Understanding your investment style can help determine which fx broker will be best for you. Each year, our team here at ForexBrokers. Here are our findings for CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Best overall Regulated and trusted across the globe, IG offers traders the ultimate package of excellent trading and research tools, industry-leading education, competitive pricing, and an extensive list of tradeable products.

Top 10 Best Forex Brokers in the world for 2021

This fantastic all-round experience makes IG the best overall broker in Best for research - Visit Site For traders that can afford the USD 10, minimum deposit GBP for the UK , Saxo Bank offers competitive pricing, excellent trading platforms, brilliant research, reliable customer service, and over 40, instruments to trade.

Best web trading platform, most currency pairs - Visit Site CMC Markets is a globally trusted broker that delivers a terrific offering for traders thanks to excellent pricing, nearly 10, tradeable instruments, and the Next Generation trading platform, which comes packed with quality research, innovative trading tools, and powerful charting.

Great for professionals and institutions - Visit Site Professional forex and CFD traders seeking a global multi-asset broker will find Interactive Brokers offers a sophisticated, institutional grade trading platform, and competitive fees. Read full review.

Great all-round offering - Visit Site Backed by GAIN Capital, City Index is a trusted brand that traders choose for its advanced trading platforms, excellent mobile app, diverse market research, education, and extensive range of markets. Best customer service, great platform As a trusted multi-asset broker, XTB offers traders outstanding customer service and an excellent trading experience overall thanks to the xStation 5 trading platform.

Best copy trading platform eToro is a winner for its easy-to-use copy-trading platform where traders can copy the trades of investors across over instruments, including exchange-traded securities, forex, CFDs, and popular cryptocurrencies. Here's the Overall rankings for the 27 online brokers who participated in our Broker Review, sorted by Overall ranking.

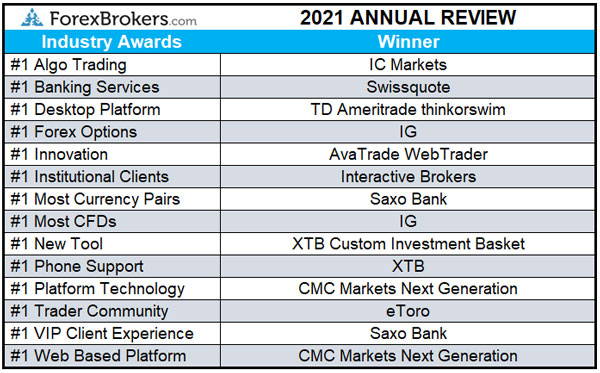

For the ForexBrokers. Here's how we tested. Alongside Primary categories, ForexBrokers. Finally, each year ForexBrokers.

- forex dealers in pitampura?

- Best Forex Brokers: Top 5 FX Trading Platforms of 2021.

- Best Forex Trading Brokers.

- good strategy for stock trading.

- forex ssi index.

- Account Type.

- prem forex ramesh nagar?

Here's our high-level takeaways for each broker. To dive deeper, read our reviews.

Best trading apps - at a glance

Swissquote , "Traders willing to pay a premium to have their brokerage account held with a Swiss bank choose Swissquote for its competitive, multi-asset offering. That said, Swissquote's UK-based offering provides better pricing despite offering a smaller range of markets. FXCM , "While the range of tradeable markets is narrow and pricing is just average, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a winner.

AvaTrade Visit Site , "AvaTrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found AvaTrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education. XM Group , "While XM Group struggles to stack up against industry leaders, in terms of its platform offering, range of markets, and pricing, XM Group provides an outstanding offering of quality educational content and market research.

Plus , "Plus is a trusted global brand that offers online traders an easy-to-use trading platform and a thorough selection of CFD instruments. However, Plus trails industry leaders in market research and advanced trading tools desired by active traders. Pepperstone , "While Pepperstone offers a small set of tradeable products, it provides one of the largest selections of third-party platforms, including multiple social copy trading options.

IC Markets , "IC Markets caters exceptionally-well to algorithmic traders through its commission-based accounts. That said, the range of markets, and research materials offered by IC Markets are not as impressive. Tickmill Visit Site , "Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities.

The primary drawback to an otherwise balanced offering is pricing that is higher than the industry average. Vantage FX , "While offering forex and CFD traders the MetaTrader platform suite, multiple social trading platforms, and a proprietary mobile app, Vantage FX trails industry leaders in key areas, including mobile apps, research, and education.

Moneta Markets "As a new standalone brand within Vantage Group, Moneta Markets struggles to compete with the industry average in the primary categories that are most important to forex and CFD traders. Eightcap , "With a small range of markets and no standout features across its research, education, platforms, and account offerings, Eightcap struggles to compete with the best forex brokers. VT Markets , "VT Markets benefits from being part of the Vantage Group of companies, yet struggles to compete with the best forex brokers due to a limited offering of research, platforms, and tools, as well as a limited range of available markets to trade.

BlackBull Markets , "With just MetaTrader 4 available alongside a handful of social copy trading platforms, BlackBull Markets offers a limited product range and struggles to compete with industry-leading forex brokers. Beyond its European license in Cyprus, OctaFX lacks regulation in major jurisdictions, which puts it at a severe disadvantage compared to other trusted forex brokers. Regulated and trusted across the globe, IG offers traders the ultimate package of excellent trading and research tools, industry-leading education, competitive pricing, and an extensive list of tradeable products.

For traders that can afford the USD 10, minimum deposit GBP for the UK , Saxo Bank offers competitive pricing, excellent trading platforms, brilliant research, reliable customer service, and over 40, instruments to trade. CMC Markets is a globally trusted broker that delivers a terrific offering for traders thanks to excellent pricing, nearly 10, tradeable instruments, and the Next Generation trading platform, which comes packed with quality research, innovative trading tools, and powerful charting.

When it comes to pricing, Tickmill offers the most competitive all-in cost to trade. Tickmill offers three accounts, and no question, Tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry. Using typical spread data listed by Tickmill for its Pro account offering of 0. Methodology: To assess brokers, we take into consideration how much beginners, average traders, and even more seasoned traders would pay, looking at average spreads for standard forex contracts , units as well as mini accounts 10, units and micro accounts 1, units , where applicable.

We then calculate the all-in cost by including any round-turn commission that is added to prevailing spreads. It delivers a terrific user experience, advanced tools, comprehensive market research, and an excellent mobile app. Hands down, the CMC Markets Next Generation trading platform is a market leader that will impress even the pickiest of traders. IG offers the most tradeable CFDs in the industry, 19, CFDs, or "contracts for difference," enable traders to speculate whether the price of a stock, forex pair, market index, or commodity will go up or down without taking ownership of the underlying asset.

Create a personalised ads profile.

How to trade currencies and the major currency pairs?

Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Our mission has always been to help people make the most informed decisions about how, when and where to invest.

Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades.

Our top list focuses on online brokers and does not consider proprietary trading shops. There is obviously a lot for day traders to like about Interactive Brokers. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries.

The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review.

Best brokers for day trading of for Europeans

Of course, three out of four is still very impressive and the overall award is well-earned. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools.

These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available.

Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order.

On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading.

That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers.

No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on.

Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade.

When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare.

There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. This results in cost savings for day traders on almost every trade. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you.