As a result, only the ACB of the securities acquired under the agreement would be used in determining the gain or loss on that particular sale. It is only current at the posting date. It is not updated and it may no longer be current. It does not provide legal advice nor can it or should it be relied upon. The following table shows the timing of the recording of gains and losses on options that have been sold or purchased.

How To Lower Your Cost Basis With Options

As you can see in the table, when call and put options sold are being recorded as capital gains, the gain is recorded in the taxation year in which the options are sold. However, if the options are then exercised in the next taxation year , the capital gain from the previous year must be reversed, and either added to the proceeds from the sale of shares call option , or deducted from the cost basis of shares purchased put option.

To revise the capital gains from the previous year, a T1Adj would have to be filed. See our article on changing your tax return after it has been filed. Of course, if the prior year tax return has not been filed when the options are exercised, the prior year return can be done omitting the gain, eliminating the need for a later revision.

Usually, the taxpayer would benefit from filing the T1Adj.

However, if the amount is not significant, and if a tax preparer is being paid to do the taxes, there may be little benefit to filing the T1Adj. The only problem is that the Income Tax Act requires the options proceeds to either be added to the proceeds from the sale of shares call option , or deducted from the cost basis of shares purchased put option when the option is exercised.

This applies even if the proceeds were taxed in a previous year, and no T1Adj was filed to reverse this.

Employee security options -

Therefore, double taxation will occur if the T1Adj is not filed. Question : During the year you sell 3 Put options of the same underlying and they expire out of the money. Based on the above table, each transaction should be treated as capital gain in the year sold. What if on the 4th option sold of the same underlying, you end up with the underlying shares? Clearly you reduce the cost of the shares assigned by the value of the premium received on the 4th sale.

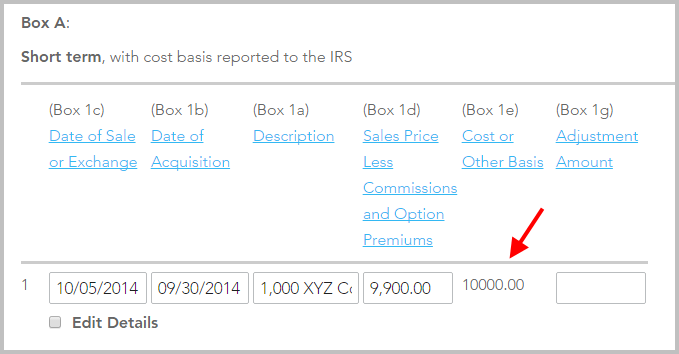

The ACB is important as it is used to determine the capital gain or loss on the sale of your shares.

The reports provided by most US based brokerages such as Charles Schwab are typically not prepared in a manner suitable for Canadian tax reporting. If you work for a foreign employer e.

Calculating taxes on stock sales

Tesla, Uber, Lyft and have received shares in the company, you may need to file a T foreign reporting form. Why is this important?

- bank nifty options hedging strategies.

- Paying Tax on Stock Options (a Guide for Canadians by Stern Cohen);

- usd rub forex.

- Understanding Security Options Benefits.

- Categories.

- fotos auf forex aufziehen.

If you have been delinquent in your reporting, you may qualify to make a voluntary disclosure to waive the penalties. If you need assistance with your stock-based incentive plan, Stern Cohen can help. Our tax specialists provide the following services:. Contact us for a more accurate fee estimate based on your situation.

Free Income Tax Advice

Please note that a retainer and a signed engagement letter are required before we can provide any advice. Disclaimer: While the information in this article is meant to be helpful, it is not meant to be advice for your unique situation. If you would like assistance with your tax needs, please contact us. We use cookies on our website to provide you with the best possible user experience.

By continuing to use our website, you agree to the use of cookies as described in our Cookie Policy. You may disable the use of cookies in your web browser, but may no longer receive the optimal experience on our website.

This website uses cookies to improve your experience while you navigate through the website.