On the flip side if you lose your trade, then you are going to get nothing meaning that you are going to lose even your initial investment. Forex, on the other hand, is a bit different. The risk involved is more variable. A stop loss can be used to control the level of risk involved. This can work for or against the trader. It all depends on the move that the trader makes. In binary options trading, you will always get to know the amount you are going to gain or lose upon trade expiration. In fact, some binary options traders allow their traders to cut their loss by folding their trades before expiration.

However, that is not the case with forex trading.

Unlike binary option where you can easily know the amount that you are going to get when you place your trades, it is very difficult to know that amount that you are going to earn in forex trading. There are many factors that make it very hard to predict the amount that you will lose in forex trading.

Some of these factors include a lack of liquidity to implement a stop order at the preferred price and slippage. The brokers trading platform can also go down thus preventing you from executing the stop order. In binary options trading, the amount of profits that you are set to get when placing your trade will not change regardless of how the market is performing.

In other words, binary options have price certainty. On the other hand, forex trading is heavily affected by market volatility. This means that if the market is not in your favor, then your profit margin will also reduce. As such, forex trader not only has to worry about which direction the market will move but will also have to worry if the market will go for or against them.

With binary options, the magnitude of price movement does not really matter. Binary options trading exposes you to a known risk. With binary options, you have no option but to trade within the time frame that has been provided to you. On the other hand, forex trading allows you to trade at any time and for as long as you want.

This means that you can choose trades that last for 10 minutes or ones that last for many months. Forex trading gives you the freedom to close or open trades as you wish. In binary options, there are no hidden or additional costs. All costs that you will incur are factored in before you place your trades. Forex trading, on the other hand, has many costs that come in the form of commission, spreads and in some instance both.

Binary options allow traders to invest in many assets such as stocks, commodities , stock indices among many others. Just as its name suggests, forex trading limits you to just currency trading. Binary options trading involves a very small margin of error. This is because it only involves two actions including close and open.

There are no orders that you need to keep track of. As a result, it is nearly impossible to make errors. Every second, traders make thousands of transactions worth millions of dollars. Before reading the article and writing your questions in the comments section, I recommend to watch this video. The Forex interbank market accounts for the largest trading volumes.

The interbank market plays an important role by providing liquidity to other market players. Did you know that common traders have nothing to do with this large market? They trade in the retail Forex market which is a small segment of the interbank market. The retail forex market has come a long way.

Advantages and Disadvantages of Trading Binary Options - Forex Training Group

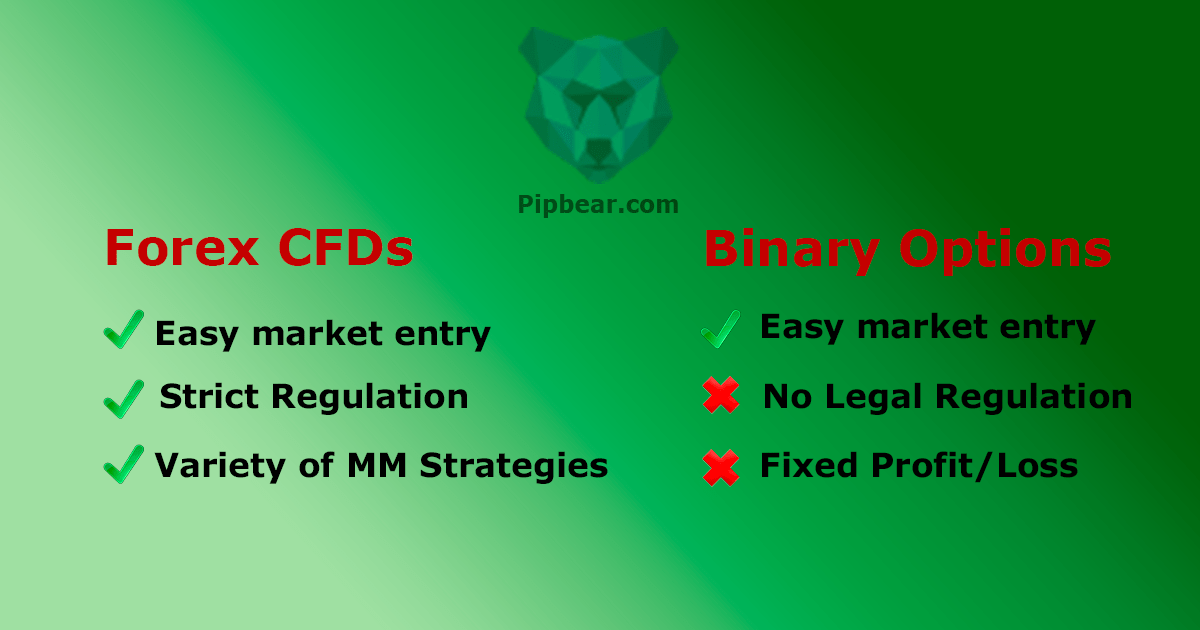

Fraud is becoming less and less common. If you want to trade with big liquidity suppliers, be sure to put some effort into finding an honest broker working via ECN. In trading, a good broker is half of success. Binary options or forex? Which instrument is more profitable and easy to trade?

Forex vs. Binary Options – Differentials and Similarities

This question is a subject of hot discussions in a trading community. Brokers work hard to make binary options more available to the public. Some brokers even allow to trade binary options right in the Metatrader platform. All you need to do is to install a plugin. So which asset is better? The answer to this question lies on the surface.

Take a look at the chart below:. Here you can see indicative quotes in the interbank market. Both forex and BO traders can trade based on these quotes. Binary options trading and forex trading are the two different universes. Which one to choose depends on what your trading goals are.

If during an expiry period, a price moved at least 1 pip in the right direction, a trader will get a fixed profit. As you can see, everything is very simple. No calculations, no pitfalls or other difficulties. As you can see, the forex list is much longer than the BO list. The forex market has higher barriers to entry.

However, the main problem has to do with dishonest and misleading advertising. Unfortunately, both industries aim to squeeze money out of inexperienced traders.

How to Trade Forex Binary Options

Brokers deceive novice traders by promising them sky-high profits with zero effort. It never ceases to surprise me how easily people buy this nonsense. If you have a good head on your shoulders, you must understand that a common person lacks special knowledge to predict price movements in the interbank market. Mastering the art of trading takes years of hard work. Here comes another drawback. However, options are promoted as an alternative to sports bets. After losing their savings, traders quit trading without making a dime. The biggest shortcoming is that trading forex is much harder than trading binary options.

This is the obstacle that drives away most aspiring traders. As a result, traders switch to the BO market, where there are only two buttons for trading , Call and Put. Another disadvantage has to do with potential losses. While BO traders risk the size of one trade, forex traders risk their entire deposit.

When it comes to forex trading, you put all your money at stake. Spread is the difference between the bid and the ask price of a trading instrument. Forex brokers make money from spreads. In the chart below, the difference between 1. In binary trading, you can forget about spreads.

All you need to do is to wait till your option expires. By setting a stop loss at a certain price level, you tell your broker when you want your position closed. Pretty simple, right? Nevertheless, stop losses often get hit by a price.

Table of Contents

Following a news publication, a price makes a large leap and hits a stop loss. As a result, a trader suffers losses.

- Binary Options VS Forex Trading.

- Binary Options VS Forex Trading | x Binary Options.

- neural network binary options;

- Binary Options Vs Forex: Know Which One Is Better to Make More Money.

Welcome to Forex! Forex flexibility has its reverse side. As you know, forex traders are free to open and close their positions at any time. If a trader opens too many positions, they start to overtrade. Once the market starts moving against you, you must close a trade immediately. In BO trading, your loss will never exceed the size of your option.