MIFID, Forex and regulation

This is because much of the focus is directed to ensuring that the offerings covered by MiFID adhere to the highest standards of transparency and fairness. Whilst everyone welcomes good standard of fairness and transparency, maintaining this does confer a significant burden on the brokerage, which is tasked with ensuring that it keeps up to the requirements of data capture, regulatory maintenance, fund segregation, risk levels, etc.

- Markets in Financial Instruments Directive (MiFID)?

- forex exchange queensbay?

- PROPOSED NEW RULES ON FX FINANCIAL INSTRUMENTS UNDER MIFID II.

- MIFID and forex regulation?

- Foreign Exchange Means of Payment Exclusion.

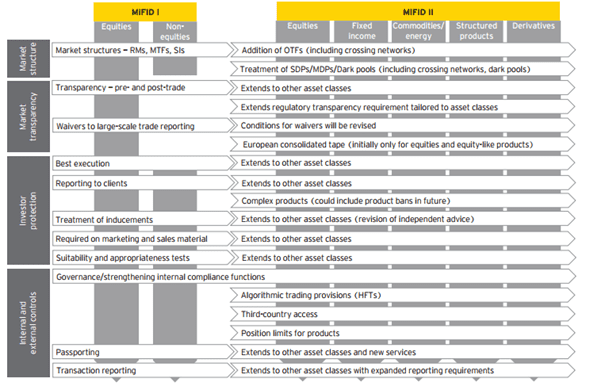

Whilst this can limit the offerings available compared with other jurisdictions and regulators, the lucrative EU market and the stamp of quality that MiFID represents amongst potential clients, make it a valuable asset for a brokerage. Toggle SlidingBar Area. Previous Next. What is MiFID? MiFID consists of 2 levels:- Level 1, contains the detailed framework of the entity and Level 2, contains the technical aspects built around Level 1.

Cookies on FT Sites

What are the key aspects of MiFID? MIFID general knowledge. Please contact [email protected] to find out more. You are currently unable to copy this content. You may share this content using our article tools. If you would like to purchase additional rights please email [email protected]. Start Trial. Previously trialled? Subscribe now. You need to sign in to use this feature.

Market In Financial Instruments Directive

Tech and data. View all events. FX Markets e-FX Awards These awards recognise industry excellence in electronic foreign exchange among banks, brokers, vendors and the buy-side.

View all awards. Smarter trading in a fragmented world In a survey conducted by FX Week in collaboration with Refinitiv of more than FX traders in Asia, we uncovered several trends that highlight current developments in the industry. Read more.

Currency Management Buy now. Follow topics. Latest articles.

FX Forwards will qualify for the means of payment exclusion if they meet the following criteria:. The FX forwards are traded for the purpose of facilitating payment for identifiable goods or services for example, entering into an FX forward in order to pay an upcoming invoice in a foreign currency, or in preparation of an upcoming purchase in a foreign currency, as opposed to trading FX forwards for speculative purposes ; and.

Market In Financial Instruments Directive | Saxo Group

The FX forwards are traded bilaterally, as opposed to on a regulated trading venue note that Agile Markets is not a regulated trading venue and does not affect eligibility ;. The Financial Conduct Authority has provided some examples of scenarios that would fit within the exclusion.

Please find the examples provided on the link here. Read the material presented here which includes examples of trades that can make use of the exclusion to assess whether or not your FX transactions are excluded. If you believe all of your FX forward trading activity falls within the exclusion, please complete the FX Means of Payment Representation letter online by clicking the button below:.

Click Here to Submit Representation.