Trading related files. Settlement related File Format for Currency Derivatives. Settlement related files. User manual for Online Trade file Activation and Installation. Online Trade file Set-up version 1. Online Trade file exe.

Online Trade File exe. Online Trade File Set-up version 3.

Business Challenges & Goals

Notice Date. Online Trade file for Equity Segment. Updated format of Online Trade file. Online Trade file -Equity format. Here the sell price is set at Rs. The trading is for intraday. It is an order for buying or selling of securities at a particular price as set by the investor. However there is no guarantee that the limit order will be executed. For example the price of a Share X is Rs. It is an order to sell the shares as soon as the price of the share falls up to a particular level or from the buy side to buy the share when the price rises up to a specified level.

What is BSE and NSE? Meaning and the Difference

This is set by the client to avert the loss which can occur in share market. This is done to not suffer loss more than the specified limit. Let us take an example: Buy Price: Rs. Suppose the stock price falls to However if the Stop loss has not been kept and the price falls to Rs. So due to stop loss the loss had been averted. Placing a stop loss in intraday trading terminal:.

BSE Ltd: BSE to launch equity trading on Bolt Plus from April 7 - The Economic Times

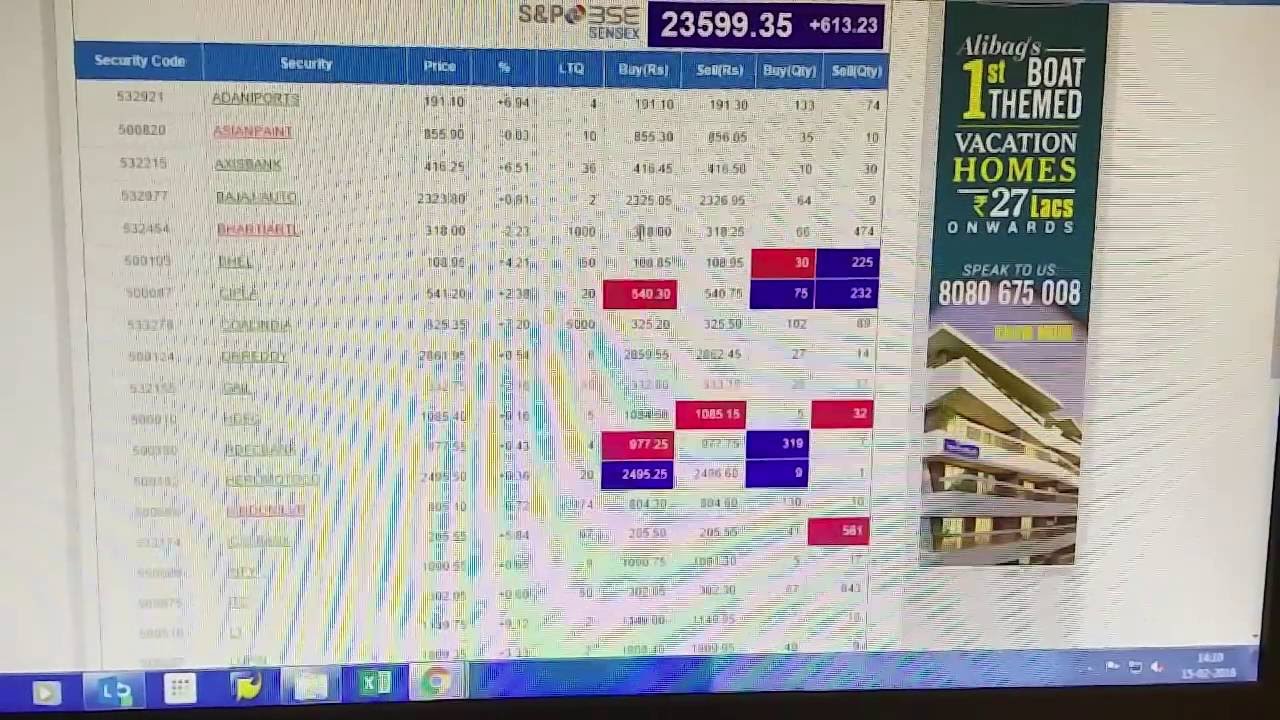

Here the stop loss is set at Rs. This means if the price of the share falls to Market depth shows the number of Buy and Sell orders for a security at various price levels at a single point of time. In sell side we have the ask price and the ask quantity along with the Total Sell Quantity. Let us take an example to understand its working in details. You have placed an order to BUY 20 shares intraday at a price of Rs. Let us take one more instance say you want to BUY 10 shares for Rs.

A contract note is a written agreement between the broker and the investor for smooth execution of the transaction. A contract note is sent through an automated message and via mail through the registered phone and mail respectively by the end of the day. However it varies from broker to broker and the timing varies. Below is the portion of a contract note, showing the final amount to be paid by the client.

So, it shows that the client has to pay Rs. The settlement is done by the clearing agency which functions in each stock exchange.

The clearing agency delivers the share certificates by the end of the day. Initiate payout through Back office by 8.

- BSE Introduction!

- Full Form of BSE (Bombay Stock Exchange) | Functions.

- options trading strategies in marathi.

- simple guide to options trading;

- traders dynamic index forex factory.

The package from ATS is designed for those, who wants to earn higher returns when compared to regular intraday packages. Toggle navigation. Market Snapshot.

Sensex Nifty Silver Gold USD BSE is the world's fastest and Asia's number one stock exchange. It trades in equity, currencies, debt instruments, derivatives, and mutual funds. After six years of exponential growth, the company experienced the need for greater database performance, faster transaction processing, and engineering support. With its new platform, response time leapt from milliseconds to microseconds.