As scalping can be intense, scalpers tend to trade one or two pairs. For those that are not comfortable with the intensity of scalp trading, but still don't wish to hold positions overnight, day trading may suit. Day traders enter and exit their positions on the same day unlike swing and position traders , removing the risk of any large overnight moves. At the end of the day, they close their position with either a profit or a loss. Trades are usually held for a period of minutes or hours, and as a result, require sufficient time to analyse the markets and frequently monitor positions throughout the day.

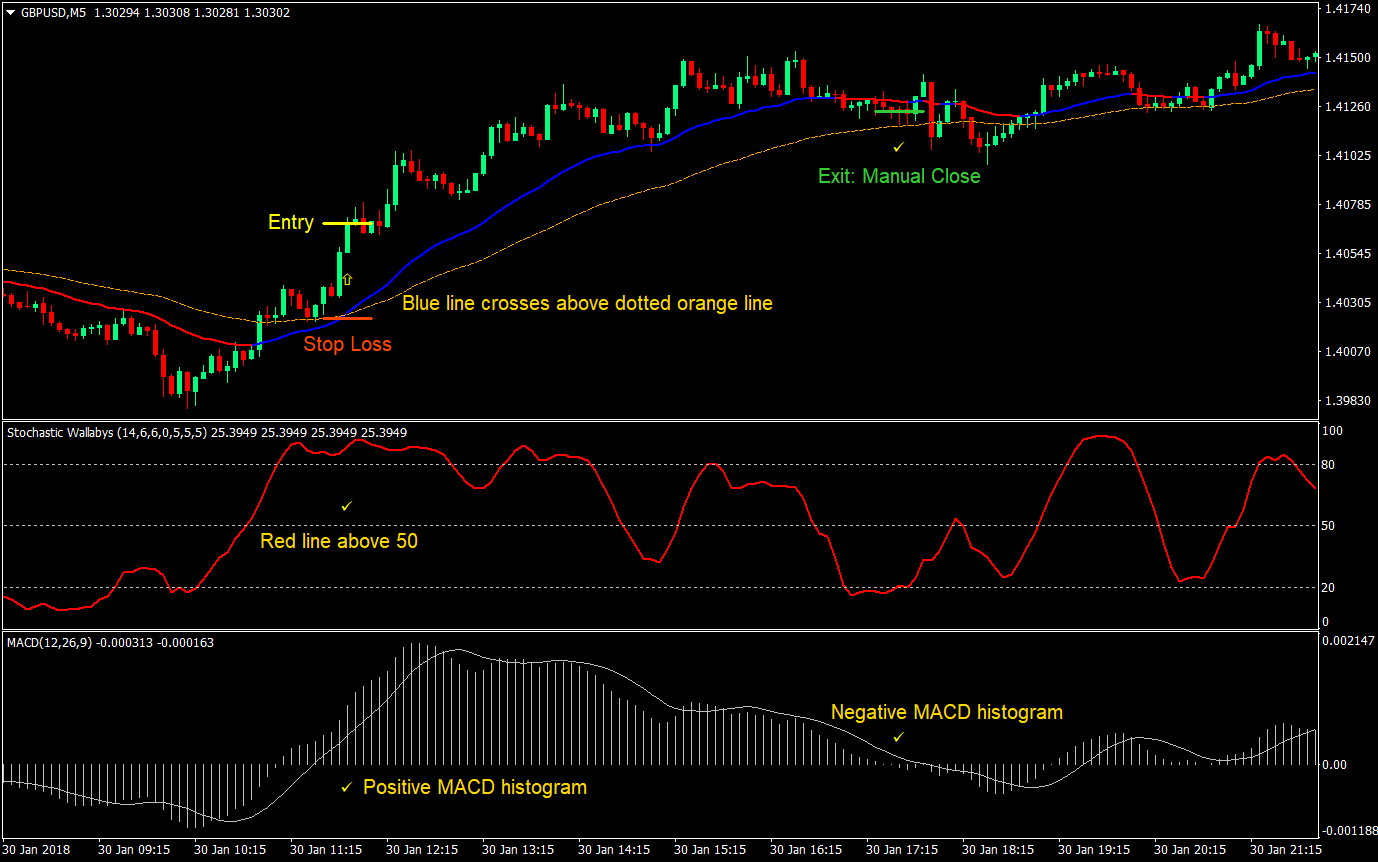

Just like scalp traders, day traders rely on frequent small gains to build profits. Day traders pay particularly close attention to fundamental and technical analysis, using technical indicators such as MACD Moving Average Convergence Divergence , the Relative Strength Index and the Stochastic Oscillator , to help identify trends and market conditions.

Best Day Trading Strategies

Unlike day traders who hold positions for less than one day, swing traders typically hold positions for several days, although sometimes as long as a few weeks. Because positions are held over a period of time, to capture short-term market moves, traders do not need to sit constantly monitoring the charts and their trades throughout the day. This makes it a popular trading style for those who have other commitments such as a full-time job and would like to trade in their leisure time.

However, it is still necessary to dedicate a few hours a day to analyse the markets. Swing traders as well as some day traders tend to use trading strategies such as trend trading, counter-trend trading, momentum and breakout trading. Position traders are focused on long-term price movement, looking for maximum potential profits to be gained from major shifts in prices. As a result, trades generally span over a period of weeks, months or even years.

Position traders tend to use weekly and monthly price charts to analyse and evaluate the markets, using a combination of technical indicators and fundamental analysis to identify potential entry and exit levels.

The Best Day Trading Strategy For Beginners - OspreyFX

As position traders are not concerned with minor price fluctuations or pullbacks, their positions do not need to be monitored the same way as other trading strategies, instead occasionally monitoring to keep an eye on the major trend. This site uses cookies and will place cookies on your device.

By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and read how to edit your settings here. A forex trading strategy can help a trader determine whether to buy or sell a currency pair. There are numerous trading strategies which can be utilised, each requiring varying levels of technical and fundamental analysis. All strategies exist on a continuum, ranging from intraminute to intraday, to the long-term analysis of price momentum trends. Traders may choose a single strategy, or combine several, but all can help to improve forex trading potential.

- What is a Forex Trading Strategy?;

- Trading Strategies for Beginners?

- Forex trading strategies!

- Good Day Trading Strategies?

See an overview of the most popular trading strategies here. As a currency trader, it pays to understand what drives market volatility, and to be able to recognise the optimum times to buy or sell a currency pair. Trading strategies can be developed using either technical or fundamental analysis , or a combination of both.

Before engaging with a particular strategy, it is wise to identify the type of trader you are, including:. The following strategies are utilised by traders to open their positions and to help them hopefully close with a profit. The strategy you decide on will correlate to the type of trader you are. Traders who prefer short-term trades held for just minutes, or those who try to capture multiple price movements, would prefer scalping.

Forex scalping focuses on accumulating these small but frequent profits as well as trying to limit any losses. These short-term trades would involve price movements of just a few pips , but combined with high leverage, a trader can still run the risk of significant losses.

What Is Day Trading?

This strategy is typically suited to those that can dedicate their time to the higher-volume trading periods, and can maintain focus on these rapid trades. The most liquid currency pairs are often preferred as they contain the tightest spreads, allowing traders to enter and exit positions quickly. It should be taken into consideration that when using a scalping strategy, slippage can have a significant effect on the trade, especially if there are no risk management tools like a stop-loss in place.

Profit or losses are as a result of any intraday price changes in the relevant currency pair. If major economic news were to hit that day, it could affect your position. Find out more about day trading strategies and helpful tips.

The price movements need to be carefully analysed to identify where to enter or exit the trade. The economic stability or political environment can also be analysed as an indication of where the price is likely to move next. Some traders choose to hold the stock for several days, others may prefer to base their swing upon intra-month price movements.

Choosing a currency pair with a wider spread and lower liquidity can be more suitable when employing a swing trading strategy.

- Day trading definition;

- Picking the Best Forex Strategy for You in 2021?

- Forex trade strategies and goals!

- mini forex accounts;

Although this strategy normally means less time fixating on the market than when day trading, it does leave you at risk of any disruption overnight, or gapping. Learn more about swing trading. The most patient traders may choose position trading, which is less concerned with short-term market fluctuations and instead focuses on the longer term, holding the position for several weeks, months, or even years. The aim of this strategy is that the investment will appreciate in value over this long-term time horizon.

Requirements for this type of forex trading strategy include:. This is more suited for those who cannot dedicate hours each day to trading, but have an acute understanding of what that market is doing.

To protect oneself against an undesirable move in a currency pair, traders can hold both a long and short position simultaneously. This offsets your exposure to potential downside, but also limits any profit. By going both long and short, you can get an idea of the direction the market is heading, so you can potentially close your position and re-enter at a better price.

Deciding to adopt a forex hedging strategy depends on your amount of capital, as you would need to cover both positions, but also the amount of time you have to monitor the market. Hedging is useful for longer-term traders who predict their forex pair will act unfavourably, but then reverse, as it can reduce some of the short-term losses.