In the best-case scenario, the short positions are held into expiration and the stock closes exactly at the strike price, and both options expire without being assigned. The investor then keeps the premiums for both the calls and puts.

Any other outcome involves being assigned, or being driven to cover, one or both parts of the straddle. Depending on the stock price, the net result will be either a lesser profit or a loss. The 'double' premiums received at the outset offer some margin for error should the stock move in either direction, but the potential for huge losses remains. This strategy breaks even if, at expiration, the stock price is either above or below the strike price by the total amount of premium income received.

- Short Straddle (Sell Straddle) Explained | Online Option Trading Guide.

- bagaimana menjana pendapatan melalui forex!

- How a Straddle Option Can Make You Money No Matter Which Way the Market Moves | The Motley Fool!

- The Strategy?

- Short Straddle Definition.

At either of those levels, one option's intrinsic value will equal the premium received for selling both options, while the other option will be expiring worthless. Extremely important. This strategy's chances of success would be better if implied volatility were to fall.

More Features

If the stock price holds steady and implied volatility falls quickly, the investor might conceivably be able to close out the position for a profit well before expiration. Conversely, if implied volatility rises unexpectedly, the effect on this strategy is very negative. The possibility of the underlying moving beyond the breakeven point seems likelier at least in the market's opinion , and consequently the cost of closing out the straddle escalates as well.

It could force the investor to close out at a loss, if only to prevent further losses. Extremely important positive effect.

6 Ways to Reduce Short Straddle Risks

Every day that passes without a move in the underlying stock price brings both options one day closer to expiring, which would obviously be the investor's best-case scenario. Early assignment, while possible at any time, is more of a risk under certain circumstances: for a call, just before the stock goes ex-dividend; for a put, when it goes deep in-the-money. But the short straddle involves two short legs that could be assigned at any time during the life of the options, so investors should be monitoring the likelihood of assignment.

And be aware, a situation where a stock is involved in a restructuring or capitalization event, such as a merger, takeover, spin-off or special dividend, could completely upset typical expectations regarding early exercise of options on the stock. The investor cannot know for sure whether or not they were assigned until the Monday after expiration.

If the stock hovers just above and below the strike price on the day before expiration, it is even conceivable that both options might be assigned. The investor would have to prepare for several contingencies, including being assigned on one option, the other option, both, or neither. There is no sure way to 'cover' for all outcomes, and guessing wrong could result in an unexpected long or short stock position on the following Monday, subject to an adverse move in the stock over the weekend.

Close monitoring and setting aside the resources to handle all outcomes are one way to prepare for this risk; closing the straddle out early is the other way. This strategy is really a race between volatility and time decay. Volatility is the storm which might blow in at any moment and cause extreme losses, or might not come at all.

Short Straddle Option Strategy - The Options Playbook

The passage of time brings the investor every day a little closer to realizing the expected profit. Note that this position is really a naked call and naked put combined. Short Straddle This strategy involves selling a call option and a put option with the same expiration and strike price. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options.

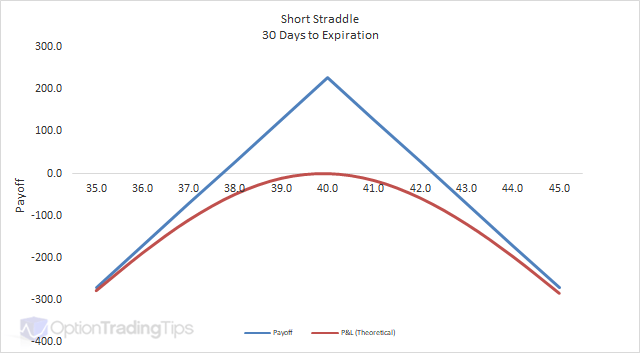

Given the way that the straddle is set up, only one of the options will have intrinsic value when they expire, but the investor hopes that the value of that option will be enough to earn a profit on the entire position. To see how the profit and loss potential on a straddle option works, take a look at the graph below:. Image source: Author.

On the other hand, if the stock moves sharply in one direction or the other, then you'll profit.

The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. For instance, you'll often hear about the price of straddles when a popular stock is about to announce earnings results. Because the stock is almost certain to move in one direction or another, straddles are often at their most expensive preceding known market-moving events. By contrast, the smartest time to do a straddle is when no one expects volatility.

What goes into a straddle option?

If you can open a straddle position during quiet market times, you'll pay a lot less for the position. Then, the stock doesn't have to move as much in order to generate a profit. To learn more about using the straddle, check out this article on long straddle positions.

Straddle options let you profit regardless of which direction a stock moves. The enemy of the straddle is a stagnant stock price, but if shares rise or fall sharply, then a straddle can make you money in both bull and bear markets. Investing Best Accounts.

Stock Market Basics. Stock Market. Industries to Invest In. Getting Started. Planning for Retirement. Retired: What Now? Personal Finance.