For consistency and correctness purposes, national currency should continue to be assigned as the local currency for each company and company code , and functional currency should be established in addition for every company code. Next, each company code and the associated lead and non-lead ledger s should have the functional currency assigned correctly as shown via screen shots later in this article.

Revaluation and Translation configuration and setup will also be addressed. In particular, Valuation Area configuration is highlighted because unique setup is required to ensure revaluation and translation to group currency is performed correctly during month-end using the functional currency as the basis where needed.

Alternative currencies

Local currency, which was historically the source currency to perform group currency updates from, is no longer needed as the foundation for revaluation of the balance sheet and translation of the income statement for those company codes having a different local and functional currency type, a significant change for customers performing and reporting on these activities.

With the addition of freely definable currency in SAP Finance the complexity of currency processes such as translation and revaluation has increased with the addition of new input parameter fields and the need for additional valuation areas. Most multinational businesses require foreign currency revaluation and translation in multiple currencies.

This article shows how to set up translation and revaluation correctly to allow general ledger accounts to adjust into themselves instead of a separate income statement or balance sheet account. Currency translation is driven from the financial statement version, and in particular the financial statement item.

Part 1 outlines the functional currency setup and later assignment to the ledgers in use by a customer. The configuration can be found at the following IMG menu in Figure 1.

- difference between forex and cfd?

- forex timing in pakistan.

- SAP Foreign Currency Valuation?

- Exchange rate!

See settings in Figure 2. The next step is to assign the source currency for each currency type and exchange rate settings for currency conversion purposes. This is because the only scenario for the customer where functional operational currency was USD and differed from the national currency was for those entities that operate in USD. The net effect of this configuration is that financial posting amounts for all non-ZZ functional currencies are equivalent for the local currency and functional currency. Next, the company code settings for each ledger must be assigned the functional currency as shown in the Step 4, Step 5 and Step 6 by first selecting the ledger, then performing the company code settings.

See the configuration in Figures Company code ledger settings require the assignment of the freely-definable functional currency to be assigned to every company code based on what the operational currency is for each Figure 6. In most cases this equals the national currency of the company code. Part 2 of this process is to walk through the financial statement version as this takes intricate and time-consuming configuration that is critical to the process. There is a requirement for a separate FSV to be created for currency translation purposes.

This is in addition to the standard FSV for financial statement creation. See the following two examples:. The first example is the standard FSV for financial reporting of the trial balance, as shown in Figure 8. The second is the specific FSV created for translation requirements Figure 9. We will explore and explain the setup of this FSV further. For the translation configuration to work every general ledger account for translation requires its own node on the FSV.

The reason for this is Translation configuration is driven by Financial statement item, hence if the GL account is to adjust into itself you need an FS item for each GL. Note that accounts that are open item managed, auto-post only, or bank accounts cannot translate nor revalue into themselves, but instead are translated and revaluated into an associated foreign exchange adjustment account.

The second aspect to cover, and the more simple of the two, is currency revaluation. In order for the revaluation adjustments to feed back into the original GL account go to the following configuration path. Next, we look at the valuation areas and valuation methods. Figure 16 shows the settings behind Valuation Method FP00 as an examples. FP01 only differs in the rate type used which was a custom configured monthly average rate specific to translation.

Here is a view of the translation configuration and it now becomes clear why you need a node for each GL account you wish to adjust into itself Figure For example, if we look at the two areas highlight above, financial statement item 10 will have one GL account assigned to it in the FSV The following contain some examples of the variants used for revaluation and translation.

Revaluation is shown in Figure 19 where a total of three variants of those shown were used to correctly revaluate the local and functional currency amounts as required, using the three different valuation areas F1, FP, and FZ. Generally, the more dependent a country is on a primary domestic industry, the stronger the correlation between the national currency and the industry's commodity prices.

There is no uniform rule for determining what commodities a given currency will be correlated with and how strong that correlation will be. However, some currencies provide good examples of commodity- forex relationships.

Consider that the Canadian dollar is positively correlated to the price of oil. Therefore, as the price of oil goes up, the Canadian dollar tends to appreciate against other major currencies. This is because Canada is a net oil exporter; when oil prices are high, Canada tends to reap greater revenues from its oil exports giving the Canadian dollar a boost on the foreign exchange market.

Another good example is the Australian dollar, which is positively correlated with gold. Because Australia is one of the world's biggest gold producers, its dollar tends to move in unison with price changes in gold bullion. Thus, when gold prices rise significantly, the Australian dollar will also be expected to appreciate against other major currencies.

How Are International Exchange Rates Set?

Some countries may decide to use a pegged exchange rate that is set and maintained artificially by the government. This rate will not fluctuate intraday and may be reset on particular dates known as revaluation dates. Governments of emerging market countries often do this to create stability in the value of their currencies.

To keep the pegged foreign exchange rate stable, the government of the country must hold large reserves of the currency to which its currency is pegged to control changes in supply and demand. Federal Reserve Bank of New York. Foreign Exchange Intervention. International Monetary Fund. European Journal of Political Economy.

Accessed Mar. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Basic Forex Overview.

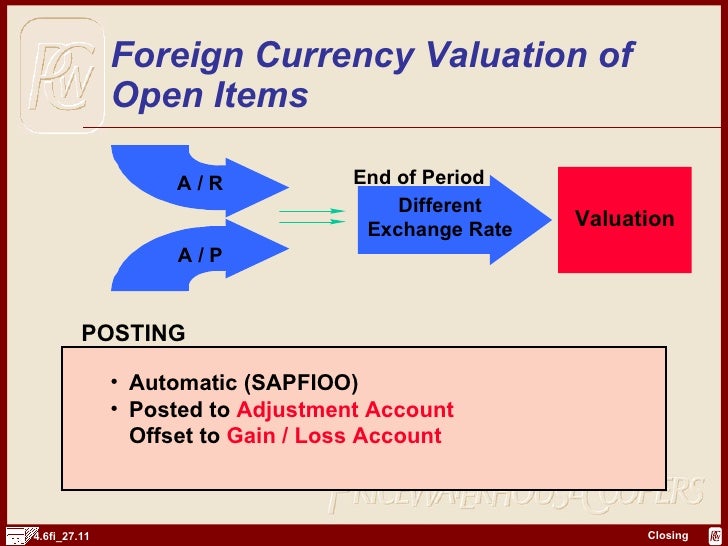

SAP Foreign Currency Business Process, Configuration, Testing

Key Forex Concepts. Currency Markets. Advanced Forex Trading Strategies and Concepts. Table of Contents Expand.

Floating vs Fixed Exchange Rates. What Influences Exchange Rates. Macro Factors. Forex and Commodities. Maintaining Rates. Key Takeaways Fixed exchange rate regimes are set to a pre-established peg with another currency or basket of currencies. A floating exchange rate is one that is determined by supply and demand on the open market as well as macro factors. A floating exchange rate doesn't mean countries don't try to intervene and manipulate their currency's price, since governments and central banks regularly attempt to keep their currency price favorable for international trade.

Floating exchange rates are the most common and became popular after the failure of the gold standard and the Bretton Woods agreement.