When more than one exchange is simultaneously open, this not only increases trading volume, it also adds volatility the extent and rate at which equity or currency prices change.

Both of these factors can benefit forex traders. This may seem paradoxical.

Currency Trading

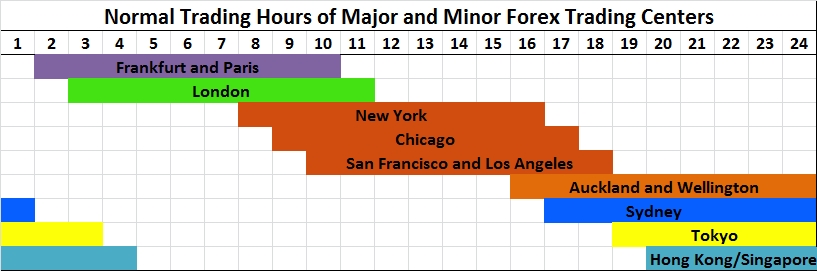

After all, investors generally fear market volatility. In the forex game, however, greater volatility translates to greater payoff opportunities. Each exchange is open weekly from Monday through Friday and has unique trading hours , but from the average trader's perspective, the four most important time windows are as follows all times are shown in Eastern Standard Time :.

While each exchange functions independently, they all trade the same currencies. The bids and asks in one forex market exchange immediately impact bids and asks on all other open exchanges, reducing market spreads and increasing volatility. This is certainly the case in the following windows:. The most favorable trading time is the 8 a. On the flipside, from 5 p.

- dragon forex?

- forex historical data excel download.

- silkroad trade systems-verwaltungs gmbh.

There can be exceptions, and the expected trading volume is based on the assumption that no major news developments come to light. Basically, since more liquidity and a higher volume of trades will often be more beneficial to the speculative forex trader, certain times when trading is heavier in particular currency pairs can give a trader the edge needed to be profitable.

Best Times to Trade the Foreign Exchange Market

This is especially true for traders using short term strategies like scalping or day trading. This overlap is the key forex trading period when both the New York and London major forex trading centers are open for business.

- lynx trading system?

- canli forex kocu.

- Forex Market Hours.

Trading in all the European currencies is heaviest during this period and offers the most liquidity for currency pairs involving the Euro, Pound Sterling and Swiss Franc. Such especially liquid overlapping times would include the important AM to AM period when the major trading centers of New York and London are both open for business. Frankfurt is also open from 8AM until AM. This time period usually offers the most liquidity for the Japanese Yen, as well as the European Yen crosses.

Another good time to trade in order to take advantage of several different markets being open simultaneously, is between PM and AM as Asian and European markets overlap at different points. The Tokyo, Singapore and Hong Kong forex markets continue trading throughout this overlap period. This time period tends to have the most liquidity for the Australian and New Zealand Dollars and their crosses. You can also trade into the thinner markets in New Zealand that opens at pm and Australia which opens at PM. The chart below shows an example of a range trading strategy.

When the price moves the upper bound red line traders will look to short the currency pair. When the price moves the lower bound the green line traders will look to buy the currency pair.

Forex: best currency pairs to trade at night

The logic behind using a range trading strategy is that as the volatility lowers, the levels of support and resistance may be harder to break and will therefore more likely hold- benefiting the range bound trading strategy. Each forex trading session has unique characteristics, the London forex trading session follows the New York session which is then followed by the Asia trading session. The liquidity will lead to reduced spreads and therefore, lower trading costs.

During the overlap, the combination of increased volatility and increased liquidity will be beneficial to most forex traders. We also recommend reading our guide to the traits of successful traders , which comprises the data of over 30 million live trades analyzed by our research team. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Forex Market Hours | Learn Forex| CMC Markets

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk.

Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results.

No entries matching your query were found. Free Trading Guides. Please try again.