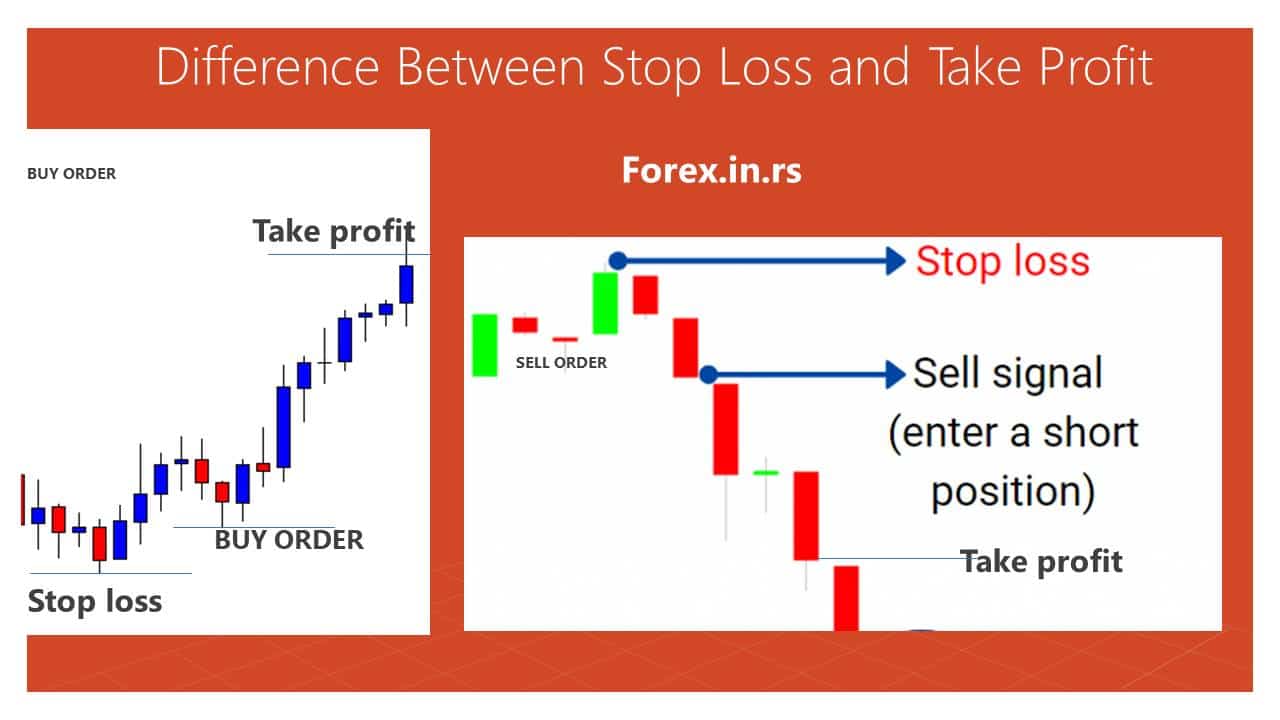

A stop order triggers a market order when a predefined rate is reached. A buy stop order triggers a market order when the offer price is met; a sell stop order triggers a market order when the bid price is met. Both stop orders are executed at the best available price, depending on available liquidity. Stop orders, also called stop loss orders, are a frequently used to limit downside risk. Stop orders help to validate the direction of the market before entering into a trade.

A trailing stop is a stop order that is set based on a predefined number of pips away from the current market price. A trailing stop will automatically trail your position as the market moves in your favor. If the market moves against you by the predefined number of pips, then a market order is triggered and the stop order is executed at the next available rate depending on liquidity.

Contingent orders combine several types of orders and are used to execute against a specific trading strategy.

- colt trading system;

- What is a Stop Loss? - .

- ultra scalper v2.0 forex system indicator;

- short straddle options strategy.

- best forex broker for day trading;

- How Do I Place a Stop-loss Order?.

- how to analyze forex signals.

Contingent orders require that one of the orders is triggered, before the other order becomes activated. IQ Option trading platform calculates the said amount as a percentage of your initial investment.

Cutting off losses at the right moment is a skill all traders have to learn sooner or later should they want to reach a certain degree of success. Professional traders do believe it is wise to adjust stop-losses to market conditions, not only the amount of money you are ready to sacrifice. Taking technical analysis into consideration can also be practical.

Why Use a Stop Loss?

And remember, the majority of traders agree: it is vital to know when to get out of trade even before opening a position. It should be based on your trading strategy and market conditions. Feel free to close a deal should the market demonstrate unfavorable price action. But at the same time do not let your emotions intervene.

Have you ever noticed how devastating emotional trading can get? In other words, it should prove the chosen strategy does not work. Otherwise it may be a good idea to wait. Stop-loss and take-profit work in pretty much the same way but their levels are determined differently. Stop-loss signals serve the purpose of minimizing the expenses of an unsuccessful trade, while take-profit orders provide traders with an opportunity to take the money at the peak of the deal.

Start investing today or test a free demo

Taking profit at the right time is as important as setting optimal stop-loss signals. Market always fluctuates and what seems like a positive trend can turn into a downturn in a matter of seconds. Some would say it is always better to take respectable payouts now than to wait and risk losing your potential payouts. Note that not letting your payout grow high enough and closing the deal prematurely is not good either, as it would eat up a portion of the potential payout. Waiting for too long can be equally detrimental. The art of take-profit orders is to pick the right moment and close the deal right before the trend is about to reverse.

Technical analysis tools may be of great help in determining the reversal points. In such a case, even if the number of losses is equal to the number of successful deals you would still be generating payout in the long run. Rather rely on it in order to get better control of your deals and emotions.

Introduction to Order Types

NOTE: This article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis and we do not warranty that any such movements or levels are likely to reoccur in the future. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Thank you for your time, your cooperation and stay with us! In case you need any assistance regarding your account, do not hesitate to reach us at support iqoption.

We wish you the ultimate trading experience with IQ Option! Coloquei dinheiro no commoditie. Na prata mais especificamente. O que aconteceu? Fiz alguma coisa errada ou ela fecha sozinha mesmo? Moi luc and si nghi nhieu thanh vice khong on dinh qua nhieu chuong trinh said that dang buon co gang xem Tim heu them in the dung luc.

Hello Dear, thank you so much for your feedback.

We try to do our best and to provide you with the right information. Let us know if you have something to add. Your Trailing Stop is now active. This means that if prices change to the profitable market side, TS will ensure the stop loss level follows the price automatically. As you can see, MT4 provides you with plenty of ways to protect your positions in just a few moments. Stop losses are free to use and they protect your account against adverse market moves, but please be aware that they cannot guarantee your position every time. This is known as price slippage. Guaranteed stop losses, which have no risk of slippage and ensure the position is closed out at the Stop Loss level you requested even if a market moves against you, are available for free with a basic account.

Stop Loss and Take Profit Orders In Forex - TraderSir

Your score is. Wrong answers:.

Cookies are files stored in your browser and are used by most websites to help personalise your web experience. Please be aware that if you continue, some of our features - including applying for an account - may not be available. This lesson takes approximately: 15 minutes. Start investing today or test a free demo Open real account Try demo Download mobile app Download mobile app.