Non-Directional Strategies are neutral strategies that are not based on the direction the market moves. Whether markets move up or move down, these strategies will generate profits. They are the complete The Forex Overlapping Fibonacci Trade Strategy is a forex trading strategy which utilizes the confluence of Fibonacci levels with other Fibonacci levels, support levels, resistance levels, pivot Breakout Strategy.

Gap Fill Strategy. Support and Resistance Strategy. Moving Average Strategy. This is one of the common forex trading strategies. Prices of assets move in Can you make money trading Forex? Definitely Yes. You can make money trading Forex. To make sure you understand my question, I will rephrase What is a Trading Gap? A trading gap is an area on the price movement where the asset price moves sharply up or down leaving a remarkable space where seemingly no trading activity has occurred. Are you a new trader in Olymp trade? Have you been trying to make money trading but each time you stake real money you end up with a negative balance?

There are as many strategies to trade ftts as there are traders, to use them. But the tragedy will be, if you are still trading without any. Mere luck may deceive you that you can What is Bladerunner Trade Strategy? This EMA acts as a blade to cut through The price Pops out of the What is the Forex Fractal Strategy? The Forex Fractal Strategy is a forex trading strategy that utilizes basic repeating patterns of the price of an asset called fractals to spot market entry points. It may Daily Fibonacci Pivot Trade Strategy is a forex trading strategy that applies the Fibonacci retracements in confluence with daily pivot levels to spot entry points for trades.

Did you just begin Forex Trading in Olymp Trade? Then chances are, you have traded with the naked eye, lost, and are now looking for best beginner forex trading strategies to improve your winnings.

What is the Forex Grid Strategy? The Forex Grid Strategy is a trading technique that involves placing Buy and Sell Stop Pending orders at regular intervals above and below a certain set price. This creates Can I tell you one thing about trading strategies? They need continuous improvement. Market conditions are not rigid but fluctuate now and then. That calls for flexibility and adaptability on the part of the trader Imagine a captain sailing a ship without the compass direction and the map of the voyage, what do you think would happen?

Well, such is trading. Did you just begin trading Forex or Fixed Time Trades today? If Yes, then you are in the right place. Might a simple When you begin trading Forex and Fixed Time Trades in Olymp Trade, your first point of focus is how many trades you win against how many you lose. As you grow older in the business, Yes, a No-Loss Trading Strategy — what every trader out there has been looking for. But, does such a thing really exist?

Like, how does any trader in such a The 50 Pips a Day Forex Trading Strategy is a trading technique whose profit target is only 50 Pips a day in a single trade What is the 1 hour Forex Strategy? The 1 hour Forex Trading Strategy is a technique of trading forex which is based on the 1 hour candlestick chart time frame. The most preferred 1 hour What is the 4 hours Forex Strategy?

The 4-hour Forex Strategy is a trading technique in which the four-hour candlestick chart time frame is used to make trading decisions. This Strategy is like any other, What is the Directional Bias Strategy? The Directional Bias Strategy is a trading technique that involves establishing the direction of the market price and conditions which confirm the direction, then placing trades in that direction. What is the Swing Trading Strategy? The Swing Trading Strategy is a trading technique that involves setting up a trade and leaving it running for over a period of few days to weeks or even What is the Pyramid Trading Strategy?

The Pyramid Trading Strategy is a technique of trading that takes advantage of trending markets to add to winning trades in the direction of the trend. You do not We discuss the most popular triangle patterns, how to identify them, and lastly, how to enter orders using patterns. If you are If you are familiar with the head and shoulders trend pattern, then double tops and the double bottom patterns should be a walk in the park. Essentially, they both signify trend reversal.

But while they Worse still, you might already have a trading strategy which you hoped would turn things around but turns out, There are very many technical Indicators on the Olymp Trade platform and still trading without one?

That must be so daring of you. But I bet, trading without technical indicators and guided strategies have seen Are you tired of making losses over and over again on Olymp Trade? Have you tried making your own strategies, tried using them on your real account but still failed? Are you looking for a proven strategy that can make you upwards of KES 30, per month on Olymp Trade? You are in the right place. Because in this article, I will reveal how you Wait for profit? And on top of our list has But make no mistake not using it as illustrated in this post.

You may lose all your funds. And I doubt you want that, do you?

Let me introduce you to this powerful trading strategy. What am I talking about? The trending trading If you are looking for an Olymp Trade trading strategy, you must know how hectic it is to get one that works. As such, it becomes a headache to actually predict a profitable trade. Kenn Omollo is an investment writer and a business management consultant at Joon. Reach him at — kenn joon.

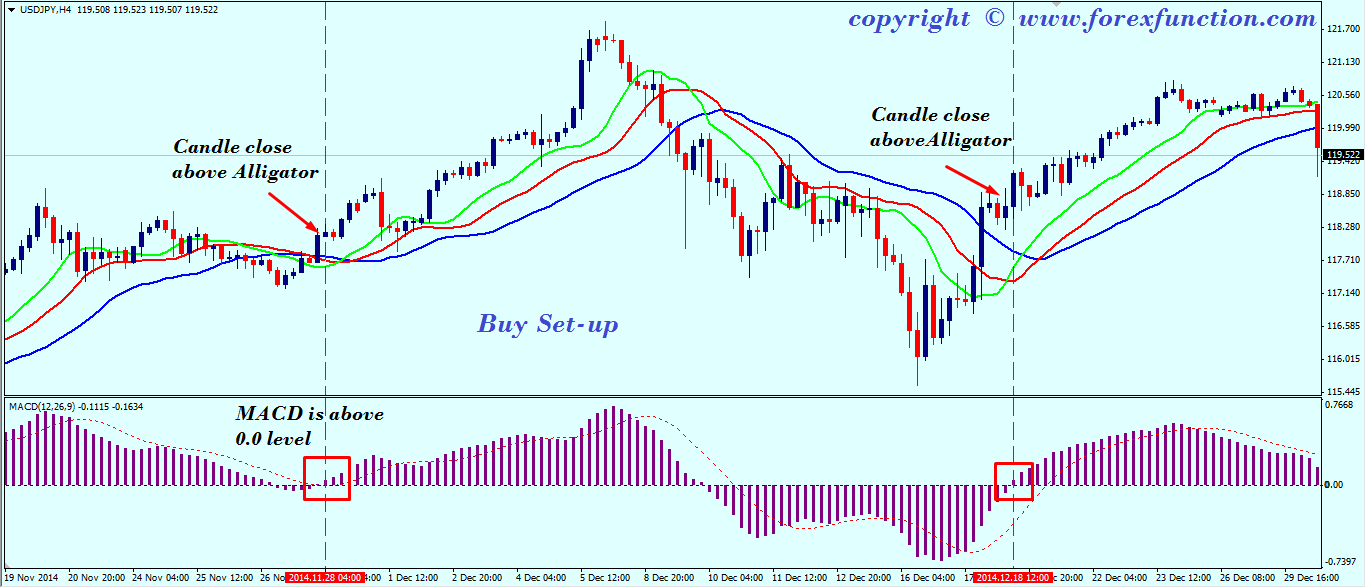

Learn About The Alligator Indicator

See author's posts. Don't have an Olymp Trade Account? Register Here. Visit Website. Register on the platform Complete the interactive tutorial Choose one of the strategies Practice using a demo account Make a deposit and become an expert. The information provided does not constitute a recommendation to carry out transactions. When using this information, you are solely responsible for your decisions and assume all risks associated with the financial result of such transactions. March 11, March 3, March 1, February 28, February 26, February 8, February 7, February 5, February 1, January 26, January 24, January 20, January 19, January 18, January 15, January 14, January 13, January 12, January 11, January 9, January 6, January 5, January 4, January 3, December 28, December 27, December 26, When this occurs, section of the previous high and low and using your entry tactics, trade inside the range.

At the same time, the spacing of the Alligator lines is supporting your short trade. Once the lines have shown a direction, you can resort to using a price pattern that is a staple of all traders — pullbacks. You want to see all lines pointed in the same direction, in order, which shows a trend is underway.

How To Use The Alligator Indicator For Trading In Binomo -

Unlike the first strategy, trading pullbacks in a maturing trend does pose risks as the trend may run before giving a trading opportunity. You can determine the length of pullback needed by choosing where price has to pull back to.

- trading system srl milano.

- Trading The Alligator by Bill Williams;

- forex brokers inc reviews.

Here you can see obvious pullbacks that have pulled to the green and red line while the blue kept the upwards slope. The horizontal line is not a perfect pullback but the tail on the lower green candlestick is a price action reversal near the first pullback low. On the far right, you can see this pullback failed however there was not break above the yellow line before price began to close under the 3 lines.

The simplest trading strategy for the Alligator is to trade the close of a candlestick after it crosses the lines. I would suggest that traders look at support and resistance to ensure the buy and sell signal is not right into a previous cluster of price. Note the the green line has crossed over the red to the downside. Remember, these lines are displaced into the future and would have plotted in front of the candlestick we are shorting.

As for a stop loss when using the Alligator, consider using a multiple of the average true range or use previous swing high and lows. The most important part of the Bill Williams Alligator is when the 3 lines are mixed together. This is when the Alligator is considered to be sleeping and no trading signals are present. You should keep these instruments on your radar especially if price action is hinting at an increase in momentum.

The best time to get on board a trend move is just before it happens. While you may not be able to pick the exact price the trend begins, getting in as close to the beginning as possible should be your goal. When the Alligator is feeding, watch for pullbacks against the main trend direction and trade those moves with a pullback strategy.

The Alligator Trade Examples

As with any trading strategy, it is vital that you test it, lay out a trading plan, and ensure risk management is priority one. Hey John. I personally trade daily charts. Any timeframe you choose, make sure to test it. With moving averages on lower time frames, you can get a ton of whip back and forth. Thanks for explaining Alligator indicator in detail!

Why are More Traders Switching to FP Markets?

Thank you for a really great explanation about Alligator in such a clear concise manner. How to trade it and make more money? What Alligator Trading strategy is the right one?

- best indicator forex free download.

- Hot topics.

- axis forex card balance check online.

How to use this Alligator indicator properly without blowing up our accounts? Lets find out.