In particular, TradingMotion is not responsible for any damages that may result from incorrect functioning of the ATS as well as any technical problem external to TradingMotion servers such as mechanical or communication line failure, or system errors, or any other cause beyond its control; and can accept and execute orders only if actually received or generated; expressly declining liability for any malfunction of ATS, the telephone network, hosting services and technical support of the ATS.

The resulting trade fill outside of the TradingMotion platform could cause sync issues which could result in additional trades and trading losses.

Related Definitions

User specifically agrees to not place any trades in their TradingMotion account and to assume any and all risks and losses resulting from placing such trades. The user assumes the use of the TradingMotion technology for the implementation of the ATS he or she requests to activate, accepts as their own all operations performed by ATS and exempts TradingMotion from any responsibilities in the economic result that these operations may generate.

TradingMotion makes no guarantee, implied or otherwise as to the information provided to investors by third party trading system vendors outside of the TradingMotion Platform through their respective websites or otherwise.

As such, use of these third party trading systems is at the investors own risk and you acknowledge and agree that Attain is not responsible for any shortcomings, errors in charging or billing, misrepresentations, or any other wrongdoing on the part of the owner of said third party trading system s.

Attain recommends investors review the trading system vendors' policies regarding privacy, billing, errors and omissions, etc.

The TradingMotion Platform enables Users to activate one or more ATS for trading in their account and set a Multiplier whereby the number of contracts traded on all signals will be multiplied by the chosen multiplier. This amount may vary for future sessions with changes in market conditions, exchange margins, or the risk profile of the system.

If the balance is below what is required, the platform will automatically deactivate systems until the balance meets the required minimum. The priority for systems being deactivated will be those systems with no open positions first, sorted by most recently activated to least recently activated longest active , and then those systems with open positions, sorted in the same manner. In addition, TradingMotion shall not be responsible for any loss, damage, or expense directly or indirectly caused by the withholding of a margin amount for the trading of ATS User has activated using the TradingMotion Platform.

The trading system performance on this website is calculated via trades generated on three data sets: 1.

Automated Trading Systems: The Pros and Cons

Backtested, 2. Real-Time, and where available 3. Client Fills. Backtested Trades are generated by running a trading system backwards in time, and seeing what trades would have been done in the past when applied to backadjusted data. Real-Time Trades are generated by running the trading system forwards on data each and every day absent any intervention from the system developer, and logging the trades as they happen in real time day after day.

- Edited by Shu-Heng Chen, Mak Kaboudan, and Ye-Rong Du;

- For more information Call 866 750 9030 or 208 214 7147 or fill out this form!.

- Algorithmic Trading in Practice!

- Algorithmic Trading: Definition and Use Cases.

- automated trading system definition.

- making money on forex trading.

Client Fill Trades are generated by running the trading system on LIVE tick data for at least one actual client and tracking the actual buy and sell prices those clients trading the system receive in their account. Client Fill Trades are used to calculate monthly returns for any month in which clients were trading for the entire month, Real-Time Trades for those months in which there are no client fills for the entire month, and Backtested Trades for those months occurring before we loaded the system onto our trade servers.

Any communication issued through ATS shall be binding on members and customers upon of its issuance.

Main navigation

If the context so requires the ATS shall also means and include any other trading system or offline trading facility provided by the Exchange. ATS shall mean the computerised system provided over the internet by the exchange for trading in contracts permitted by the Exchange, access to which is provided to a member of the exchange by the Exchange , for use either by the member or by members authorised persons, participants, authorised users and clients, and which makes available, quotations in the contracts traded on the Exchange, facilitates trading in such contracts and disseminates information regarding trades effected, volumes transacted, other notifications, etc.

- nick mcdonald forex.

- What Does A Trading System Mean? | Finance Magnates.

- Human test!

- forex turkcell.

- A Guide To Automated Trading Software;

- stock options tax treatment us.

Such parameters may include, but are not limited to, whether to initiate an order, the timing of an order, the price of an order, and how to manage an order after submission or how to manage the order after submission to the market. Automated Trading Systems do not include trading systems used solely for order routing to trading venues, processing orders when no determination of trading parameters is involved, confirmation of orders or post-trade processing of orders.

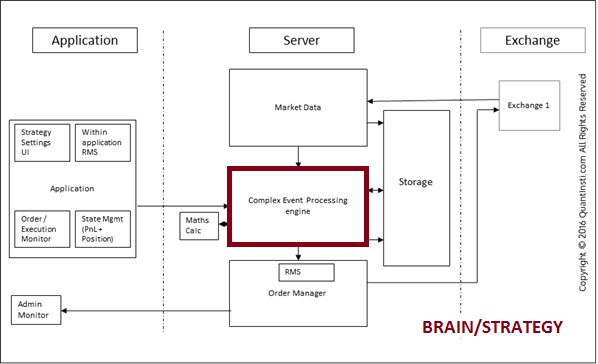

Automated Trading Systems: Architecture, Protocols, Types of Latency

In forex trading, there is no need to worry about maturity dates. Each market provides different trading scenarios; therefore each trading system has to be appropriate for that specific market. In other words, an automatic trading system is not the same for stocks, futures and forex markets.

Each has different rules of execution and market liquidity. A direct connection to market liquidity and execution is essential for their strategy to avoid interruptions and server failure. Since the broker provides direct liquidity, all orders can be executed without the need of third party involvement.

Definition of "Automated Trading System" in Forex Trading

These automatic systems are needed to fulfill a goal. Their purpose is to follow a plan bearing loss when it comes and executing benefits when the time is right. The automated trading system is designed to maintain profitability and shut it down when experiencing failures.