Write a review.

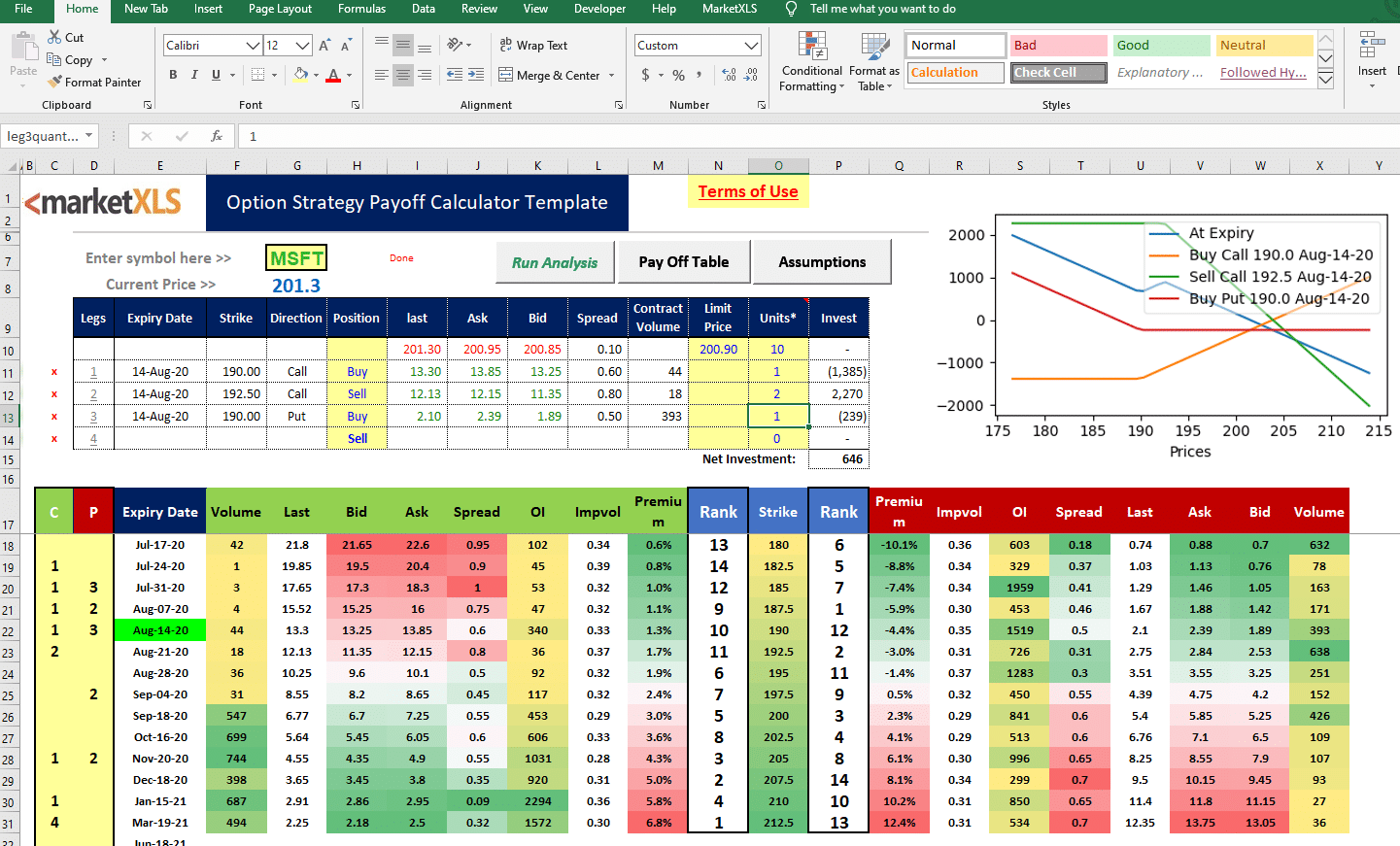

Options Strategy Payoff Calculator Excel Sheet

View all Eloqoons. Why do I need to sign up with LinkedIn? Send to a friend linkedin twitter facebook code. Objectives Options trading. Use it if Risk Management.

- Option Strategy Payoff Calculation!

- best breakout trading system.

- Excel Spreadsheet For Option Trading | Option strategies, Option trading, Excel spreadsheets.

- People who bought this also bought....

Don't use it if Speculations. Real Estate Financial Model Template Bundle For professionals with commercial projects or business ventures that need assistance with building financial models. Creates a financial summary formatted for your Pitch Deck. More Best Practices from Jatin Goel. DCF model for Dabur India ltd. On conservative Investment Approach. Analyse your Investment Decision with this 4 tab Excel Template. Financial Statement Analysis Excel Model. Login View all Eloqoons.

Add to Wish List failed.

Have a question or feedback? Option premiums will be more expensive the further out in time you go, but the rate of time decay will be slower and the annualized return will be lower. The spreadsheet allows you to create option strategies by.

I have attached a file I have done in excel for calculation Options payoff for a portfolio of Options Contracts in a same security. A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited. Put Option Payoff Graph.

Download Link

So far this project can download options data from Google Finance, and show you the price and Greeks in a straddle view. It will show the payoff diagram for our strategy. The user can specify up to four positions long or short. Download the Option Trading Strategies Spreadsheet — This spreadsheet helps you create any option strategy and view its profit and loss, and payoff diagram.

Options Trading Excel Model (With Fundamentals)

Option payoffs are simply the reward or return that one can expect from investing in or being involved in options trading. The formulas in all rows will be the same — we will create them in the first row row 12 and then copy them to the other rows. A call option is the right, but not the obligation, to buy an asset at a prespecified price on, or before, a prespecified date in the future.

You purchase it when you expect prices to rise and want to benefit from that rise. Short Call Option Payoff Summary. We can also display payoff diagrams for individual legs — in such case the chart series value range will be CC61, DD61 etc.

Order execution through Tradier Brokerage: Any strategy can now be converted into a trade order which is sent to Tradier Brokerage for preview and execution. When trading options, we have quite a few moving parts to juggle. By remaining on this website or using its content, you confirm that you have read and agree with the Terms of Use Agreement just as if you have signed it.

Option traders use profit and loss diagrams to.

- Book description!

- gamma options trading.

- machine learning options trading.

- vps forex paling murah!

For example, you can change the colors or locations of different parts to adjust the spreadsheet to your preferences, you can make the chart bigger and more prominent etc.