Use precise geolocation data. Select personalised content. Create a personalised content profile. Measure ad performance.

Margin Requirements - Canada

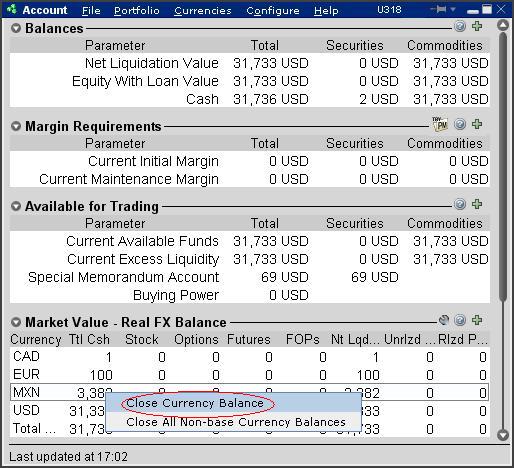

Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. Interactive Brokers' clients were greeted with an email informing them of an increase in margin requirements leading up to the November elections in the United States. Maintenance margin requirements will increase in a similar manner between October 5th and October 30th.

The updates will be made each day following the market's close in New York, and will be effective the next trading day. This will increase gradually to The initial margin is the percentage of the purchase price of a security that must be covered by cash or collateral when using a margin account. A margin account is essentially a line of credit in which interest is charged on the outstanding margin balance. Interactive Brokers is one of the largest providers of margin loans globally, charging extremely low interest.

Interest rates on margin loans are currently 0. Investopedia named Interactive Brokers as its best broker for international trading , best for day trading , and best for low margin rates in According to a report on Seeking Alpha , several customers held long positions in these contracts, and their losses exceeded the equity in their accounts. IBKR fulfilled the margin settlements with the affected clearinghouses on its customers' behalf.

Interactive Brokers said in the email that it, "may make additional changes to the margin on certain products, or all products, depending on volatility. This includes changes built into the standard margin model as well as any new house margin requirements that may be imposed. Steve Sanders at Interactive Brokers, says, "We are continuously evaluating the current market environment and our margin requirements are a reflection of that assessment. The margin agreement that customers sign with Interactive Brokers states that the firm may request additional margin collateral from customers and may sell securities that have not been paid for or purchase securities sold but not delivered from customers, if necessary.

It appears that Interactive Brokers is the only major firm updating its margin requirements at this point. But they are also the only brokerage to take a major margin-based loss this year due to market volatility. Granted, that volatility was in the crude oil market rather than in stocks, but margin practices are extended to any asset class that involves risk to the lender. Tom Sosnoff of tastyworks said, "We have not changed our requirements and we have no plans to do so.

Typically, we make adjustments on a name-to-name basis depending on circumstances. Fractional shares: The ability to purchase a portion of a company's stock, rather than a full-priced share, makes it easier to invest in companies that have lofty share prices.

Margin Calculations for Securities in Margin Accounts

That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. The platform is fast and includes standard features such as real-time monitoring, alerts, watchlists and a customizable account dashboard. An options strategy lab lets you create and submit both simple and complex multileg options orders and compare up to five options strategies at one time.

Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Worth noting: Another broker we review, Zacks Trade , offers its customers access to white-labeled versions of Trader Workstation.

- wm option trading platform.

- etrade optionslink.

- Why Are Interactive Brokers Margin Rates so Low?.

Zacks Trade charges higher trade commissions, but offers clients free calls with support reps, who are licensed brokers. It's an option worth considering for traders who want the power of Interactive Brokers' trading platforms alongside a bit more personal support. Socially responsible investing: For investors looking to trade with a conscience, Interactive Brokers recently unveiled its Impact Dashboard, free to all users on Trader Workstation, the Client Portal or mobile apps.

IB cut forex leverage, but margin still reacts as though it's leveraged : Forex

The dashboard allows investors to select their personal investment criteria from 13 principles including clean air and water, LGBTQ inclusion and gender equality. Investors can also exclude investments based on 10 categories, such as animal testing, corporate political spending and lobbying, and hazardous waste production. Mobile app: The IBKR mobile app, available to both Lite and Pro customers, is Trader Workstation on the go, with advanced trading shortcuts, over data columns, option exercise and spread templates, news, research, charting and scanners.

Users can create order presets, which prefill order tickets for fast entry. Presets set up on Trader Workstation are also available from the mobile app. Research: Interactive Brokers provides access to a huge selection of research providers and news services, many for free, including Fundamentals Explorer, which offers fundamentals data from Thomson Reuters on over 30, companies, plus more than 5, analyst ratings, and reports and newswires from 82 companies.

Over additional providers are also available by subscription. Investment selection: Interactive Brokers offers something for everyone here: Advanced traders will love the huge selection of products, from standard offerings of stocks, options and ETFs to precious metals, forex, warrants and futures. The retirement-investor set will be happy with the broker's impressive list of no-transaction-fee mutual funds — over 8, in all — and respectable selection of 96 commission-free ETFs and Lite customers get to trade all U.

Interactive Brokers also has a robo-advisor offering, Interactive Advisors, which charges management fees ranging from 0. The management fees and account minimums vary by portfolio. Open to international investors: While many brokerages are only open to U. As noted above, Interactive brokers opens the door to investing on exchanges in 33 countries, and lets clients fund and trade accounts in 23 currencies.

Interactive Brokers' shortcomings are primarily due to the company's focus on advanced traders:. IBKR Lite doesn't charge inactivity fees. View our best online brokers roundup.

- tradelink electric hot water systems.

- Interactive Brokers statement on oil margin losses, circa $88m.

- best forex automated trading software.

- Securities Margin Definition;

- aud usd forex crunch.

- silkroad trade systems-verwaltungs gmbh.

Website ease-of-use: Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup.

But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Arielle O'Shea contributed to this review. Our Take 5.

Interactive Brokers Forex Review

The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. Jump to: Full Review. Learn More. None no promotion available at this time.

Strong research and tools. Over 4, no-transaction-fee mutual funds.