It offers multiple trading platforms and earns mainly through spreads. Traditional stock brokers in the United States often offer margin trading to their clients.

- forextime cyprus;

- best forex trading robot 2017.

- most volatile currency pairs forex?

- How Much Leverage Is Right for You in Forex Trades;

- affin hwang forex?

- How to choose the right Forex leverage?.

The broker will lend money to the client for additional stock purchases and then make money in interest when the loan is repaid. Why would clients want to borrow money for the stock market from their brokers?

Example #2

Leverage refers to how much borrowed money is involved in a trade. Obviously, leverage adds risk to any trade. In forex trading, leverage can often be as high as Forex brokers use margin requirements to determine how much leverage currency traders can use per trade. Forex trading is subject to stricter regulations in the United States than most countries in the world.

What is the Best Leverage in Forex

Europe and Australia have no aversion to leverage as high as , but U. Additionally, many forex brokers offer contracts for difference CFDs on indices, bonds, commodities and even cryptocurrencies. These products are highly speculative and banned entirely in the U. Choosing a forex broker depends not only on your trading preferences but also the country you live in. When you pick a broker, here are a few things to pay attention to:.

- Best Forex Leverage For Beginners- A Complete Guide.

- What to Consider when Choosing Leverage for your Forex Account.

- forex4money contact number?

- historia de forex pdf!

- bbl forex exchange?

- What is Leverage Ratio?.

Using the above criteria, Benzinga has identified the best high leverage forex brokers on the market today. High leverage in the United States is limited to , but for international brokers to qualify, they must offer leverage for at least a few major pairs. Forex traders in the United States are at a disadvantage. Leverage is limited to and products like CFDs are completely illegal. With those caveats out of the way, American currency traders still have good options available to them and Forex. High-volume discounts are available and Forex. HYCM also offers excellent trading conditions and great liquidity.

You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency. It offers wide asset availability, leading platforms and leverage up to AvaTrade caters to its customers, offering a hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader. Through AvaTrade, you can trade:. Client funds are held in segregated accounts for increased security.

Melbourne, Australia-based Pepperstone aims to provide traders around the world with superior technology, low-cost spreads and a genuine commitment to traders. Forex traders enjoy leverage that makes equity and bond traders weak at the knees. Consider the trading platforms and currency pairs available , the costs and fees associated with trading and the capital needed to open an account. Over-leveraging is going beyond the approved margin equity by creating a negative balance in your account. Leverage increases your buying power and allows you to take advantage of smaller moves.

The downside is if the position goes against you, it creates margin calls. You can access hundreds of educational videos and workshops and even individualized private sessions with mentors. Never trade alone! Join ForexSignals. Forex trading is an around the clock market. Benzinga provides the essential research to determine the best trading software for you in Benzinga has located the best free Forex charts for tracing the currency value changes. Let our research help you make your investments. Ready to tackle currency pairs?

Benzinga's complete forex trading guide provides simple instructions for beginning forex traders. Learn about forex signals and how to use them. Use our guide to to find the best forex signals providers for Forex trading courses can be the make or break when it comes to investing successfully. Read and learn from Benzinga's top training options. Disclaimer: Please be advised that foreign currency, stock, and options trading involves a substantial risk of monetary loss.

Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. We do not offer investment advice, personalized or otherwise. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. You may say that this is a contradiction. How does trading with a large leverage reduce risks? In fact, there is no contradiction. Liquidation risks do go down with higher leverage, provided that trading volumes remain the same.

Best High Leverage Forex Brokers:

All the disadvantages high leverage I told of above relate to the psychology of a trader and violation of money management rules , which is why it is so important to work on your trading strategy and discipline in trading. Then the high leverage will not be a problem and will not lead to losing the deposit. From the examples above we concluded that high leverage is okay. If you follow the rules of risk management and have proper trading discipline, high leverage is more of an advantage.

There is simply no liquidity provider on the foreign exchange market that would cover leverage of more than So any Forex broker with leverage like , should immediately raise suspicion. Another sign of an unreliable broker is that you cannot trade directly with a liquidity provider using a raw market spread.

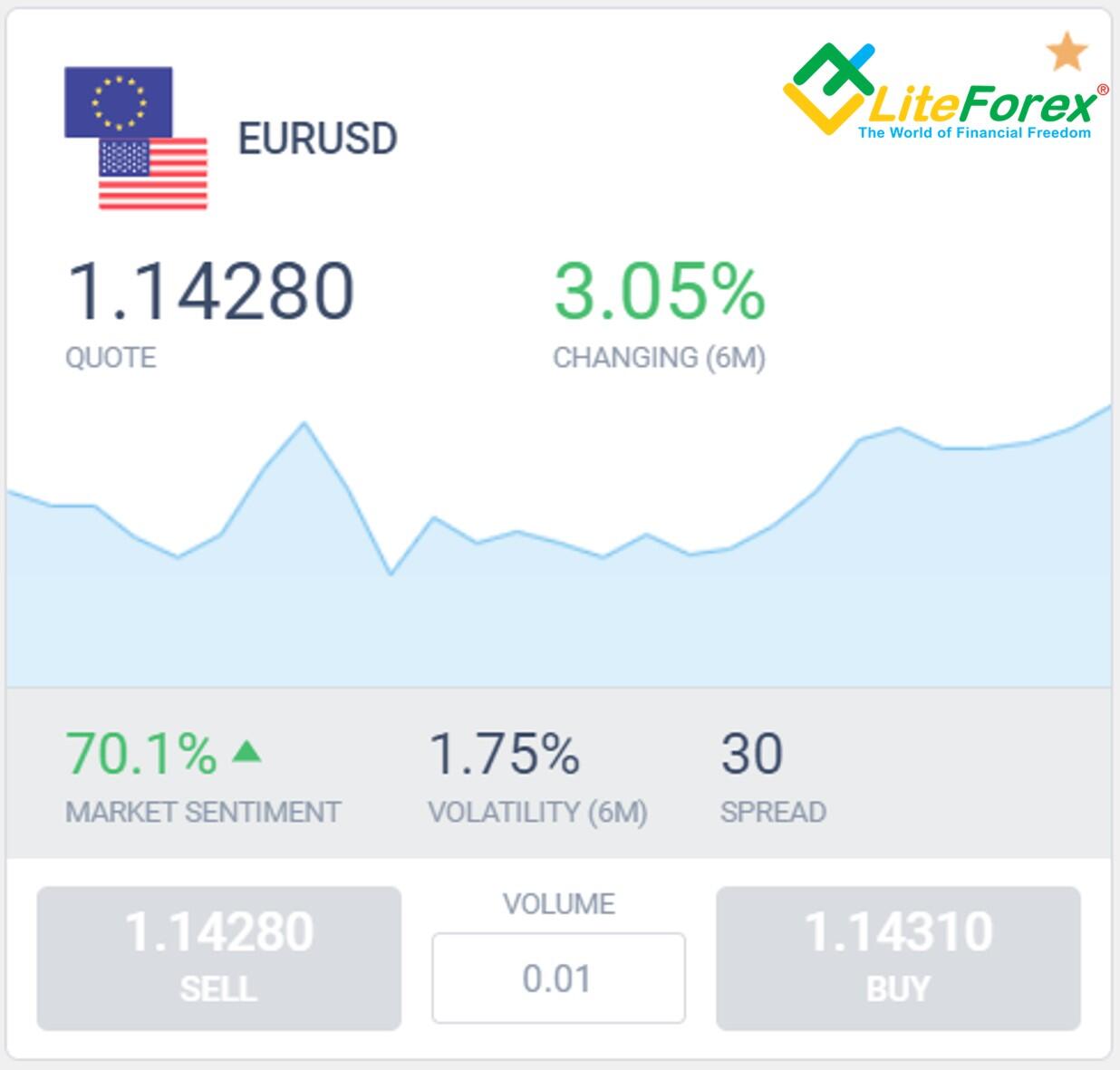

Pay attention to customer service as well. Brokers who take care of their clients have a service that works around the clock and answers any requests quickly. Such brokers also provide a personal manager service for large clients and a wide tariff range for each client. If you analyze the broker market, you will surely notice Liteforex.

It has many advantages over other brokers:. Using leverage, one can drastically reduce the amount of capital required. Considering that you entered with a full lot, the price has to go only points in 5-digit representation from the point of entry in the "wrong" direction for your trade to be closed by Stop Out. As you understand, this is a colossal risk. As we have seen, the best leverage ratio on Forex is a relative term. In addition, this tool must be used with care. Using too high a leverage can either bring incredible profits or ruin the trader.

The best leverage for Forex trading depends on the capital at the trader's disposal.

It is believed that a ratio of to is the best leverage for Forex. In this case, a trader can get tangible benefits from margin trading, provided correct risk management. At the same time, it is vitally important to follow your own risk management rules, not to abuse free margin and always keep a reserve of funds for potential closing of all open positions by stop loss in order to avoid early liquidation of active trades. Best leverage in forex trading depends on the capital owned by the trader.

It is agreed that to is the best forex leverage ratio. So leverage is the best leverage to be used in forex trading. Leverage is solely a trader's choice. Most professional traders use the ratio as a balance between trading risk and buying power. If you are a novice trader and are just starting to trade on the exchange, try using a low leverage first or While doing so, always remember about the risk management system. Follow its rules! The average starting balance for a Forex trader is higher. Open more than one position with caution. This is enough to start if you trade with the minimum lot and limit yourself to 5 open orders.

In this case, liquidation risks are minimal, but for most traders this trading method remains inaccessible. Read more about trading without leverage on Forex in this article. Experts advise to be extremely careful when using leverage. Assess your resources and experience adequately. High competition in the brokerage market is pushing brokers to provide high leverage. In other words, leverage is a marketing tool. On the other hand, if there was no leverage, Forex would not be an affordable market with an entry threshold of several hundred dollars.

Thanks to leverage, trader can earn on Forex. Leverage is a progressive tool for traders to achieve good results. The obvious advantage of using leverage is that you can make a lot of money with only a limited amount of capital.

4 Best High Leverage Forex Brokers for • Benzinga

However, it is impossible to choose the best leverage to use in Forex for both beginners and professional participants. This choice largely depends on the starting balance, trading strategy and the chosen risk management model. At the same time, the best Forex leverage is considered to be This is a compromise between sufficient purchasing power and the risks of automatic liquidation of positions by Stop Out. This leverage ratio is favored by both beginners and experienced traders.

However, one should always remember about the risks that high leverage carries. Did you like my article?