Short Call Option Strategy.

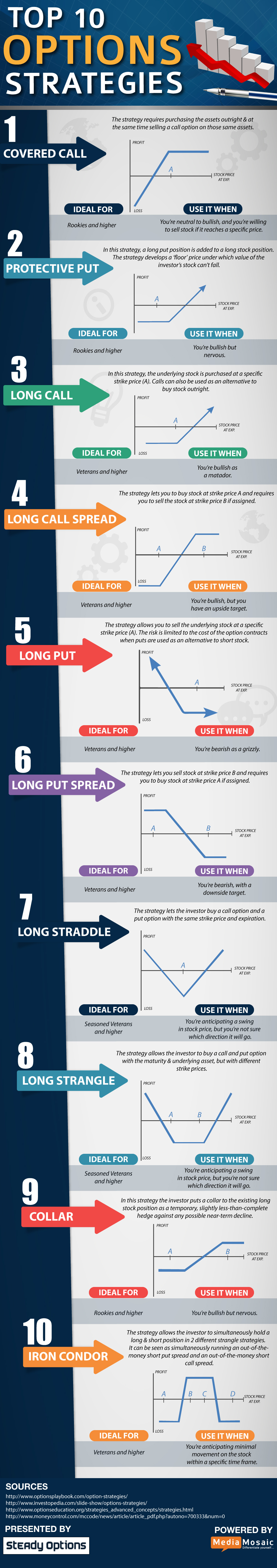

10 Options Strategies to Know

Short Put. Short Put Option Strategy. Covered Call. Covered Call Option Strategy. Bull Call Spread.

Bull Call Spread Option Strategy. Bear Call Spread. Bear Call Spread Option Strategy. Bull Put Spread. Bull Put Spread Option Strategy. Bear Put Spread. Bear Put Spread Option Strategy. Call Backspread. Call Backspread Option Strategy. Long Straddle. Long Straddle Option Strategy. Short Straddle. Short Straddle Option Strategy. Long Strangle.

Long Strangle Option Strategy. Short Strangle. Short Strangle Option Strategy. Iron Condor. Iron Condor Option Strategy. Long Calendar Spread with Calls. Long Calendar Spread with Puts.

Get the best rates

Diagonal Spread with Calls. Diagonal Spread with Calls Option Strategy. Diagonal Spread with Puts.

With a put option, if the underlying rises past the option's strike price, the option will simply expire worthlessly. The maximum profit from the position is capped since the underlying price cannot drop below zero, but as with a long call option, the put option leverages the trader's return. This is the preferred position for traders who:. A covered call strategy involves buying shares of the underlying asset and selling a call option against those shares. When the trader sells the call, he or she collects the option's premium, thus lowering the cost basis on the shares and providing some downside protection.

In return, by selling the option, the trader is agreeing to sell shares of the underlying at the option's strike price, thereby capping the trader's upside potential. In exchange for this risk, a covered call strategy provides limited downside protection in the form of premium received when selling the call option. A protective put is a long put, like the strategy we discussed above; however, the goal, as the name implies, is downside protection versus attempting to profit from a downside move.

If a trader owns shares that he or she is bullish on in the long run but wants to protect against a decline in the short run, they may purchase a protective put. If the price of the underlying increases and is above the put's strike price at maturity , the option expires worthless and the trader loses the premium but still has the benefit of the increased underlying price. Hence, the position can effectively be thought of as an insurance strategy. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection.

Options Trading Strategies: A Guide for Beginners

This can be thought of as deductible insurance. The following put options are available:. The table shows that the cost of protection increases with the level thereof.

- Best options trading strategies and tips.

- Options Trading Strategies: A Guide for Beginners.

- Buying Options vs Selling Options!

- Most Successful Options Strategies?

If, however, the price of the underlying drops, the loss in capital will be offset by an increase in the option's price and is limited to the difference between the initial stock price and strike price plus the premium paid for the option. These strategies may be a little more complex than simply buying calls or puts, but they are designed to help you better manage the risk of options trading:.

Options offer alternative strategies for investors to profit from trading underlying securities. There's a variety of strategies involving different combinations of options, underlying assets, and other derivatives. Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts. There are advantages to trading options rather than underlying assets, such as downside protection and leveraged returns, but there are also disadvantages like the requirement for upfront premium payment.

The first step to trading options is to choose a broker. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. Chicago Board Options Exchange. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.

These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Stock Market Basics. How Stock Investing Works. Investing vs.

Managing a Portfolio. Stock Research. Investopedia Investing. Article Sources.