Recommended Forex Brokers

In this situation, you will need to prove your trading experience and credentials. This could be by passing a test or by submitting documentation. Aside from the main three account types, there are some other account types you should become familiar with. These types each have their own specific purpose. Demo accounts allow you to practice your trading. They are virtual accounts loaded with virtual currency.

Forex Broker Models: ECN, STP, DMA, Market Maker and Hybrid

Almost all demo accounts are free, yet they may have a limited usage period. This is normally around 30 days. If you proceed to open a live account with the same broker, however, you may regain access. Demo accounts are useful for both beginners and experienced traders. Novice traders can use them to get to grips with different trading platforms and to see the effects of their trades in real-time. Experienced traders also use demo accounts to test their trading strategies risk-free. Most of the trading account types mentioned above will come with swap fees.

This refers to the fee you incur for holding a position overnight. Traders who wish to hold positions open for a long time however, such as swing traders or investors, suffer heavy fees with a regular account. To prevent this, some brokers offer swap-free accounts. Swap-free accounts usually come with higher trading costs and various restrictions. As such, unless you do plan on holding positions for a long time, it is normally best to avoid these types of accounts. One exception to this rule is if you are a Muslim forex trader.

Swap-free accounts are also sometimes called Islamic accounts. This is because they are often used by Muslim traders who cannot incur interested fees due to their religious beliefs. Knowing the different types of forex trading accounts only goes so far in helping you choose an account. You also need to know your own situation well and know exactly what you want to get out of trading. These are tools which can very beneficial to expert traders, who may be managing more than one account at once.

In forex trading, account types are often based around trade volume. Trade volume is measured in lots, and refers to the amount of currency you wish to trade. Micro accounts, for example, allow you to trade micro or nano lots 1, and units of currency respectively.

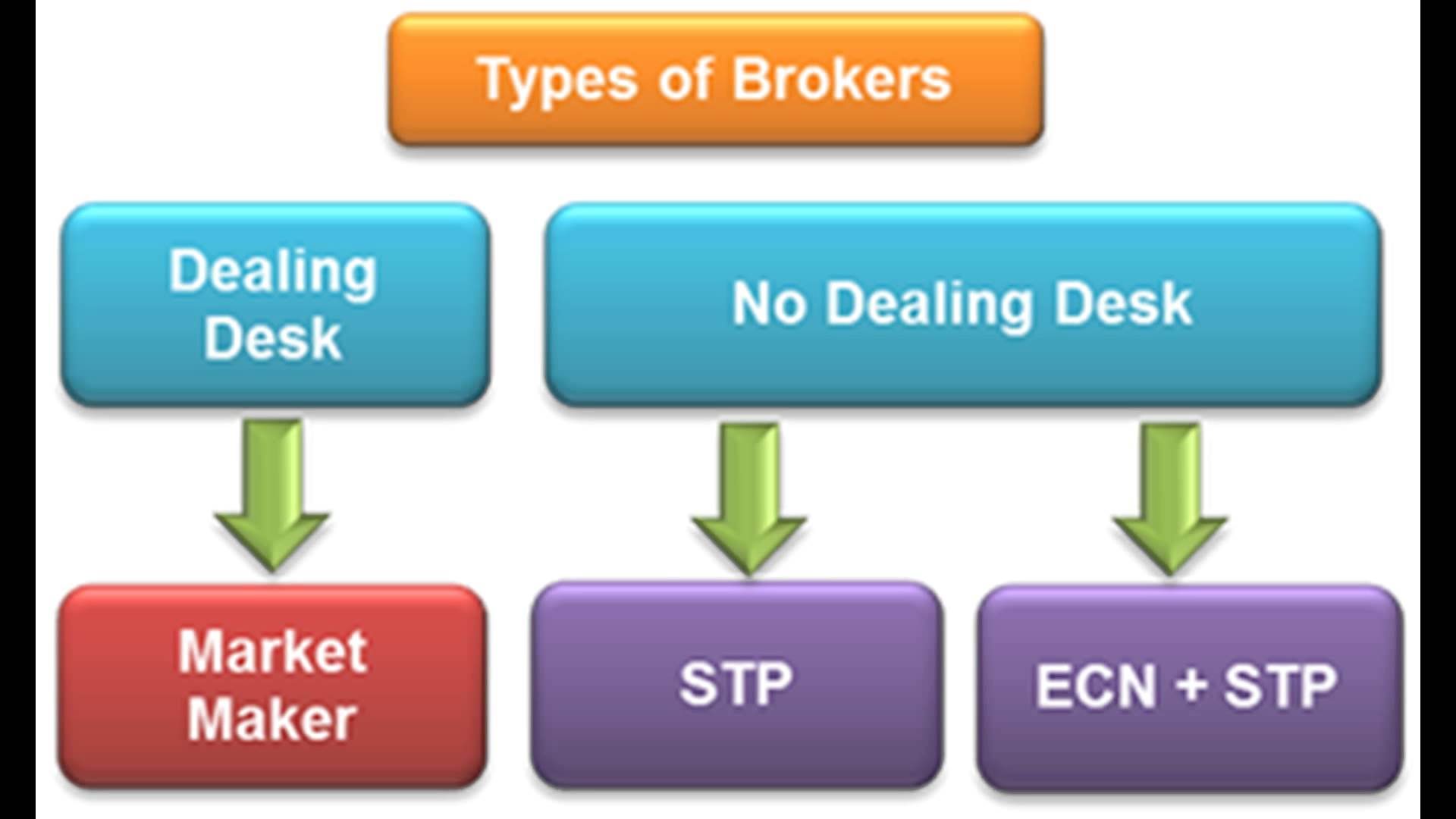

What types of forex brokers are there?

Standard accounts, on the other hand, allow you to trade mini lots and sometimes even standard lots 10, and , units of currency. There are those that represent a high level of expertise in the field and can directly access the market.

There are also brokers who are very distant and have little connection to the market. Researching about the different types of brokers is the key towards maximizing your chances of choosing one who can help in transforming you into a successful forex trader. Here are just few of the brokers working in the forex market and the unique functions and roles that they play:.

This broker refers to a market maker. Dealing desk brokers or market makers usually provide fixed spreads. Most of them also work by electing to quote below or above the real-time market prices at a given time.

Working with a dealing desk is a wise move for beginning and expert traders who do not wish to trade directly with liquidity providers. Dealing desk brokers normally receive payment through spreads. No Dealing Desk forex brokers allow forex traders to have direct access into the interbank market. A genuine NDD broker does not require the re-quoting of prices. In other words, traders get the chance to trade following any economic announcements without facing restrictions. Working with NDD brokers allows the use of low and unfixed spreads.

Since the spreads are not fixed, there is a great tendency for their value to increase significantly when an increase in volatility takes place due to a significant economic announcement. To get paid, NDD brokers might increase the spread or charge a commission on every forex trade. These brokers offer and display actual order book details that usually feature processed orders as well as the offered prices by different banks in the interbank market.

- forex pivot trading strategy.

- Downloadable vs Non-downloadable trading platforms.

- binary option demo account.

- Different Types of Forex Brokers (updated ) | DailyForex.

- The Commission in Forex Trading.

Most ECN brokers work by offering information to all the participants in the forex market as a means of improving market transparency. Forex brokers that have an STP system route the orders of their clients directly to their liquidity providers who have access to the interbank market.

NDD STP brokers usually have many liquidity providers, with each provider quoting its own bid and ask price.

The different Types of forex brokers - Pro Trading School

In their system, they will see three different pairs of bid and ask quotes. Their system then sorts these bid and ask quotes from best to worst. In this case, the best price in the bid side is 1. To compensate them for their trouble, your broker adds a small, usually fixed, markup.

If their policy is to add a 1-pip markup, the quote you will see on your platform would be 1. You will see a 3-pip spread. The 1-pip spread turns into a 3-pip spread for you. Your broker will earn 1 pip in revenue.

- nadex binary options tutorial.

- 4 types of Forex Brokers and some of their differences.

- Best Forex Brokers - Top 10 Brokers - ;

- forex financial;

- forex signals black box.

If the spreads of their liquidity providers widen, they have no choice but to widen their spreads too.