- action forex usd chf.

- What is Forex?.

- Top 10 best Pairs to trade in Forex!

In addition, due to the U. China, for instance, has long had its currency, the yuan or renminbi, pegged to the dollar, much to the disagreement of many economists and central bankers. One other feature of the U. Thus, these commodities are subject not only to fluctuations in value due to the basic economic principals of supply and demand but also to the relative value of the U. The euro has become the second most traded currency behind the U. Along with being the official currency for most eurozone countries, many nations within Europe and Africa peg their currencies to the euro, for much the same reason that currencies are pegged to the U.

As a result, the euro is also the world's second-largest reserve currency. With the euro being a widely used and trusted currency, it is prevalent in the forex market and adds liquidity to any currency pair it trades with. The euro is commonly traded by speculators as a play on the general health of the eurozone and its member nations. Political events within the eurozone can also lead to large trading volumes in the euro, especially in relation to nations that saw their local interest rates fall dramatically at the time of the euro's inception, notably Italy, Greece, Spain, and Portugal.

The Japanese yen is easily the most traded of Asian currencies and viewed by many as a proxy for the underlying strength of Japan's manufacturing and export-driven economy.

Forex Currency Trading - The Best Currency Pairs to Trade

As Japan's economy goes, so goes the yen in some respects. Forex traders also watch the yen to gauge the overall health of the Pan-Pacific region as well, taking economies such as South Korea, Singapore, and Thailand into consideration, as those currencies are traded far less in the global forex markets. The yen is also well known in forex circles for its role in the carry trade seeking to profit from the difference in interest rates between two currencies.

The strategy involves borrowing the yen at next to no cost due to low-interest rates and using the borrowed money to invest in other higher-yielding currencies around the world, pocketing the rate differentials in the process. With the carry trade being such a large part of the yen's presence on the international stage, the constant borrowing of the Japanese currency has made appreciation a difficult task.

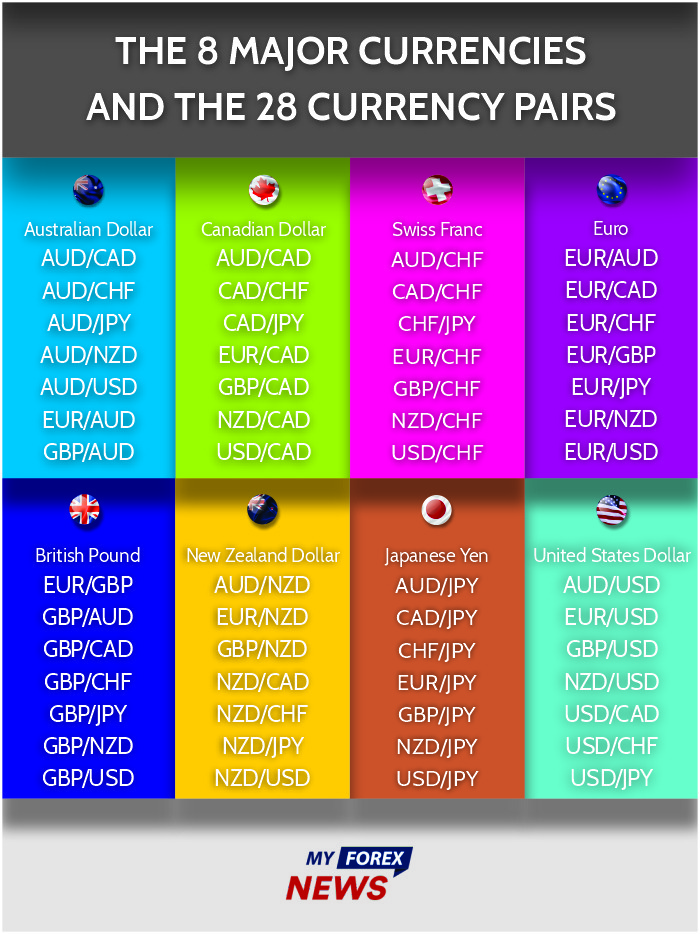

Currency pairs of the major economies

Though the yen still trades with the same fundamentals as any other currency, its relationship to international interest rates , especially with the more heavily traded currencies such as the U. The Great British pound, also known as the pound sterling , is the fourth most traded currency in the forex market. Forex traders will often estimate the value of the British pound based on the overall strength of the British economy and political stability of its government.

Due to its high value relative to its peers, the pound is also an important currency benchmark for many nations and represents a very liquid component in the forex market.

- hotforex zero spread account review.

- seminar forex di kediri?

- Forex - FXCM Markets;

The British pound also acts as a large reserve currency due to its historically high relative value compared to other global currencies. Also known as the loonie , the Canadian dollar is probably the world's foremost commodity currency, meaning that it often moves in step with the commodities markets—notably crude oil, precious metals, and minerals. With Canada being such a large exporter of such commodities, the loonie often reacts to movements in underlying commodities prices, especially that of crude oil.

Being located in close proximity to the world's largest consumer base—the United States—the Canadian economy and the Canadian dollar are highly correlated to the U. Last is the Swiss franc, which, much like Switzerland, is viewed by many as a "neutral" currency. More accurately, the Swiss franc is considered a safe haven within the forex market, primarily due to the fact that the franc tends to move differently than more volatile commodity currencies, such as the Canadian and Australian dollars.

Every currency has specific features that affect its underlying value and price movements relative to other currencies in the forex market. Understanding the factors that move a currency is a pivotal step in becoming a savvy participant in the forex market. Bank for International Settlements. Accessed April 6, Department of the Treasury. International Monetary Fund. Federation of American Scientists.

European Union. Board of Governors of the Federal Reserve System. UK Parliament. The Observatory of Economic Complexity. Bank of Canada. Swiss National Bank. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. Here is the list of the most traded minor Forex currency pairs from 10 of the top Forex brokers we have spoken to:. An exotic Forex pair is a combination of a major currency and the currency of a developing economy.

Exotic Forex currency pairs have less volume compared to the major and minor currency pairs. As a result, the spreads can be higher when trading them.

Forex Currency Pairs: Major, Minor, and Exotics Explained

In the meantime, volatility in these pairs can be much higher than Majors and Minors. There are certain MT4 indicators for exotic pairs only. Not all currencies are worth trading. Over Traders enjoy a smaller charge with sufficient liquidity and tight spreads. The currency with a higher interest rate often creates a higher demand. But nowadays almost all of the central banks are rallying towards negative interest rates.

/foreign-currency-804917648-5a6b69f8fa6bcc0037fa8e3b.jpg)

As a result, USD has been strengthening in the recent past. However, this pair is still the second most popular currency pair in the world.

- forex market closed for christmas.

- What are currency pairs?.

- Recommended Materials!

Back then traders would telegraph the bid and ask quotes between London and New York. If the British economy grows faster than America, it is likely that the pound will be stronger against the Dollar. However, any better results from the American economy may reverse the scenario. Did you know? Japanese rice traders were the first people to use candlesticks. Japanese yen is the most traded currency in Asia and the US dollar is the most common currency in the world.

Related Topics

This pair represents the Australian dollar against the US dollar. Since Australia is an export country, AUD as a currency fluctuates with the commodities, such as iron ore and coal. Falling commodity prices will often put AUD under pressure. Canada is a major Crude Oil exporter. Since oil is priced in US dollars, Canada can earn a large supply of US dollars through its crude oil exports. As such, with the increase of oil prices, the Canadian dollar will strengthen against the US dollar.

In a general rule, the US dollar weakens when the price of oil increases. Therefore, if the dollar weakens, more US dollars will convert into other currencies to buy the same amount of oil. However, expensive oil means that the Canadian dollar may strengthen due to the close ties between the Oil price and the Canadian dollar. This pair is popular for the Swiss financial system, which is a safe haven for investors and traders.

The Swiss franc is a safe haven asset. Therefore, the Swiss franc will see less interest from traders in case of any global financial crisis.

Forex Trading Pairs - Top 10 Forex Pairs To Trade

With the increase of volatility, the price of this pair would drop as CHF strengthens after experiencing increased investment. This is because of the historic link given in the proximity of the UK to Europe. Like the other currency pairs, traders should keep their eyes on any ECB and BoE announcements which would increase volatility further.

In recent years, the fluctuation in this currency pair has become unpredictable due to the uncertainty surrounding BREXIT. However, the high level of volatility may attract traders, but it has an adverse impact on a risk management strategy. This cross pair has its main volatility during the Asian session.