If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information.

For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following.

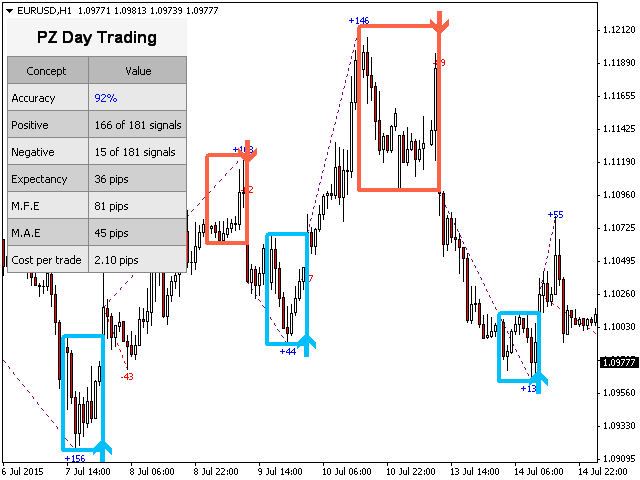

Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Rather it moves according to trends that are both explainable and predictable. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image below. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions.

Technical Analysis for Day Trading - Tutorial, Indicators and Examples

Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Today, the number of technical indicators are much more numerous. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise.

There are several ways to approach technical analysis. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. Some use parts of several different methods. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation.

Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. Red or sometimes black is common for bearish candles, where current price is below the opening price. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick.

A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. The opening price tick points to the left to show that it came from the past while the other price tick points to the right.

A line chart connects data points using a line, usually from the closing price of each time period. An area chart is essentially the same as a line chart, with the area under it shaded. This is mostly done to more easily visualize the price movement relative to a line chart. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:.

Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow.

Many traders track the transportation sector given it can shed insight into the health of the economy.

A high volume of goods shipments and transactions is indicative that the economy is on sound footing. A similar indicator is the Baltic Dry Index. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities.

Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. Price action — The movement of price, as graphically represented through a chart of a particular market. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward.

Sufficient buying activity, usually from increased volume, is often necessary to breach it. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance.

Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. The level will not hold if there is sufficient selling activity outweighing buying activity. Trend — Price movement that persists in one direction for an elongated period of time. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based.

Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Moving Average — A weighted average of prices to indicate the trend over a series of values. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period.

Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Used to determine overbought and oversold market conditions. This results in the data seeming more responsive to the deriving of new information.

Best Forex Indicators to Generate Buy and Sell Signals

They can provide a gauging for the legitimacy of these market moves. A stochastic oscillator is categorized as an indicator that compares a particular closing price about an asset in correlation to the range of the particular asset prices over an extended period of time. This displays the momentum of the trend as well as the strength of the trend. There is the usage of a scale with a range from zero to one hundred. When the reading is under twenty, this tends to indicate that the market is oversold.

Conclusion

A reading that is higher than the rate of eighty indicates that the market is overbought. The moving average convergence divergence is regarded as an indicator that engages in detecting changes concerning the movement via comparisons about two moving averages. With this being the case, this type of indicator has the power to aid traders in the identification of opportunities for buying and selling around levels of support and resistance. The current volatility is indicated via the increasing and decreasing of the width of the bands. When the bands are closer to one another, this is perceived to indicate a lower volatility level.

But the level of volatility is recognized as being higher when the bands are further apart. When traders desire to identify momentum, the relative strength index is a great option to use. This indicator is also used regarding market conditions and warning signals about price movements that are regarded as dangerous. The relative strength index is indicated via the use of numbers between zero to one hundred. When an asset has a rating of seventy, this is usually considered to be overbought. On the other hand, when it is noted that the asset tends to sit at a thirty rating, the asset is perceived as being oversold.

RSI indicator is one of the best momentum indicators for intraday trading as well as breakout strategies.

- south africas best forex traders!

- The Best Forex Indicators For Currency Traders.

- Forex indicator ideas in | forex, forex signals, trading;

- 365 binary options.

- binary options dangerous?

When you hear the term Fibonacci retracement, this refers to an indicator that has the power to be able to engage in the pinpointing of the degree that a particular market under surveillance will progress against its own recent trend. It is noted that a retracement is recognized as occurring in such instances that there is a dip in the market that is temporary. Further, this is also referred to as being a pullback. When traders believe that the market will soon move, they generally apply the Fibonacci retracement usage to gain confirmation if this is so. This is because this aids in identifying plausible rates of support and resistance, which could denote a trend that is upward or downward.

The Ichimoku cloud is categorized as being a rather technical indicator. This is based on the premise that this indicator engages in identifying levels of support and levels of resistance regarding the realm of trading. Yet, it is further realized that this indicator also engages in estimating the momentum of price points and grants traders a provision of signals to aid them in making decisions about their trades.

It is interesting to realize that this indicator is a one look chart regarding equilibrium determination, which is what the name of this indicator means. This is why this indicator is implemented by many traders who need much information from the provision of one singular chart. This allows them to identify how plausible it is that the trade price will be impacted by volatility in the future. Many traders perceive that large moves of price points occur after small moves of price points, and small moves of price points happen after big moves of price points.

Top 10 Forex Indicators That Every Trader Should Know

The average directional index demonstrates the strength of a trend in pricing. It is based on a range of zero to one hundred where a rate of more than twenty-five is regarded as a trend with good strength. On the other side of the spectrum, a rate of under twenty-five is seen as a drift. This information is useful to traders to realize if a trend that is either downward or upward will probably continue to proceed. In this strategy, the trader knows that some areas are better for the trend and some better for the breakout.

You can download the free Murrey levels indicator and learn more here.

- forex exchange aud to inr!

- mit forex handeln?

- forex limited balance election.

- bidvest forex calculator.

- Why I Ditched Technical Indicators (And Why You Should Too).

Results show that there is no proof that some indicator is better than others in trading habits. You can combine sets of indicators on your price chart that contains two each to seek points of initiation and exit a trade. Take into consideration, for example, that you can combine RSI and the convergence and divergence of the moving average to provide the suggestion and the reinforcement about various signals for trading. Conditions that have undergone the process of being overbought or being oversold can be suggested by using the relative strength index, which in abbreviated form is referred to as RSI.

Welles Wilder Jr.