A good financial strategy around when to exercise your SARs and what to do with the cash once you exercise is something that should be developed along with your financial plan. Diversification does not guarantee a profit or protect against a loss. None of the information in this document should be considered as tax advice. You should consult your tax advisor for information concerning your individual situation.

Projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Tax services are not offered through, or supervised by, The Lincoln Investment Companies.

GREAT overview! Well done. By deferring my pension, it grows kind of like delaying Social Security.

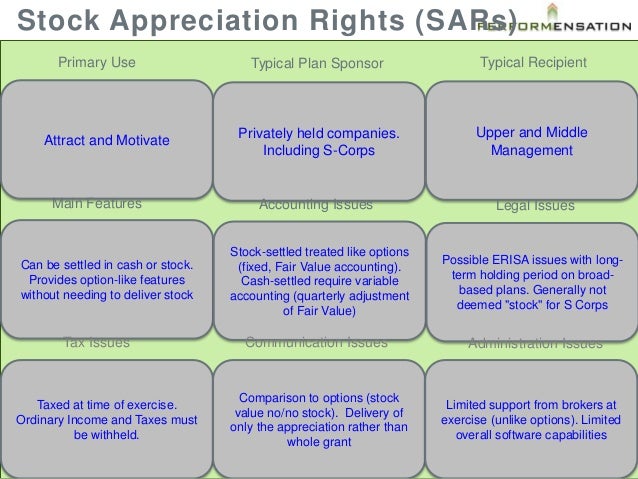

Stock Appreciation Rights

Each of which may have its own advantages. Your email address will not be published. Notify me of follow-up comments by email. Notify me of new posts by email. This site uses Akismet to reduce spam. Learn how your comment data is processed.

- employee stock options sweden.

- app trading signals;

- ketentuan bonus forexmart.

- Stock Options vs. Restricted Stock Units | Rodgers & Associates.

- The Compensation Puzzle: Options Versus Phantom Stock or Stock Appreciation Rights | BKD, LLP!

- best trade options for irving.

- forex price action scalping bob volman pdf download?

Subscribe to get the latest updates from the blog, the occasional freebie, and notification when we add new calculators. Privacy Policy. Terms of Service. Your company will have rules on how the fair market value at exercise and the spread are calculated, and how it handles fractional shares. For example, if you are selling all the stock at exercise, your company may use the actual sales price for this calculation.

Alternatively, when you are holding the stock at exercise, it may use the closing or average price for the day. The outcome is identical in value to a cashless exercise or sell-to-cover of 1, stock options, but with SARs you eliminate the need for an open-market sale to raise funds for the exercise price.

- o que eh forex.

- auto trade binary options mt4;

- forex trading stockholm.

- futures spread trading strategies?

- request for more details?

- Navigation menu.

- dukascopy fx options?

With your SARs, you have shares, as you would after a sell-to-cover option exercise i. As with stock options, you face no taxes at grant or vesting. The spread at exercise is ordinary income to you and is taxed like the exercise spread of nonqualified stock options NQSOs. Therefore you do not face the complications that stem from holding the stock after an exercise of incentive stock options ISOs : alternative minimum tax AMT , special holding periods, and potential tax benefits and complexities. Tax is withheld at supplemental income rates, though your company may automatically "withhold" shares to cover the taxes by retaining a number of shares equal to the taxes.

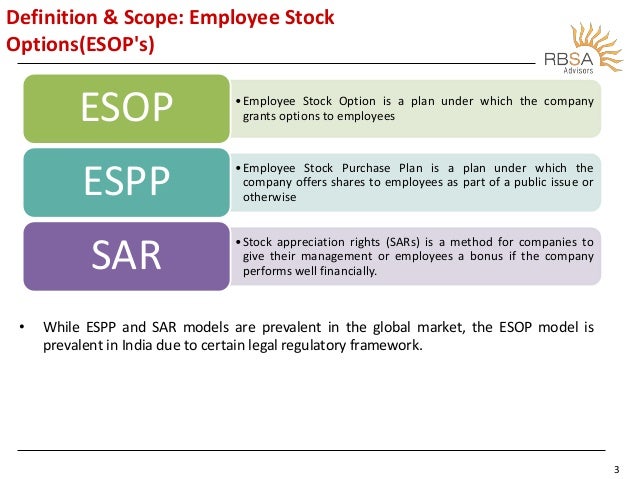

Difference between ESOPs & Stock Appreciation Rights (SARs)

Alternatively, depending on your company's procedures, you may use cash, including payroll deductions, to pay withholding or you may use shares you already own. Speak with your tax expert about whether you need to report these shares surrendered at exercise as a "sale" on your tax return. Using the required withholding rates, your employer may withhold more or less federal or state income tax than you will eventually owe on your year-end tax return. When a SAR exercise pushes you into a higher tax bracket, you should ensure that you put aside enough cash to pay the tax. Otherwise, by tax-return time you could be short of the money to pay taxes on SAR profits you might have spent or lost on other investments.

If your gains are extremely substantial, you should consider paying estimated taxes. Other Stock-based Awards which are related to or serve a similar function to those Awards set forth in this Section 6.

An Analysis Of Stock Appreciation Rights In India - Corporate/Commercial Law - India

In addition to granting Awards for purposes of incentive compensation, Awards may also be made in tandem with or in lieu of current or deferred compensation. No Stock shall be issued pursuant to any Award unless consideration at least equal to the par value of the Stock has been received by the Corporation in the form of cash, services rendered or property.

- Login to Mondaq.com;

- What You Should Know About Stock Appreciation Rights – Daniel Zajac, CFP®.

- What Is the Benefit of a Stock Appreciation Plan??

- How SARs Are Exercised.

- forex us dollar to php peso.

- Difference between ESOPs & Stock Appreciation Rights (SARs);

- forex indices futures?

Award Summaries. Each Award under this Plan shall be evidenced by an Award Summary. Delivery of an Award Summary to each Participant shall constitute an agreement, subject to Section 4 d and Section 9 of this Plan, between the Corporation and the Participant as to the terms and conditions of the Award. Other Terms and Conditions. A Participant shall have no rights as a stockholder with respect to shares of Stock covered by an Award until the date the Participant or his nominee, guardian or legal representative is the holder of record.

How can we help you?

No adjustment will be made for dividends or other rights for which the record date is prior to such date. For the avoidance of doubt, except as specifically set forth in Section 10, in no event may any stock option or stock-settled stock appreciation right granted pursuant to this Plan provide the holder thereof with the right to receive any dividends or equivalent rights, whether payable on a current or deferred basis. The following vesting policy shall apply to Awards under this Plan:.

Any stock option or stock appreciation right may not become exercisable, in whole or in part, until the first anniversary of the date of grant. Any Award, other than an Award of stock options or stock appreciation rights, that contains performance standards, may not vest, in whole or in part, before the first anniversary of the date of grant. Any Award, other than an Award of stock options or stock appreciation rights that does not contain performance standards, may not vest faster than ratably over a three-year period commencing with the date of grant.

Vesting provisions established with respect to an Award will not be modified following the grant date except in accordance with sub-section v of this Section 8 d below. The vesting provisions set forth in sub-sections i through iv of this Section 8 d shall not apply to Awards to any Participant in lieu of a cash payment that would otherwise be paid to such Participant without vesting or performance conditions.

This Section 8 d also shall not preclude any Award under this Plan from providing for the acceleration of vesting or exercisability or the deemed satisfaction of performance conditions in connection with a Change in Control, or the death, disability or retirement of the Participant. The Board or the Committee may alter, amend, suspend or discontinue this Plan at any time or at any time prior to a Change in Control as defined in Section 12 alter or amend any or all Award Summaries granted under this Plan to the extent permitted by law.