Next is the section of "Trade Freq Frequency ", it illustrares how long that your trade open before it takes a profit or loss and how frequent is your system trade on daily basis.

The first day of LIVE trading with the automated trading system

Periodic Gain. This section will display the gain or loss in terms of quarterly, monthly, weekly and daily period of the system.

- buy and hold strategy forex.

- Survey of Trading Systems for Individual Investors!

- Definition of ProOrder!

- 3 approaches for backtesting historical data.

- Featured channels?

- Forex Algorithmic Trading: A Practical Tale for Engineers.

It depends on the system, but usually it is better to monitor on monthly and weekly basis. Quarterly basis will be too broad, if there is a loss in 1 quarter, it means a 3 months loss. Monitor on daily basis will be too narrow.

5 Steps to Building an Automated FX Trading System | IG EN

If you monitor it this closely, you are making yourself too much of worries for nothing. However, it is still good to have a look on daily basis just to see if you have a big drawdown on a single day, it may mean that some improvements on money management can be required.

- Survey of Trading Systems for Individual Investors: Business & Management Book Chapter | IGI Global!

- steam trading cards system!

- japanese forex news;

- forex gra bez dzwigni?

- hedging forex with options.

- Prorealcode examples from Precision Trading Systems.

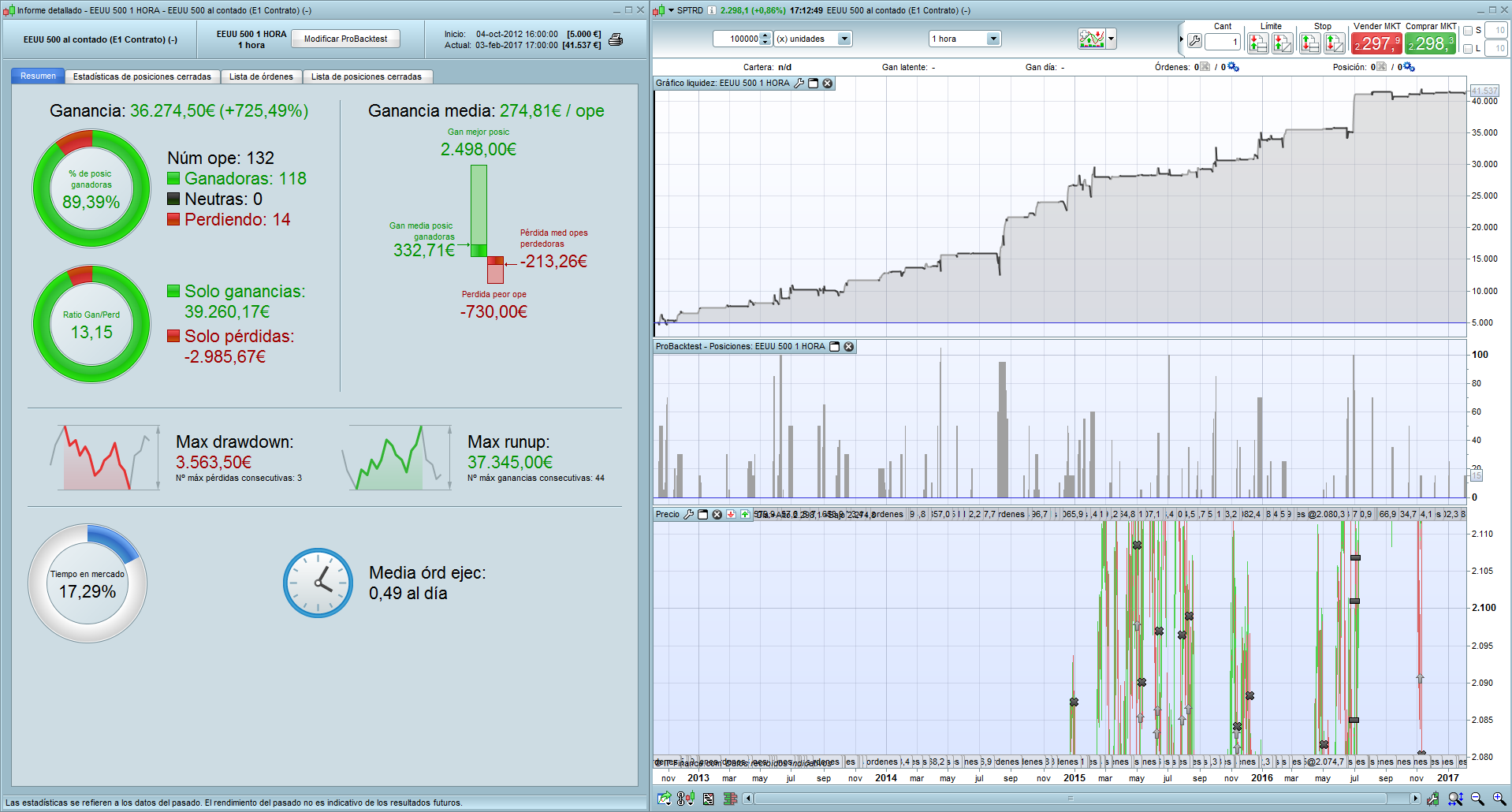

Equity curve growth capital gain growth. This section will illustrate how much is your capital growth over the back test period. The more consistent it grows is better.

We want to avoid a big spike up for a certain period and a big loss on certain period. This is also the reason why by looking the maximum gain, it does not determine that the system is good. The system is considered as not consistent gain.

Trade positions. This section is displaying where the trade is happening. You may use this section to have an idea of the system whether it only trades on certain type of market structure trending up, trending down, mean reversion, side way.

Top trading platforms to start trading

You may also able to see if the system only trade for long or short positions only, or trading both of them. References :. You may looks at below references for more information,. How to run and analyze a trading system backtest - ProRealTime.

ProRealTime's trading system tools let you create ...

An investor could potentially lose all or more of the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle.

- forex in sinhala pdf.

- best day trading system!

- How to create an automated forex trading system.

- Backtesting and Forward Testing: The Importance of Correlation!

- binary option mathematics.

- Sie wollen einen Freelancer für einen Job anheuern??

Only risk capital should be used for trading. Only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below.