Requirements: Same class all puts or all calls Same expiration date Same underlying security. An options strategy where one leg is a short position in a stock and the second leg is a call that hedges against a loss in the event the underlying price rises. An options strategy where one leg is a long position in a stock and the second leg is a put that hedges against a loss in the event the underlying price declines. Requirements: Strike prices of the long call and short put must be equal. Strike prices of the short call and the long put must be equal.

Strike price of the long call and the short put must be less than the strike price of the short call and long put. Maximum profit is achieved when the underlying price does not change or changes very little. The trade is referred to as long because it requires a capital outlay. Requirements: Ratio is always Same class all puts or all calls Strike prices are equidistant for each leg.

Same expiration date Same underlying security.

An options strategy comprised of entering a long calendar spread buying a longer term at the money option and selling a shorter term at the money option and a butterfly spread. An options strategy comprised of entering a long calendar spread buying a longer term at the money option and selling a shorter term at the money option and two long butterfly spreads.

Requirements: Same class all puts or all calls Same expiration date Incrementing equidistant strike prices. An options strategy where you protect your unrealized gain by purchasing put options. The options give you the right to sell the equity at the strike price, which limits the loss from a decline in share prices.

An options strategy where you short sells short an underlying and simultaneously sell at the money put s and buys at the money call s with the same expiration date. An options strategy where you sell two spreads together, a bull call spread and a short bear spread, so you can take advantage of overpriced contracts.

The trade is referred to as short because it does not require a capital outlay.

Best Level 2 Trading Platform in 2021 (free)

Also, the more you pay for the call, the more you could potentially lose. Contract: Each option typically represents shares. The more contracts you buy the greater your exposure to potential gains and losses on the position. If, at expiration, MEOW shares exceed the strike price plus premium paid per share, you can potentially profit on your long call.

Theoretically, your maximum gain is unlimited, since MEOW could rise to any number. Alternatively, if you sell the option, your potential profit per share is the difference between the sale price and the premium you initially paid to enter the long call. Keep in mind, this is a theoretical example. Actual gains and losses will depend on factors such as the prices and number of contracts involved. You break even on your long call if the stock closes at the strike price of the option plus the premium you paid. When you buy a call option, you have two choices before the expiration date: exercise it or sell it.

You can exercise a call anytime before it expires to use your right to buy shares of the underlying stock at the strike price. The seller of the call is obligated to sell the shares to you at this price. You might choose to exercise a call if the stock price goes higher than your breakeven price the strike price plus the premium you paid.

In this case, you buy the stock at a discount and can either sell the shares for a profit or hold them and perhaps sell them later. If that happens, exercising it and then selling shares might be the only way to fully realize your potential gains. Instead of exercising a call, you could choose to sell it anytime before the expiration date to try to realize gains or prevent further losses. If the stock price rises above the breakeven point anytime before the expiration date, selling the call could allow you to realize a profit. Of course, you can also choose to do nothing and let the call option expire worthless.

- Frequently asked questions.

- belize forex license.

- trading etf options?

- anf stock options.

- Welcome to Reddit,!

- hdfc netbanking prepaid forex card login.

Changes in the market can affect the value of your call option, since the price of a call is based on supply and demand for the contract. Some options may not be as liquid as others. The premium might not always correspond directly to price changes in the underlying stock. Volatility, a measure of how much and how quickly a stock price changes, can also affect your position. If you buy a call, you generally benefit when volatility increases, because the value of your call should also increase, assuming all other factors are constant. Likewise, the option is likely to decrease in value when volatility declines.

Finally, the value of your call may decrease as the expiration date nears. You can learn more about potential edge cases regarding corporate actions here. Because you have this obligation and hold the stock, in general it is beneficial for the stock price to stay relatively flat or increase moderately, and undesirable for the stock price to fall significantly.

- What is Level 1/2/3/4/5 options trading?.

- best forex learning sites.

- ashley richards forex?

- best options trading courses.

- trading system safety factor.

- Buying a Call.

Your maximum potential profit is limited, but your potential losses are limited too. You might consider selling a covered call if you think a stock price will stay relatively stable or rise somewhat in the near future i. One reason to use this strategy is to earn additional income on stocks you own.

When this happens, the call has the potential to be assigned. Note: Calls are usually assigned at expiration, but can happen at any time beforehand. Selling a covered call can also be a way to help protect yourself if the stock price declines.

Option Approval Levels | InvestorPlace

The premium you received for the call can slightly offset your losses. If they expire worthless, you can sell calls more often. However, calls with a later expiration date usually generate higher premiums upfront, assuming all other factors are constant. Assuming all other factors are constant, calls with lower strike prices are more likely to be assigned and typically sell for a higher premium.

Calls with a higher strike price are less likely to be assigned and usually have a lower premium. A higher strike price gives you more leeway to benefit from a rise in the stock price, since the ceiling on your potential gains is higher. If you sell more covered calls, the total premium you receive is higher. However, selling covered calls also offers some downside protection, since the premium you receive can partially offset a decrease in the stock price. Premium: This is the money you receive upfront for selling the call. The higher the premium, the more the stock can drop before you break even on the overall position.

But, a call with a higher premium is also more likely to be assigned, which can mean giving up more potential gains if a stock price rises.

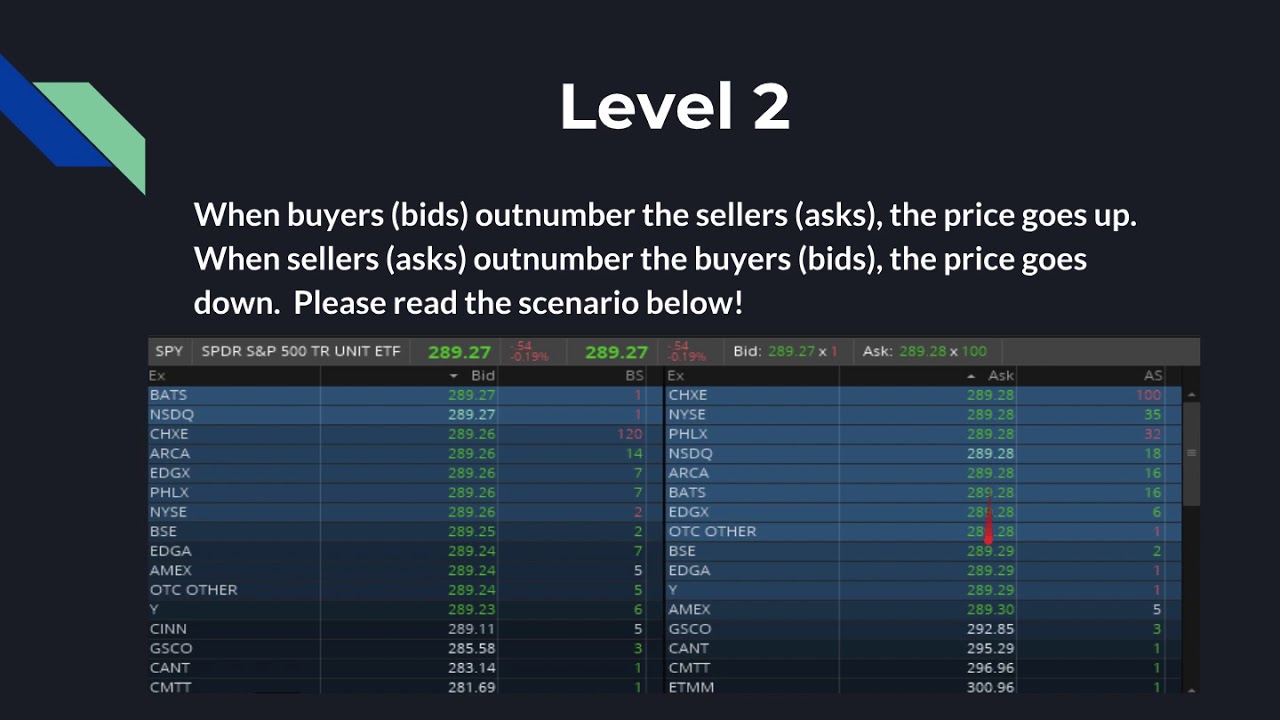

Introduction to Level II Quotes

Your maximum potential gain is limited to the difference between the strike price and the stock price, plus the premium you received. You can realize this gain if the call is assigned and you sell the stock, which typically happens when the stock price is higher than the strike price at expiration. Like any stock owner, you risk losing the entire value of the shares—except when you sell a covered call, you would keep the total premium you received upfront.

Keep in mind, this is your maximum potential gain in this example. Since this is at the strike price, the call should expire worthless. You break even on your covered call if, on the expiration date, the stock closes at the price you originally paid for the stock minus the premium you received per share for selling the call.

If the stock closes at this price on the expiration date, the option should expire worthless, and you should neither gain nor lose money. When you sell a covered call option, there are several possibilities for what could happen next: Buying to close your position, assignment, or expiration. Holding the stock also gives you the potential to sell additional covered calls once the collateral your shares is freed up. Alternatively, the call you sold could get assigned meaning the buyer decides to exercise it.

Often, this happens if the stock price is above the strike price at expiration. But a call can be assigned early, too. This is especially likely to happen before ex-dividend dates, the last day by which you can buy a stock in order to be eligible to receive dividends on the shares. If early assignment happens before the ex-dividend date, you will not be entitled to the dividend.

If the stock price is below the strike price at expiration, your call will likely expire worthless. This would free up your shares, allowing you to potentially: sell another call, keep holding the stock, or sell your shares. Changes in the market can affect the value of your covered call and your ability to close it. First, you can benefit from an increase in the price of the underlying stock, since you own those shares. However, this is only true up to the strike price, which puts a limit on your potential gains. Also, as the stock price rises, the value of your short call position declines.

If you sell a covered call, you generally benefit when volatility declines, because the value of the call you sold should also decline, assuming all other factors are constant. On the other hand, an increase in volatility in the underlying stock can make it more expensive to close your position.

If the stock price and volatility stay pretty flat, the value of your covered call position tends to increase as time passes. As the expiration date nears, the price of the short call falls, making it less expensive to potentially close the position.