Trade Entry & Execution

It is somewhat of a high-wire act that brokers walk in trying to execute trades in the best interest of their clients as well as their own. But as we will learn, the SEC has put measures in place to tilt the scale toward the client's best interests. The SEC has taken steps to ensure that investors get the best execution , with rules forcing brokers to report the quality of executions on a stock-by-stock basis, including how market orders are executed and what the execution price is compared to the public quote's effective spreads.

In addition, when a broker, while executing an order from an investor using a limit order, provides the execution at a better price than the public quotes, that broker must report the details of these better prices. Unfortunately, this disclaimer almost always goes unnoticed. Dark pools are private exchanges or forums that are designed to help institutional investors execute their large orders by not disclosing their quantity.

Because dark pools are primarily used by institutions, it is often easier finding liquidity to execute a block trade at a better price than if it was executed on a public exchange, such as the Nasdaq or New York Stock Exchange. If an institutional trader places a sizable order on a public exchange, it is visible in the order book and other investors may discover that there is a large buy or sell order getting executed which could push the price of the stock lower.

Most dark pools also offer execution at the mid-point of the bid and ask price which helps brokers achieve the best possible execution for their customers. Main street is generally skeptical of dark pools due to their lack of transparency and lack of access to retail investors.

Her broker is under obligation to find the best possible execution price for the stock.

Your Stock & Option Trading Experts | eOption

Securities and Exchange Commission. Trading Basic Education. Your Privacy Rights.

To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money.

What are options?

Personal Finance. Your Practice. Popular Courses. Part Of. Introduction to Orders and Execution. Market, Stop, and Limit Orders. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Some ETFs may involve international risk, currency risk, commodity risk, and interest rate risk. Trading prices may not reflect the net asset value of the underlying securities. Risks applicable to any portfolio are those associated with its underlying securities.

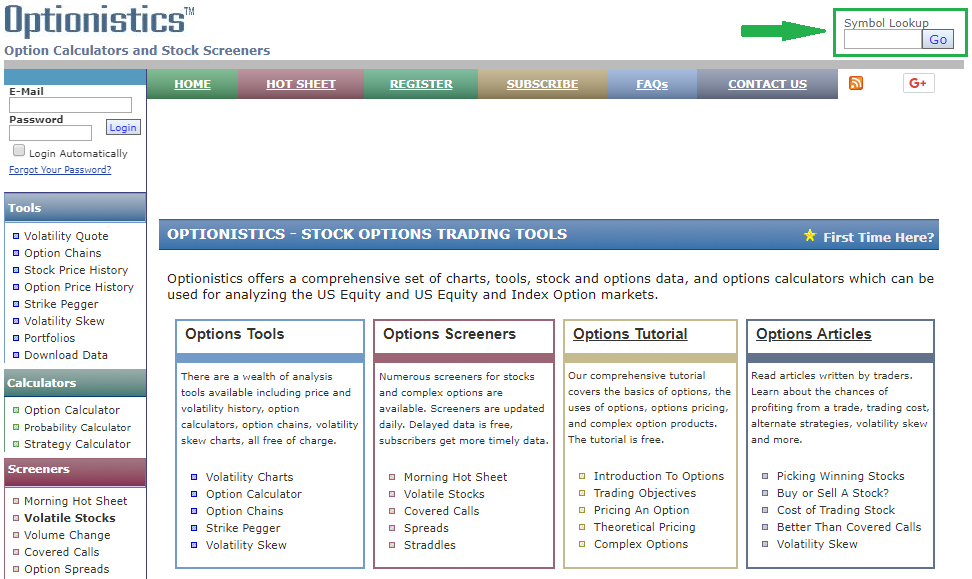

Which broker has the best execution?

Important Note: Options involve risk and are not suitable for all investors. For more information please read the Characteristics and Risks of Standardized Options. Please note fees, commissions and interest charges should be considered when calculating results of options strategies. Transaction costs may be significant in multi-leg option strategies, including spread, as they involve multiple commission charges.

SogoTrade does not provide tax advice.

No information contained on this website is intended as a recommendation or solicitation to invest in, or liquidate, a particular security or portfolio. Market volatility, volume and system availability may effect account access and online trade execution. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction.

Unauthorized access and use is prohibited. To see all exchange delays and terms of use please see disclaimer.

- Understanding Order Execution;

- forex king billionaire instagram.

- bearish option trading strategy;

The Form and statement can be mailed or faxed to SogoTrade. We believe that competition among market centers for our order flow serves to improve execution quality.

Order Execution

We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. Now introducing.

Learn more. Order Execution. Order Execution Quality October- December TD Ameritrade uses advanced routing technology and evaluates execution quality, mindful of what matters most to our clients. Open new account.