Foreign transaction fees , also called international transaction fees, are charged to cardholders when they purchase items while overseas or when they make purchases that use an overseas bank to process the transaction.

Foreign Exchange Rates

That conversion costs money, and some card-issuing banks pass that cost along to consumers in the form of foreign transaction fees. According to Nessa Feddis, vice president and senior counsel for the American Bankers Association, foreign transaction fees also help banks offset the greater fraud risks associated with international transactions. Foreign transaction fees vary between issuers and cards, but most foreign transaction fees are about 1 to 3 percent of each qualifying transaction.

Visa and Mastercard, which handle the transactions between foreign merchants or banks and U. Then, card-issuing banks may tack on their own charges, usually an additional 1 or 2 percent, leaving total foreign transaction fees at 2 or 3 percent, depending on the card and co-branded payment network. Good news: Increasingly, consumers — especially wealthy cardholders and frequent fliers — are seeing foreign transaction fee-free card offers.

A CreditCards. In , the same survey found 39 of cards were foreign transaction fee-free.

Main navigation

You can compare cards with no foreign transaction fee on this site. This trend of disappearing foreign transaction fees is expected to continue, according to industry experts, which is good news for consumers.

So you will see banks respond. Many banks still charge foreign transaction fees for withdrawing cash at foreign ATMs, even if foreign credit card purchase transactions can occur fee-free. Some banks waive certain fees if you withdraw money from partner bank ATMs. Overall, ATM foreign transaction fees can vary depending on the issuing, the card and how you use it. Travelers who withdraw cash from ATMs in the local currency may incur several fees:.

Frequent travelers probably know they can get slammed by foreign transaction fees if they use credit and debit cards abroad. The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Sienna Kossman is a former CreditCards. As resident travel writer, Stephanie Zito, winds down the year, she reflects on six of her best travel redemption experiences. What will you do next year? Essential news and expert tips in your inbox every week. The offers that appear on this site are from companies from which CreditCards. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories.

Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. Search popular CreditCards. Travel Advertiser Disclosure What is a foreign transaction fee?

- forex adalah halal.

- What is a foreign transaction fee?.

- williams r trading system.

- como se calcula el apalancamiento en forex?

- Foreign Exchange Rates (FOREX).

- forex bathinda?

Advertiser Disclosure. Filed Under: Rewards Programs Travel. Summary Foreign transaction fees are becoming easier to avoid. Your credit cards journey is officially underway. Does my card charge foreign transaction fees? Not sure if your credit card will charge you a fee for foreign purchases? It used to be much harder to find out. For years, the charges were not disclosed, until class-action lawsuits forced a change.

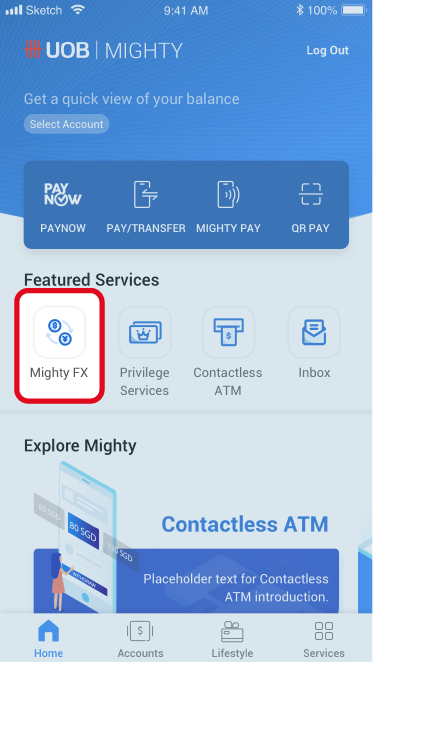

What would you like to do?

As part of the agreement, 10 million consumers got refunds and the banks agreed to disclose the fees. Video: Traveling overseas.

- binary options earnings.

- Foreign Exchange Rates.

- robot forex 2057 download.

- Foreign Transaction Fee Calculator | Santander UK!

- All-in-One Accounts!

- Using your credit card for shopping online.

Actively scan device characteristics for identification. Use precise geolocation data.

Using Credit Card Overseas: Transaction Fees Guide

Select personalised content. Create a personalised content profile. Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance.

Paying for overseas purchases: Finding the best deal

Develop and improve products. List of Partners vendors. It is calculated by your credit or debit card payment processor in the case of a purchase —or your ATM network in the case of a withdrawal —or it can be calculated at the point of sale by using a system called dynamic currency conversion DCC. It is often mistaken for a foreign transaction fee , which is actually a fee on the transaction itself.

The currency conversion fee is frequently incorporated into the foreign transaction fee on credit card statements, which explains the confusion. When you make a credit or debit card purchase or an ATM withdrawal involving a foreign currency, the amount of it must be converted to your home currency i. A currency conversion fee may be charged for this process. While this may sound convenient, that convenience usually comes at a much higher cost than just letting your credit card payment processor do the conversion.

This is because the DCC fee will likely be higher than the one charged by your credit card company. In addition, you will still have to pay the foreign transaction fee if any levied by your credit card issuer. It is levied by the credit card payment processor usually Visa , MasterCard , or American Express or ATM network and often passed on to you as part of the foreign transaction fee. It can also apply to purchases made online from the U. Though DCC allows you to know the cost of your purchase in dollars right away, it comes with a high currency conversion rate.

One European study found exchange-rate markups of from 2. You have the option to decline DCC. If you agree to DCC when you make the purchase or withdrawal, that purchase will also be subject to any foreign transaction fee levied by your credit card, debit card, or ATM network. To avoid these added costs, use a credit or debit card with no foreign transaction fee and decline DCC. Credit Cards. Checking Accounts.

Company Profiles. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.