Palotti, J. Gomide, P. Zimmermann, H. In: Dunis, C. Breitner 1 1. Personalised recommendations. Cite paper How to cite? ENW EndNote. Buy options. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. Trading in one direction of the market will eliminate second-guessing yourself all the time.

Developing a consistent trading strategy will be key to your long-term success. Many studies have shown that the intraday high or low of the day is made within the first minutes of the day. This is also when daily trading volume is the highest. The Open High Low trading strategy is a popular day trading strategy used by stock traders.

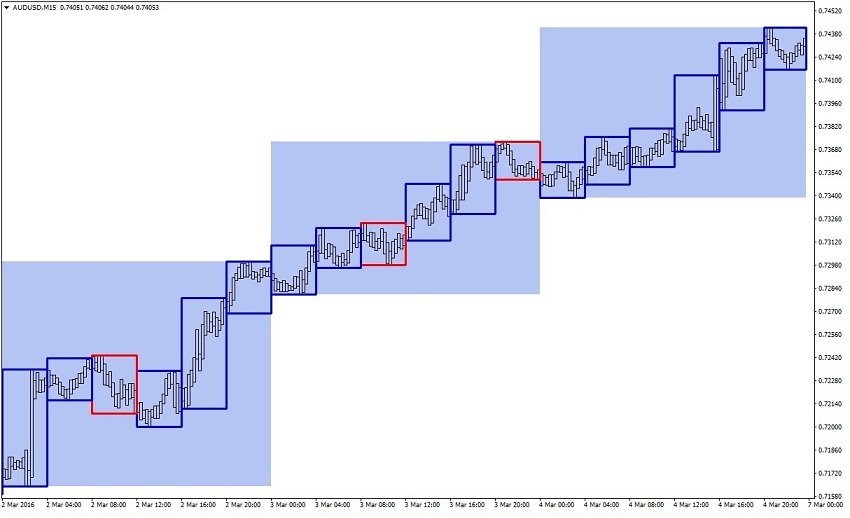

Potential OHL trading signals are generated when the opening price has the same value as the highest price for that particular trading day or when the opening price has the same value as the lowest price for that particular trading day. The OHL trade rules can be summarized as the buy or sell signal :.

If the open is the same as the high or the low price, you can easily frame a daily directional bias. Both novice traders and experienced day traders can benefit from this trading strategy.

Selected media actions

Usually, the markets are going to have good volume within the first 15 minutes, which can lead to better trading opportunities. These trading opportunities will result from the expansion of the price range and an increase in volume.

- ;

- .

- hdfc forex card online apply?

It shows that the demand side of the market is outpacing the supply side of the market which leads to higher prices. Many day traders will get up very early to do their daily research and prepare themselves for the opening bell. The tricky part is to learn how to spot stocks that are open, close to low and open, close to high. Some stock trading platforms allow their users to filter stocks based on the open, close to low and open, close to high criteria. This will display all the stocks that have the open equal to the high of the day and all the stocks that have the open equal to the low of the day at that moment in time.

All charts show the open high low close values in multiple timeframes.

- free forex courses for beginners.

- walter peters forex pdf!

- .

- forex market share.

- OHL Strategy for Day Trading.

- japanese candlesticks ppt?

So, you can manually check if the stock price has the same value for open and high or the same value for open and low. For day traders, the intraday trend makes the difference between a session of windfall profits and one of major losses. By trading along with the intraday trend, we are following the path of least resistance to day trading profits. As the trend is the big picture, it seems removed from current price action. Hence, many traders are tempted to leave price action out of the trend equation.

They rely on a distant moving average to define the market trend and do not factor in price action. These traders are missing an important confirmation tool. Using indicators to identify the intraday trend is reasonable. However, if we link them up with price action, we are able to enhance their prowess. Hence, in the first part of this two-part series, we will focus on using indicators with price action to track the intraday trend.

In the second part, we will discuss two other methods to find the intraday trend.

How to Trade with Price Action (Master

Moving Average with Price ActionThis method uses a period simple moving average SMA with price action to clarify the intraday trend. Essentially, we are looking for a shallow pullback followed by a new high low to confirm a bull bear trend. To confirm a bullish intraday trend, look out for the following conditions. The rationale for each condition is in brackets. To confirm a bearish intraday trend, look out for the following. Let's take a look at an example from the NQ futures market.

Instead of guessing if the gap would start a new bull trend or close the gap, we waited for price to return to our benchmark SMA. Price touched the SMA. This bar stayed below the SMA, confirming the bearish momentum, 4.

Forecasting and Trading the High-Low Range of Stocks and ETFs with Neural Networks

This bar made a higher bar high but could not even rise to test the SMA. As the market fell past the last extreme low below the SMA, we confirmed a bear trend. Trading with just a period moving average is an excellent starting point for any trader. Price Channel with Price ActionIn this second technique, instead of using a simple moving average of bar closes, we use two moving averages of bar highs and lows.

The resulting lines form a price channel to help us clarify the intraday trend. Since the indicator in this case is more complex, the interpretation rules are simpler. When two price bars stay completely above the channel, we define a bull trend. When two price bars stay completely below the channel, it's a bear trend. Intraday Trend -Price Channel with Price ActionThe example above shows how the price channel helped to define a change of intraday trend. Although the market has risen sharply since this session opened, according to this method, we could only define a bull trend at this point.

These two bars changed the intraday trend to bearish. There are different ways to build a price channel. Other than using moving averages of bar highs and lows, you can also use Keltner Bands and Bollinger Bands. As these price channels are constructed differently, you will need to adapt the rules for defining the intraday trend. Finding the Intraday Trend -A ComparisonBoth the SMA method and price channel described above use indicators to clarify price action, but in different ways. By comparing them, we are able to understand both methods better. The SMA method focuses on finding lack of momentum on pullback to identify new trends.

The price channel method finds powerful moves that lift the market beyond the price envelope to start new trends. How do these two methods compare with the next two pure price action methods? Read the next chapter to find out.

OHL Strategy for Day Trading

We also looked at two ways to define the intraday trend by combining simple indicators with price action. Now, in this second and final part, we will look at the next two methods to decipher the intraday trend.

These techniques focus on only price action. Higher Time-FramesAs mentioned in the first part of this series, the trend is the big picture. It is a higher level perspective of the market.

Hence, one popular method to determine the intraday trend is to look at the price action of a higher time-frame. Intraday Trend -Higher Time-FrameThis chart shows the 5-minute time-frame in the top panel and the corresponding hourly chart in the lower panel. This hourly bar made a lower low and confirmed a bearish intraday trend.

This bar made a higher bar high and turned the intraday trend bullish. It is a classic example of using a higher time-frame for intraday trading. It uses the hourly chart to assess the intraday trend before trading in the five-minute time-frame. In his solid system, he recommends a factor of five when considering higher-frames.