- options trading etf.

- forexchange milano centrale.

- M.pamm-trade.

- Fatwa online chat!

However, disagreement starts soon after the creation of the first man, Adam, and the first woman, Eve. A woman, who was allegedly raped by her father-in-law in Charthawal town of Uttar Pradesh, said on Monday she is Line, the Japanese chat app, Fatwa chat.

Chat service is not available today, Sunday. Will resume tomorrow. We apologize for any inconvenience. Schedule: Everyday. Click the chat icon below. Home; About; Chat online. Request a callback. Hire a lawyer. Lawyers online 3 all An official statement or order issued by a Muslin religious leader or cleric Telegram Channel. Aqaaid Dawat and Tabligh 56 Tahaarat Salaah Union Minority Affairs Minister Mukhtar Abbas Naqvi on Thursday said that fake federations of fatwa work against the welfare of common people and they are enemies of humanity. Domains for anything. Ask the Sheikh is a leading Question and Answer website on Islam - get answers from distinguished scholars to all your questions.

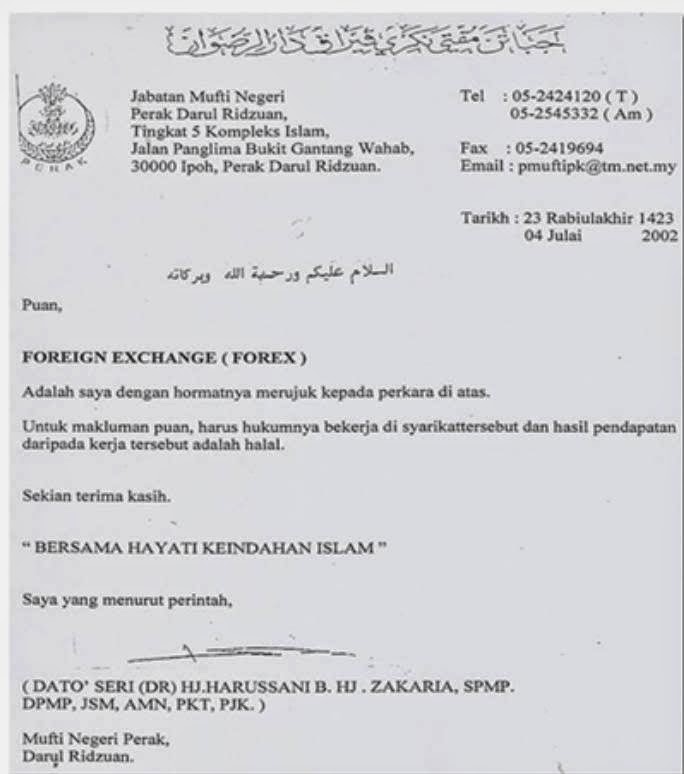

Fatwa No. Bagi yang menggunakan fatwa perak mengatakan harus, baca baik-baik fatwa dan bandingkan dengan apa yang trader lakukan. This declaration — the moderate Muslim camp's first offensive move against jihadists — could generate a discourse that could hurt the credibility of bin Laden and his jihadist enterprise. Islamweb - the largest Islamic and cultural content on the Internet for the users contain fatwa, quran, articles , fiqh , lectures , prayer times , about islam etc.

Minister of Finance Incorporated

As the user enters his question and some required personal information, a welcoming message is sent to him with the question reference number. Willkommen bei Chat Islam Online. Chatting with opposite gender in online games Assalaamu alaykum My name is Rama and I am 13 years old I have a question and I would like to receive a personal answer and not be sent to article numbers to read because they do not suit the situation that I want answered Now I play this game and obviously it has different genders My question is is it haram to chat and play with the opposite The Christian Science Monitor is an international news organization that delivers thoughtful, global coverage via its website, weekly magazine, online daily edition, and email newsletters.

Profit Rates. Current Time World Clock and online and printable Calendars for countries worldwide. Instead of an Islamic scholar doing the honours in person, the AI-powered Virtual Ifta gave the declaration on internet chat against the competitor, whose identity cannot be revealed given that the firm is now wajib-ul-qatl in its Islaamic Legal Rulings. Sudais calls for measures to counter anti-Islam campaign 8 June ; Extremist ideologies must be countered, says Muslim World League chief 5 May ; Idelogies of extremism, fanaticism and terrorism 22 January ; Tackling religious and intellectual extremism 16 September ; Council of Senior Scholars: Saudis aware of the bad intentions of terrorist groups You can email us your query and someone from the Fatwa department will get back to you as soon as possible.

For Fatwa related questions email: [email protected]. YouTube is as popular as ever with users spending an average of 40 minutes per YouTube session.

ISFIRE Feb Issue by ISFIRE11 - Issuu

In line with this digital shift, the next thing you should learn is how to make money on YouTube. The Regional Darul Ifta of Bangsamoro's primary role is the promulgation and issuance of fatwa or legal opinions concerning Muslim personal laws as well as jurisprudence with the Article VIII, Section 20 of Republic Act as the basis for this function.

Imams Online is a global platform that provides a voice for Imams. We provide news, global events, job portals and an Ask your Imam service. Fatwa is a judicial decision or legal opinion on Sharia issues.

Inexpensive powder coating oven

In Islamic finance it is usually a short document that Islamic theologians - jurists faqihs - confirm the compliance of legal and commercial aspects of the transaction to the Sharia law. Fatwa dan Pramoedya lantas larut dalam perbincangan selama dua jam. Tak ada pembicaraan serius soal ideologi atau kebudayaan. Hanya obrolan ringan, kata Fatwa. In fact, the positive implications of helping fellow Muslims to earn a halal income far exceed the benefits of giving in a charitable manner.

While the Western system employs material incentives to motivate individuals to undertake entrepreneurial activities, Islam mainly uses moral incentives without failing to account for the material stimulus. In conclusion, the essence and function of the market is entrepreneurship and trade, and not banking. This is a profound point that needs to be seriously considered by all those involved in the Islamic banking and finance industry.

Rasem N. A Culture of Excellence Islamic economics is not a new phenomenon; it is simply adapting to the challenges of modernity. Its history is replete with examples of ideas and products, thinkers and policies that have contributed to the creation of societies with an impressive socio-economic structure.

From financial practices, product development, education and innovation, the Islamic Economy undoubtedly created a culture of excellence. This culture of excellence continues through Islamic banking and finance, a sector that has been praised for its resilience during the credit crisis. OIEF brings together world renowned experts in the field to discuss, argue and proffer advice to strengthen the industry.

This event is anticipated to be a pivotal event for the industry in Oman, a country which has recently opened its doors to Islamic finance and is making impressive strides in the world markets. Ready for the Next Phase of Development The GCC has been a popular market for takaful in the last few years due to the support of governments and the backing of regulators. Sohail Jaffer. This is poor when compared to the Malaysian takaful industry which registers contributions of USD In addition, the return on equity for GCC based- companies remain below average as compared to their conventional counterparts.

The picture is one of stalled growth as opposed to dynamic growth but the horizon looks bright. An established takaful infrastructure, as the GCC can boast, provides the platform from which the industry can grow. Exploring new lines of business Opportunities for the market to grow abound.

There is an underpenetrated life insurance market in the GCC, and immense potential for family takaful products. Increasing awareness of financial planning and protection of wealth creates a burgeoning pool of potential More needs to be done to create a product portfolio that meets the desires of this growing population. Consequently there is optimism that the industry can rebound from its stagnancy.

Increasing per capita income and favorable demographics are key contributory factors to this precipitous ascent. The region has a large young, working population with approximately 70 per cent in the years bracket. Moreover, according to World Bank forecasts, the total population of the GCC will grow by an average of 2. This seems promising for the takaful and the overall insurance market. As this young population in the region matures, the demand for takaful products should increase. Other insurance products such as investment-linked and annuities product categories are underdeveloped and require more attention.

Takaful solutions for corporates and SME remain weak but there is much potential for takaful companies to work in parallel with Islamic banks in the area of project financing and micro takaful solutions. The emergence of new customer segments comprising of an informed population that have specific requirements and greater.

Products need to be built around customer specifications, such as bundled protection coverage, travel insurance, credit, life insurance, female illness plans including covering specific diseases like breast cancer, and family plans that include critical illness cover, travel cover, and children protection. Subsequently, there is scope to create tailor made plans. Investment innovation: Innovation is also reaching investment strategies; takaful players are thinking ahead and starting to develop solutions for the rising number of risk averse investors due to uncertain market conditions.

A prime example is the creation of a dynamic principal equity growth strategy by FWU Group in conjunction with an international bank for takaful customers. The main benefit for the customer is that the new technology secures capital growth at maturity by locking in the highest net asset value NAV of the. Innovation for operational efficiency: Investing in technology to simplify the sales process and deliver high customer service standards is also becoming of paramount importance. Call centers, internet and mobile phone services can offer distinct advantages to elements of the sales process far above adopting a personal contact only strategy.

As the needs of wealth management and financial planning become more widespread throughout all customer segments, technological improvements that smooth the flow of information is expedient. The need for investment products with yields higher than cash is growing. There has also has been significant growth in sukuk funds as investors are becoming more sophisticated in their asset allocation decisions, and are searching aggressively for higher returns. There has been a revival of the sukuk market in the Gulf, and issuance is anticipated to follow an upward trend.

In the UAE, the Insurance Authority issued a circular in September to all insurance and takaful companies setting out guiding rules for their bancassurance business. Takaful operators had to adjust their internal accounting structures, remove the use of wakala and qard, and amend product terms and conditions. This shift away from the pure takaful model may have widescale effects on the industry especially since Saudi Arabia is the largest takaful market, globally. Oman has recently opened up their takaful markets following government endorsement of Islamic banking in the country, the last Gulf state to do so.

The CMA has finalised the draft law which will go to the cabinet and then to Ministry of Legal Affairs and other related institutions before it is issued.

While the new regulations are seen as a positive development, the increased variances in regulatory regimes across jurisdictions could make it difficult for takaful operators to function across regions. It may lead to confusion for customers and multinational insurers. The market needs restructuring as it matures in order for takaful operators to benefit from economies of scale and large distribution networks. However, this is subject to other challenges, such as limited Islamic investment avenues, lack of re-takaful capacity, lack of standardization and shortage of qualified personnel, which seems to be particularly challenging in the case of the GCC.

Recent political developments in the MENA region, triggered by the Arab spring, are expected to create a favorable environment for Islamic finance in general: a prime example is the announcement of the interim head of Libya to incorporate Islamic finance in the post Gaddafi era. This will result in opportunities for GCC operators to export their expertise and enter new markets, with a massive potential for cross border expansion in high potential markets such as Egypt, Morocco, Libya and Tunisia.

Takaful will benefit further from the boom predicted for the GCC insurance industry. Its market share is set to grow as competition intensifies between takaful operators and their conventional counterparts. The increasing awareness and acceptance levels of the takaful concept and the business opportunities created by compulsory lines and corporate business are providing a sound foundation for the Islamic insurance to take a leap forward. One of the major challenges for the GCC takaful market remains its fragmentation, with increasing number of small local players competing against established conventional.

Regular and lump sum contributions Open investment architecture Dynamic Protected Sharia compliant Equity Strategy Robust web-based sales and policy administration system designed for customer convenience Structured Retakaful solution with a major global reinsurance company Annual Retakaful surplus distributed to the individual participants. Manfred J. Dirrheimer fwugroup. Jaffer fwugroup. Looking at the Muslim population, for every man, there are 1. However, the employment rate amongst women in the Muslim world is far less than for men. These professions are seen as being culturally acceptable, perhaps leading to an over supply of women in the educational sector, and increasingly in public health and medical professions.