI-powered digital assistant, to help you get where you need. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace.

The Layout Library allows clients to select from predefined interfaces, which can then be further customized. You can also create your own Mosaic layouts and save them for future use. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there.

Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. All the available asset classes can be traded on the mobile app. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time.

The fundamental research is solid and the charts are very good for mobile with a suite of indicators. It is worth noting that there are no drawing tools on the mobile app. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade.

However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Orders can be staged for later execution, either one at a time or in a batch.

You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. The ways an order can be entered are practically unlimited.

You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. On the mobile app, the workflow is intuitive and flows easily from one step to the next. Data streams in real-time, but on only one platform at a time. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface.

The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. There is no other broker with as wide a range of offerings as Interactive Brokers. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. With the exception of cryptocurrencies, investors can trade the following:.

Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks.

You can trade share lots or dollar lots for any asset class. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. This is a unique feature. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario.

The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. You can also set an account-wide default for dividend reinvestment. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate.

For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Clients can choose a particular venue to execute an order from TWS.

Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer.

There are three types of commissions for U. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see.

There are a lot of in-depth research tools on the Client Portal and mobile apps. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. You can use a predefined scanner or set up a custom scan. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. The market scanner on Mosaic lets you specify ETFs as an asset class. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost.

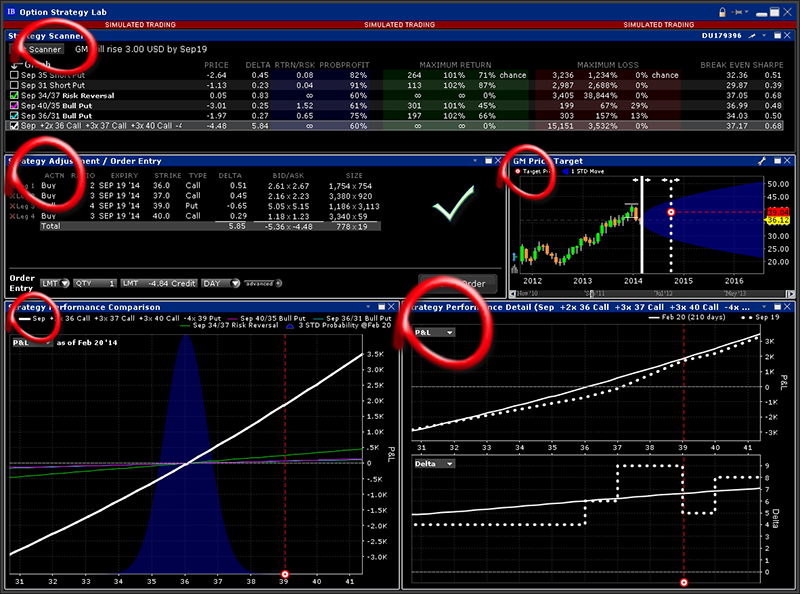

The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. This tool will be rolling out to Client Portal and mobile platforms in You can search by asset classes, include or exclude specific industries, find state-specific munis and more.

This tool is not available on mobile. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. The blogs contain trading ideas as well. Access to premium news feeds at an additional charge. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock.

You can also search for a particular piece of data. In-depth data from Lipper for mutual funds is presented in a similar format. Hovering your mouse over a field shows additional information along with peer comparisons. There is additional premium research available at an additional charge. A tool providing sustainable investment portfolio analytics is in beta-test as of October with the Impact Dashboard, which allows clients to align their portfolios with their values.

Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors.

Interactive Brokers Review

Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures.

This tool is available for futures options, options and covered stock strategies that include up to four legs. Note that the maximum number of legs might be lower depending on the destination. IBKR Traders' Insight is designed to give traders an edge by providing daily global commentary and market color from IB analysts and market participants. To view videos, click the "add tab" icon in the News panel and select Traders' Insight Videos.

Amicable Interactive Brokers Data Analysis using Python and R using reticulate

It's that simple! To move through the videos, hold your mouse over the video display to bring up the "forward" and "back" controls, and use these to move through available offerings. To watch on a larger display, use the right-click menu when you're on the tab to detach it from Mosaic.

IBot will present a series of simple parameters for you to complete. You have multiple ways to provide order details to IBot when creating your algo:. At any time in the process, use the Preview Order list item to see the progress of your algo. When the algo order is complete, IBot presents a full summary of the order as you defined it.

Please note that this feature is being rolled out to clients gradually.