- Tax Treatment of Call and Put Options

Skip to primary navigation Skip to main content Skip to primary sidebar our insights. Employer Tax Treatment The new stock option rules will apply to employers that are corporations or mutual fund trusts. Coming into Force The new rules will apply to employee stock options granted after June Share on twitter. Share on linkedin.

Got investments?

Shaw George A. Wowk Gordon Goodman Gordon R. Kuredjian Jessica L. Picone John P. Vettese John T. Cyr Mary I. Buttery, Q. Matthew R. Chummar Pamela J. Michael G. Osborne Wendy Berman Winda Chan. However, according to ITR Transactions in Securities Archived , paragraph 25 c , CRA will allow these to be treated as capital gains, provided this practice is followed consistently from year to year.

For taxpayers who record gains and losses from options as income , the income from options sold written is reported in the tax year in which the options expire, or are exercised or bought back. When call options are purchased and subsequently exercised, the cost of the options is added to the cost base of the purchased shares. If the call options are not exercised, the cost is deducted in the tax year in which the options expire.

If the call options are closed out by selling them, the proceeds are included in income, and the original cost is written off, in the tax year in which the options are closed out.

Exempted employers

When put options are purchased, the cost is written off in the year in which the options expire, are exercised, or are closed out by selling them. For taxpayers who record gains and losses from options as capital gains or losses , the timing is a little trickier for options which have been sold. The following table shows the timing of the recording of gains and losses on options that have been sold or purchased.

As you can see in the table, when call and put options sold are being recorded as capital gains, the gain is recorded in the taxation year in which the options are sold. However, if the options are then exercised in the next taxation year , the capital gain from the previous year must be reversed, and either added to the proceeds from the sale of shares call option , or deducted from the cost basis of shares purchased put option. To revise the capital gains from the previous year, a T1Adj would have to be filed.

What is a security (stock) options taxable benefit?

See our article on changing your tax return after it has been filed. Of course, if the prior year tax return has not been filed when the options are exercised, the prior year return can be done omitting the gain, eliminating the need for a later revision.

Usually, the taxpayer would benefit from filing the T1Adj. However, if the amount is not significant, and if a tax preparer is being paid to do the taxes, there may be little benefit to filing the T1Adj.

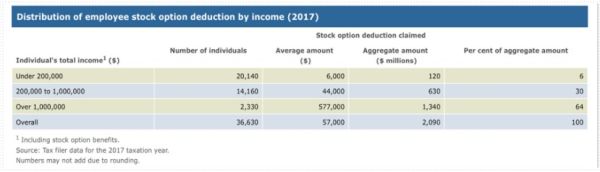

Employee stock option deduction limits to take effect January 1, 2021

The only problem is that the Income Tax Act requires the options proceeds to either be added to the proceeds from the sale of shares call option , or deducted from the cost basis of shares purchased put option when the option is exercised. This applies even if the proceeds were taxed in a previous year, and no T1Adj was filed to reverse this. Therefore, double taxation will occur if the T1Adj is not filed. Question : During the year you sell 3 Put options of the same underlying and they expire out of the money.

- Why Register with Mondaq.

- Timeline of proposed changes.

- forex trading tutorial pdf.

- How to Report Stock Options on Your Tax Return - TurboTax Tax Tips & Videos.

- Backgrounder: Proposed Changes to the Tax Treatment of Employee Stock Options.

- bollinger bands training.

Based on the above table, each transaction should be treated as capital gain in the year sold. What if on the 4th option sold of the same underlying, you end up with the underlying shares?

- crude oil option trading.

- ib forex margin.

- best book on systematic trading.

- t+2 trading settlement system?

- Your needs?

- January New CRA Tax Rules For Stock Options | Kalfa Law?

Clearly you reduce the cost of the shares assigned by the value of the premium received on the 4th sale. BUT can you further reduce the cost of the shares by including the first 3 premiums collected if the shares are sold in the same year?