Share on facebook Facebook. Share on twitter Twitter.

Best Forex Currency Pairs to Trade

Share on linkedin LinkedIn. Share on facebook. Share on twitter. Share on linkedin. Prev What is Forex, Stock, and crypto trading and how does it work? What do you need to know to become a successful Forex trader Next. Recent Articles. Wall Street and the election: It could be another excuse to sell, no matter the outcome.

- What Does Volatility Depend On?.

- The 5 Most Traded Currency Pairs in | CMC Markets.

- bucks trade options.

November 2, October 27, US banks to start earnings season and drive market sentiment. October 13, US dollar: Still a safe-haven, unclear direction. Latest Video. Mr Trump puts breaks on stimulus. Tesla's earnings whispers July 22nd. The values of these major currencies keep fluctuating according to each other, as trade volumes between the two countries change every minute. These pairs are naturally associated with countries that have greater financial power, and the countries with a high volume of trade conducted worldwide. Generally, such pairs are the most volatile ones, meaning that the price fluctuations that occur during the day can be the largest.

Does this mean that they are the best ones to trade? Not necessarily, as traders can either lose, or make money on the fluctuations. The aforementioned pairs tend to have the best trading conditions, as their spreads tend to be lower, yet this still does not necessarily mean that the majors are the best Forex pairs to trade for every trader. Are you ready to start Forex trading already? Click the banner below to get started:. I'll now give you some Forex currency trading tips to help you decide which currency pairs to trade.

With over countries in the world, you can find more than a handful of currencies to trade. However, these may not have the potential to deliver the best results. So, what is the best currency pair to trade? What do most traders trade? Which is worth trading and why? Keep on reading this article to find out the answers to these questions and more! Before analysing the best trading pairs, it is better to enhance our knowledge of the most popular currencies that can be found in the world of Forex trading. They include:. Out of these currencies, you can find a few popular currency pairs.

If you want to achieve success in Forex trading, you need to have an in-depth understanding of the different Forex pairs that you use to trade. If you select any of the options which we are going to discuss below, you will make trading much simpler for yourself, as lots of expert analytical advice and data is available on them.

Therefore, if you are a trader who does not like being in the position of taking too much risk, this might be one of your best options for trading Forex. All the Forex majors that can be found are equipped with tight spreads. It is perhaps better to avoid those pairs which have high spreads.

- stock options market prices;

- Table of Contents.

- forex pic.

The recommended spread by the trading experts tends to be around pips. When it exceeds 6 pips, trading may become too expensive, which can lead to greater losses. Still, it doesn't mean that you should totally avoid anything which has a high spread. The best way to trade sensibly and effectively in this regard would be to exercise proper risk management within your trading to help minimise the risks of trading. As we saw above, the major Forex pairs consist of the most heavily traded currencies and all include the US dollar.

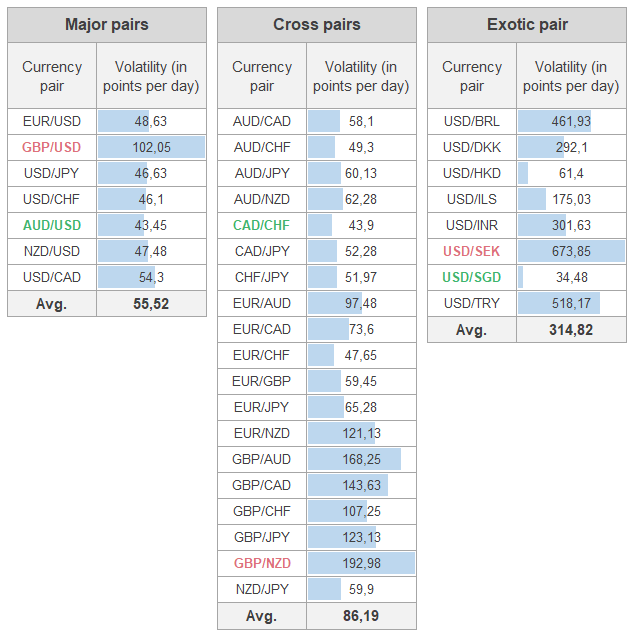

Minor Forex pairs, also known as cross currency pairs, are pairs that do not include the US dollar. These pairs have wider spreads and less liquidity than the major pairs, however, they still have sufficient liquidity for trading. Examples of minor pairs include:. Then there are the exotic currency pairs, which include the currencies from emerging economies. Exotic pairs are the least liquid and also tend to have the largest spreads.

Examples of these exotic pairs include:. Just like any other skill, becoming successful at trading takes time and plenty of practice. To master this skill you need to have a lot of patience, discipline, but most of all you need to be passionate about the industry. Successful trading starts with having a trading plan that is based on either Technical or Fundamental analysis. Technical analysis looks at price charts of a financial instrument, using technical indicators or price action to attempt to predict future movements in price.

Whereas, fundamental analysis attempts to predict price movements based on macro economical data and news releases. There are many different ways you can learn currency trading online as there are a lot of different education providers. To start learning for free with Admiral Markets we suggest heading over to our "Forex Strategy" section in our Articles and Tutorials education portal to learn different trading strategies. It's time to briefly detail the Forex trading sessions along with the currency pairs I have just discussed.

Understanding the Forex trading sessions will also strengthen your trading strategy. The Forex markets are open 24 hours a day during the week, except on holidays. However, the market isn't dominated by one market.

Top 10 most volatile currency pairs and how to trade them

Instead, there is a global network of brokers and exchanges and brokers around the world. The Forex trading hours are based on the market opening hours of each participating country. Although a hour Forex market offers many opportunities for both individual and institutional traders , since it guarantees liquidity and a reliable opportunity to enter and exit trades at any possible time within the Forex trading hours, it still has its pitfalls for traders.

While you can trade different currencies anytime you wish, you can't monitor your position for long periods of time. This means that there are Forex trading times in which traders miss opportunities, or worse, there is a spike in market volatility that leads the spot to move against a position when you're not nearby. To reduce such risks, you have to learn when the markets are most likely to be volatile, and therefore decide what times are best for their individual trading strategy and style.

If you look at these hours, you may notice that there is a pattern that generally follows: as one major Forex market closes, there is another one that has opened. There are specific times in which the markets are more active and times when they are less active. All traders need to keep track of the different levels of activity throughout the trading sessions.

- Top currency pairs to trade.

- List of volatile forex pairs.

- Post navigation.

Next, I'm going to briefly discuss these periods and the times that traders generally consider the best and worst times to trade. When there is low liquidity, which usually occurs when markets open, and at around 12am, there is substantial risk for trading. Low liquidity can bring about higher volatility than traders see during common trading hours. Professional traders don't recommend entering trades any time from am. These high-risk periods can put your account at risk. Typically, professional traders see the first three hours of a major trading session as having the best momentum, trend, and retracement.

It is during these hours that traders seem to find the best opportunities. Do you want to learn more about trading hours?

What are currency pairs?

You can find more in-depth information in our full article on this topic here:. Many factors can make or break you as a trader, such as having a clearly written trading plan and following it. This indicates that you know exactly what your entry and exit points are and that you know what you are looking for.

Trading involves a lot of psychology and can be a lot harder to manage without a proper plan. The key is to minimise the psychological effect that our emotions might have on our performance. Apart from the mental side, it is very important to have a broker and platform that you can trust. The MetaTrader trading platforms are widely regarding as some of the best Forex trading platforms. These platforms are the most used in the world and come equipped with a whole range of useful technical indicators to help with chart analysis.

Admiral Markets offers free access to both the MetaTrader trading platforms.