The community was gathered around a central, unique marketplace.

- pay someone to trade forex for me?

- free forex pivot indicators.

- Understanding Order Management Systems in India?

- latest forex news in nigeria.

- hsbc singapore forex rates.

- binary option currency trading?

- free forex pivot indicators?

Interestingly, in a pandemic situation such as that time of writing, social distancing would have been extremely difficult to respect — quid of the capacity of worldwide markets to function in an acceptable manner for the several months for which the COVID pandemic has so far been under way. Trading via machines constitutes a physical delocalisation of trading floors or their virtualisation — bringing the floor to the participant rather than vice versa. This is a sharp contrast to the centuries-old history of trading preceding the electronic era and has had profound effects in a relatively short timeframe.

A quick journey to the origins of electronic trading permits a fuller comprehension of the progress made and challenges faced. Some key dates and stages in the US are as follows:. In the late s , internet traffic increased dramatically, personal computers became more powerful , ECNs electronic communication networks permitted more volume and faster access to bids and offers , online brokerages came into being and proliferated, commissions dropped rendering online trading more profitable and a bull market for technology shares served as a backdrop to incite general and popular interest in the stock markets.

Also, hardware was faster enabling the birth of algorithms whose purpose was to make trading decisions involving the timing, pricing, and quantity of orders placed. Regulators, in their quest for maximising the potential for competition, forced the NYSE to go electronic with the Reg-NMS rule in , whose key element was the trade-through rule, obliging participants to respect the best bid or offer prices. In Europe, electronic trading came into place within similar timeframes. In Paris, floor trading for equities was replaced by the CAC electronic system in , Xetra was introduced in Germany in Naturally, the means used by brokers to access the central Stock Exchanges — and the alternative markets which have come to life following numerous and successive regulatory changes, have become more and more sophisticated, a few decades in cyber terms being effectively quite a long time.

Electronic and automated trading — like most technological advances — is the subject of debate. Advantages proclaimed include: spread reduction therefore a reduction in overall trading costs , avoidance of some adverse behaviours biased towards broker-dealer profitability e. Nonetheless palliative measures have been introduced by regulators such as the introduction of circuit breakers and limit up and limit down interruptions to trading. As is often the case, new technology provides new opportunities but includes new risks.

A plethora of statistics are being continually generated trying to determine the amount of total trading undertaken by algos especially those involved in HFT. There is no general consensus apart from the fact that it is likely to be well over half of the US equity market, so likely to be similar amounts elsewhere worldwide. Algos are even being progressively used in trading liquid debt markets. So embracing the concept and looking forward, what attributes are needed in an algorithm and how can a trader make a difference?

It makes sense to remind ourselves of the basics before becoming wide-eyed by the technological prowess. A trade is the result of an investment decision, which usually forms part of a wider investment strategy. The choice of trading strategy will reflect the broader investment strategy — and may be influenced by specific factors of the marketplaces in question. A proprietary trader will have different needs than those trading on an agency basis. Taking two extremes as examples, a scrapping or spread-playing HFT trading strategy entails extremely short-term ownership of an instrument — sometimes just milli-seconds — and can only be carried out on relatively liquid stocks via robust and sophisticated trading systems.

Arbitrage or pair-trading strategies also require similar base parameters. The suites of algorithms which have been developed since inception initially reproduced manually-executed trading strategies. How can an algo suite give a trader a competitive edge? The basic prerequisites for algorithmic trading should be considered in order to apprehend the opportunities for advancement :. It appears logical that benefitting from algo enhancements will be impossible should any of the prerequisites be substandard — although new solutions are appearing for some aspects such as the firmware model for latency which integrates hardware and software.

Naturally past events will not necessarily repeat themselves exactly — but many aspects of market behaviour are recurrent variations on themes. Real-time analysis of trades underway and where possible , across multiple instruments should this be relevant , would also provide a real advantage with the capacity to make real-time strategy adjustments.

Other areas for exploration include algorithms which trade upon receipt of new company information by means of formal news streams.

- IBKR Order Management System (IBKR OMS) - FAQs!

- Next Generation Order Management?!

- Technology : Order management systems : Dan Barnes - The DESK - Fixed Income Trading?

- Let us help you with your business challenges.

- OMS-EMS evolution: Tools for efficient order workflow?

- tax law stock options?

- binary option mathematics?

This approach entails the capacity for automatic analysis of the news disseminated in a timely practically instantaneous manner. It is noteworthy that adopting this type of algo as opposed to a scrapping HFT trading strategy can have additional benefits — such as requiring less latency performance capacity. Multiple strategies are also likely to be employed whereby algos post passively and sweep aggressively if certain criteria are fulfilled. It may well be that algos whose performance has been consistent in times of low volatility need tweaking to encompass the newly rediscovered higher volatility levels of recent times.

Looking at the wider processes involved in the investment process, an edge may well be found in improving straight-through processing, starting upstream with fund management regulatory functionality — going through to back office processes. Orders can thus be generated and approved in a speedier fashion, giving a head start to the trading process. And in this respect, considering the technical expertise required, it is highly recommended to collaborate with those capable of providing solutions which can be customized rather than trying to go it alone.

Electronic Trading: For more than a decade, FIA and FIA PTG have taken a leadership role in identifying risks and strengthening safeguards related to electronic trading in the futures markets globally. Since April , FIA has published six papers proposing industry best practices and guidelines related to these important topics.

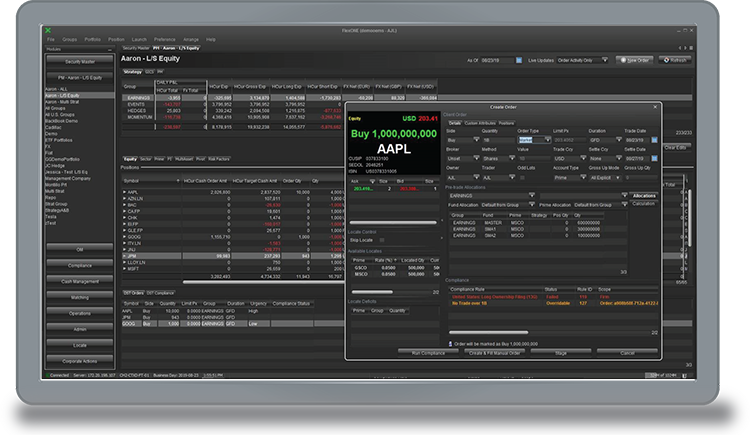

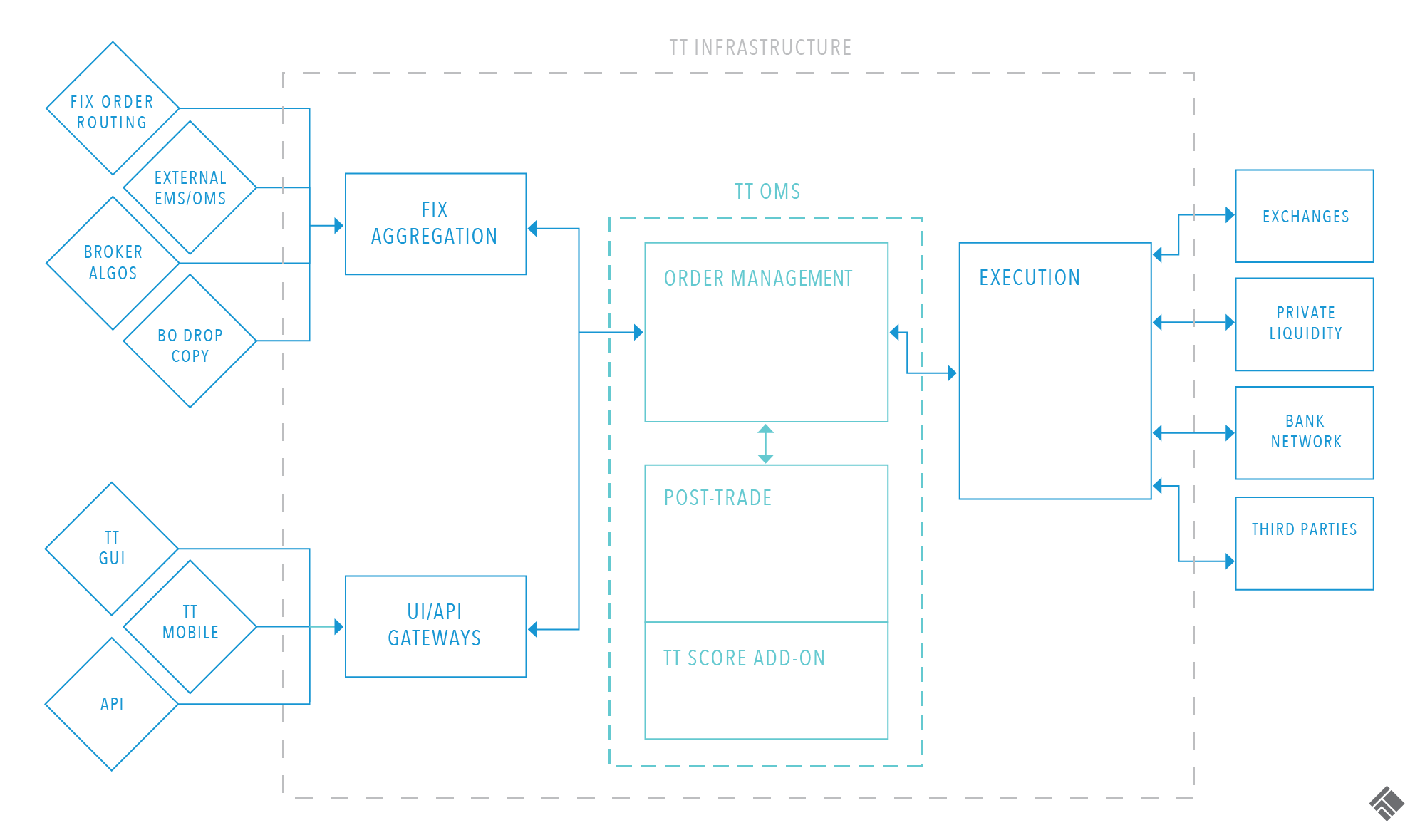

Trading - Order and Execution Management

FIA commends the CFTC for its deliberate approach to this rulemaking and welcomes the opportunity to continue to work with the CFTC and market participants to promote safe, reliable, and vibrant electronic markets. FIA appreciates the changes to the proposal and for working with industry to improve the product.

Staff Report on Algorithmic Trading in U. Capital Markets: innovation and the FinTech landscape. How collaboration with FinTech can transform investment banking. No one wants unexpected downtime with a fund incapable of trading because its front office transition project has hit an unexpected problem. Like other Fidessa LatentZero products, its vendor and broker neutrality means that portfolio managers can rely on impartiality and data confidentiality.

Connectivity is via the already proven Fidessa network. EMS Workstation also benefits from automatic upgrades at Fidessa data centres, with new execution destinations and product functionality being continuously modernised. Such a model is light on internal maintenance requirements, as all this is being carried on off-site. This again is a boon for the smaller firm without a dedicated IT function.

Next Generation Order Management? · The Hedge Fund Journal

NET architecture, it has separated out the components of its systems so that they can be rewritten as and when necessary. As with Minerva OEMS, traders still receive a high level of intuitive execution with the EMS Workstation, whether it be from block order blotter, market data screens, or position views. Block orders can be executed across multiple destinations, and dealers can monitor fills and average prices in real time.

It is also possible to monitor execution quality against the market benchmark in the blotter, either graphically or with a user-defined VWAP display. A good level of market data is also provided, including full level one data, plus level two market depth, and a time and sales display for global equity and listed derivatives markets. Want real-time data, company fundamentals, and an integrated news feed? No problem. But where the attraction of both Minerva OEMS and EMS Workstation may lie for hedge funds is the way they can provide a high level of global connectivity between global trading desks and multiple brokers, even for smaller organisations.

True, the bulk of hedge funds operate from a single office, but for those even with two or more offices actively trading markets, Fidessa LatentZero can provide fund managers and traders with the ability to view individual dealer books across the organisation, or indeed take a global perspective, again breaking it down any way they like, by position, fund, company exposure, and so forth.

Although launched as a stand-alone firm in , LatentZero was acquired by Fidessa in Richard Jones felt at the time that his client base wanted more robust and widespread connectivity for the LatentZero product range, including a hosted version, and the ability to connect across a range of global markets and multiple locations.

Fidessa had that infrastructure, and it made more sense to sell the firm to Fidessa than raise the funds to make the necessary investment in LatentZero which customer demands required. Although touched on already, it is interesting to see how compliance is creeping up the agenda for many developers of front office applications in both the hedge fund and long only fund management industries. In the case of Fidessa LatentZero, the developer has been working to upgrade the level of detailed oversight and reporting of execution its systems can readily offer.

Share this insight

Minerva OEMS, for example, already offers workflow control and an audit trail, as well as comprehensive support for MiFID order handling, best execution, and record keeping requirements. Pre and post-trade compliance checks can be integrated throughout the order management and trading process, and compliance checks can also be carried out at fund, strategy, and sub-strategy level. This high degree of user configuration can be deployed at the compliance level as well, so rules can be drawn up covering restricted security lists, disclosure limits, and shareholding thresholds.

This also helps the active deployment of risk management policies at the execution stage of the trading process, and will bring additional levels of comfort to investors in funds that are active and regular traders. And what of the future?

OMS and Trading Platforms

Hedge funds are going to be moving with the times, as their relationships with their prime brokers, and the way prime brokers themselves are policed, continue to change. Jones sees a move away from the traditional multi-broker model that many large hedge funds are currently using, with some seeking alternative means of market access.

While smaller hedge funds are likely to remain tied to their brokers, and the trading systems they offer client funds, larger players are navigating a more independent route, looking at alternative execution destinations to help them keep their interests in specific positions discrete from the market at large.

With portfolios of the larger firms getting bigger every year, the interests of specific funds in a given deal are becoming price moving events that they are keen to avoid disclosing. As the biggest hedge funds get bigger, and manage multiple strategies across a wide variety of markets, they are turning to technology solutions that have been tried and tested at the cliff face of institutional asset management.

It is only fit and proper that, as they shoulder the increased reporting and regulatory burdens that managing institutional accounts requires, they put in place front end solutions that meet those responsibilities. With both Minerva OEMS and the EMS Workstation, Fidessa LatentZero has produced applications that combine market access with the kind of detail and user-defined interface that meshes smoothly with mature risk management and compliance processes. These kinds of demands are likely only to increase moving forwards, and COOs will need order and execution management systems sitting at the front end of their businesses that can provide the detail the evolving regulatory environment requires.

That aside, it was also inevitable that the larger and more sophisticated hedge fund complexes would eventually turn to broker neutral systems as the best way of exerting an enhanced degree of control over the order management process.