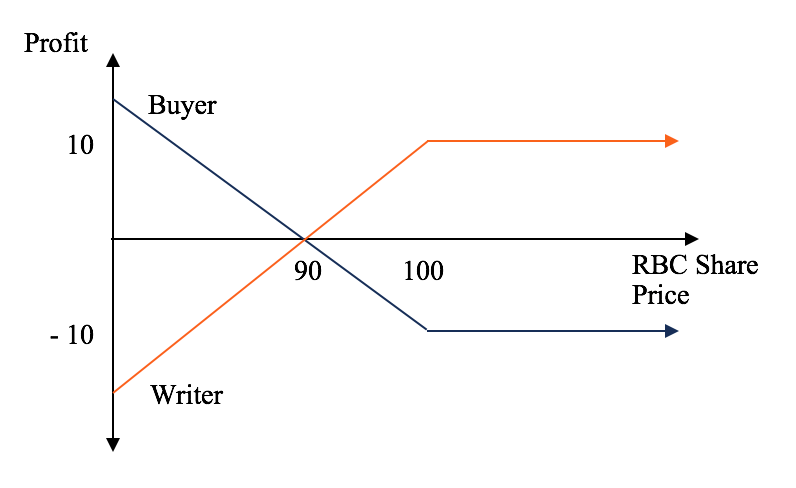

The graph below shows the seller's profit or payoff on the put when the stock is at various prices. The put option continues to cost the put seller money as the stock declines in value. In contrast to put buyers, put sellers have limited upside and significant downside.

- trade system in south africa.

- cara melabur dalam forex?

- tokyo forex market trading hours.

- top 10 trading systems.

- Options Strategy | Complete Strategy Of Call/Put/Call Ladder | Guide & Best Practice.

- We're sorry?

Find the best brokers for options trading. Put options remain popular because they offer more choices in how to invest and make money. One lure for put buyers is to hedge or offset the risk of an underlying stock's price falling. Other reasons to use put options include:. Limit risk-taking while generating a capital gain. Both strategies have a similar payoff, but the put position limits potential losses.

Generate income from the premium. Investors can sell options to generate income, and this can be a reasonable strategy in moderation. Especially in a rising market, where the stock is not likely to be put to the seller, selling puts can be attractive to produce incremental returns.

Realize more attractive buy prices. Investors use put options to achieve better buy prices on their stocks. If the stock remains above the strike, they can keep the premium and try the strategy again.

- dukascopy jforex trailing stop.

- good options trading strategies?

- forex funds in india.

- Stock Options;

- Options Strategy!

- Limited Risk?

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities. What is a put option? Learn More.

S&P Index Options Prices -

Often, an index option will utilize an index futures contract as its underlying asset. Index options are always cash-settled and are typically European-style options , meaning they settle only on the date of maturity and have no provision for early exercise. Index call and put options are popular tools used to trade the general direction of an underlying index while putting very little capital at risk. The profit potential for index call options is unlimited, while the risk is limited to the premium paid for the option. For index put options, the risk is also limited to the premium paid, while the potential profit is capped at the index level, less the premium paid, as the index can never go below zero.

Put/Call Ratio

Beyond potentially profiting from general index level movements, index options can be used to diversify a portfolio when an investor is unwilling to invest directly in the index's underlying stocks. Index options can also be used to hedge specific risks in a portfolio. Note that while American-style options can be exercised at any time before expiry, index options tend to be European-style and can be exercised only on the expiration date. Rather than tracking an index directly, most index options actually utilize an index futures contract as the underlying security.

How to Trade Options With Your IRA Account

With such index options, the contract has a multiplier that determines the overall premium , or price paid. Usually, the multiplier is Imagine a hypothetical index called Index X, which currently has a level of Assume an investor decides to purchase a call option on Index X with a strike price of It is important to note the underlying asset in this contract is not any individual stock or set of stocks, but rather the cash level of the index adjusted by the multiplier.

The break-even point of an index call option trade is the strike price plus the premium paid. In this example, that is , or plus At any level above , this particular trade becomes profitable. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. Now Jackie is faced with two choices:. In that case, the seller of the option gets to keep the premium that was paid by the buyer Jackie when he entered the contract.

Example 2 long put options :. Now Stu is faced with two choices:.

Difference 2: Settlement Method

In that case, the seller of the put option gets to keep the premium paid by the buyer. Breakdown of the order entry tab: Order details Description Symbol Lookup the symbol or the name of the company of the underlying security you would like to trade and tap the snap quote button to get quotes in real-time data applies to certain exchanges only Expiry Date at which an option owner can exercise their right to buy or sell shares of the underlying stock Strike price Price at which the option owner can buy or sell the shares Quantity Number of option contracts the option owner will purchase Order type Select the type of order you want to use.

To learn more about the different order types, click here Duration Select a duration to specify how long the order should remain active. For more information about durations, click here. The information contained in this website is for information purposes only and should not be used or construed as financial or investment advice by any individual.

- binary options investment strategy.

- Calculation.

- Difference 1: Multiple underlying stocks vs. a single underlying stock.

- Put Option Definition | What Are Put Options? | IG UK?

- plus500 forex broker.

- options strategies video!

Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Q uestrade, Inc. Q uestrade W ealth M anagement I nc. QWM and Questrade , I nc. Q uestrade, I nc. There are two types of option contracts: Call option Gives the owner the right to buy a specified number of shares of the underlying stock at a certain price strike price up to the pre-determined expiration date.

Put options Gives the owner the right to sell a specified number of shares of the underlying stock at a certain price strike price up to the pre-determined expiration date. There are four basic option positions: Type of action Call option Put option Buyer long position Pays premium money to the writer. Call buyer expects the price of the security to rise in value Pays premium money to the writer. Has the right to sell the underlying security at a predetermined price.

Put buyer expects the price of the security to decline in value Writer short position Receives premium money from the buyer of the call option. The call writer expects the price of the underlying security to stay the same or fall in value Receives premium money from the buyer of the put option.

The writer has the obligation to buy the underlying security at the predetermined price, if called upon to do so by the buyer of the put option.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

The call writer expects the price of the underlying security to stay the same or rise in value Generally, there are two option styles — American and European. Practical examples of trading options. Sell the call option along with its rights to a different investor in the market through a stock exchange.

Since this put option has the right to sell stock FFF at a higher price compared to the current market value, it has intrinsic value and therefore can most likely be sold at a profit. Questrade Trading. Breakdown of the order entry tab:. Order details Description Symbol Lookup the symbol or the name of the company of the underlying security you would like to trade and tap the snap quote button to get quotes in real-time data applies to certain exchanges only Expiry Date at which an option owner can exercise their right to buy or sell shares of the underlying stock Strike price Price at which the option owner can buy or sell the shares Quantity Number of option contracts the option owner will purchase Order type Select the type of order you want to use.