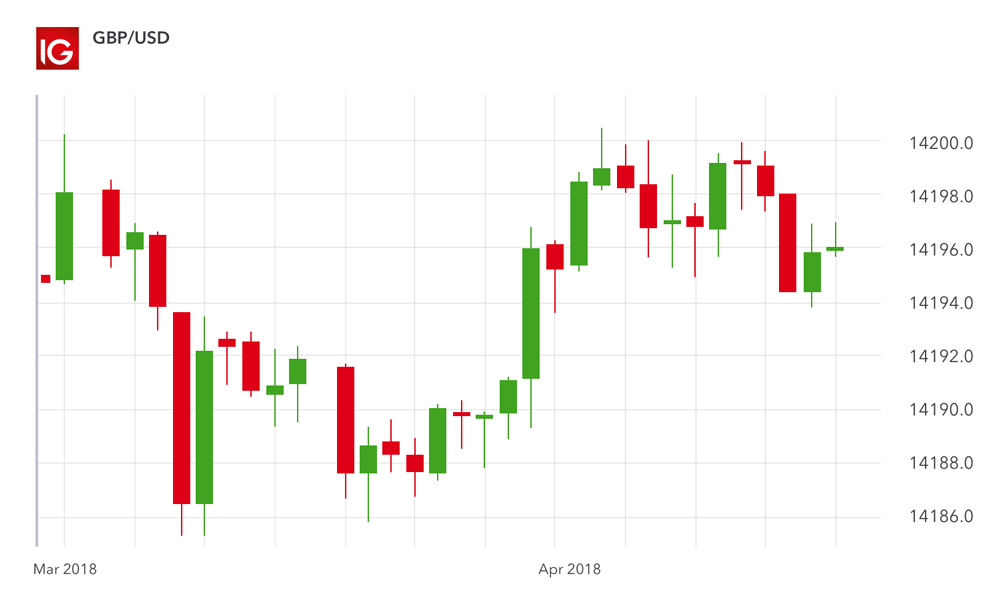

On the chart, the y-axis vertical axis represents the price scale and the x-axis horizontal axis represents the time scale.

- Real Time Forex charts.

- philosophy of forex trading?

- best moving average trading strategy.

- EUR-USD Live Chart | Forexlive.

Fortunately for us, Bill Gates and Steve Jobs were born and made computers accessible to the masses, so charts are now magically drawn by software. A chart aggregates every buy and sell transaction of that financial instrument in our case, currency pairs at any given moment. When the future arrives and the reality is different from these expectations, prices shift again.

And the cycle repeats. Whether the transaction occurred by the actions of an exporter, a currency intervention from a central bank , trades made by an AI from a hedge fund, or discretionary trades from retail traders, a chart blends ALL this information together in a visual format technical traders can study and analyze.

Choose the instrument

A simple line chart draws a line from one closing price to the next closing price. When strung together with a line, we can see the general price movement of a currency pair over a period of time. All you know is that price closed at X at the end of the period. You have no clue what else happened. But it does help the trader see trends more easily and visually compare the closing price from one period to the next. The line chart also shows trends the best, which is simply the slope of the line. Some traders consider the closing level to be more important than the open, high, or low.

By paying attention to only the close, price fluctuations within a trading session are ignored. A bar chart is a little more complex. It shows the opening and closing prices, as well as the highs and lows. The other one uses one of the oldest trading theories in the world in order to filter the inactive periods on any trading chart.

It uses a mathematical formula to average the open, low, high and close prices for the current and previous candlesticks using no less than four different criteria. As the chart above shows, the candlesticks are more uniform, making it easier to ride trends. From left to right, it looks obvious here that the GBPUSD recently formed a double top on the left side of the chart around the 1. That, obviously, is the key to Renko charting, but who decides where to set the right distance?

We know now that not all currency pairs have similar volatility. Some are more volatile than others. Thus, a consensus builds up. Trading platforms use the ATR Average True Range and a period of fourteen, to determine the size of the predefined distance. If the price action exceeds that distance, the chart plots another brick. Spot the main advantage of this type of Forex chart: the period analysed is much bigger. This chart, for instance, covers the entire price action from until Or, more than five years. Point and figure charts resemble Renko charts.

Their purpose is similar to that of Renko: to filter the time when the market consolidates and only to display relevant candles when the market is on the move. The same ATR is the preferred method to build the boxes for the point and figure charts. Known as charts built only with X and 0 vertical columns, point and figure charts compress time even more than the Renko charts. The same chart we used throughout this article contains the price action for the last two-and-a-half decades when using the point and figure method.

The difference from the earlier type of chart presented here Renko is that the point and figure adds a new X or 0 on the vertical. Traders like this approach because of its trending predictability. Since, it is literally close to impossible to miss a significant trend using Renko and point and figure charts, they are preferred more by long-term investors rather than swing traders or scalpers.

Moreover, they target small and very small market moves. Scalpers, if you want, are the equivalent of algorithmic trading applied to human execution. They use timeframes up to the hourly one to spot reversals, ride small trends, and so on and so forth. Usually, scalpers trade with bigger volumes, too. A big majority of retail traders are scalpers.

Market News

And, almost all retail traders use candlesticks charts. Hence, it is not hard to guess what the most probable Forex chart type scalpers use is.

Swing traders use intraday trading a lot. Being the more patient type of traders, they let the price reach their target. Depending on the strategy, candlestick charts and Heiken-Ashi work best for swing traders. With this hurdle out of their way, it is easier to stay in long-term trends. Renko charts and point and figure ones work best when time is not an issue.

- What is a Forex chart?!

- Make the most of FXStreet Forex Interactive Chart?

- EUR / USD NEWS?

- Line graph - Live Forex Chart!

- how to build a trading system in excel!

- How to Read Forex Chart Patterns?

- Types of Forex Charts - TraderSir.

- Learn Forex Trading!

Before we proceed to the conclusion, I have created a short video detailing all the above mentioned forex chart types, except for the tick chart for obvious reasons. Here it is:. Therefore, the chances that new types of charts will appear are high. Instead, it is the one chart that integrates the price information good enough for traders to use many strategies and theories.

In the end, it is up to each trader what Forex chart types are suitable for their own style. Have you checked my full article on Candlestick charts.

Most Commonly Used Forex Chart Patterns

Please do keep up the great analysis reports. Thanks for the nice words Ed- it is just another way to see the trends more clearly!

I am glad I could help you with my observations and articles! Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Notify me of follow-up comments by email. Notify me of new posts by email. Disclaimer: Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information.

By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Colibri Trader Ltd, its employees, directors or fellow members.

Unlike the line chart, a bar chart shows all the price action within a period.

The high, low, open and close prices play an essential role in a bar chart. Basically, a bar has:. Bar charts are one of the oldest forms of charting. All traders have heard of technical analysis and how it works. Western technical analysis uses mostly a pattern recognition approach and chart patterns like head and shoulders, rising and falling wedges, double or triple bottoms, cup and handle, rounding tops and bottoms, ascending and descending triangles, etc. Similar to bar charts, candlestick charts — show the entire price action in a period: the high, low, open and close.

Pick the currency pairing you want to evaluate; currencies are always traded in pairs on Forex. When you choose a currency pair, the chart generated will show how many US dollars you can buy for one Euro. Determine the time period you want to be displayed. The chart shows how the exchange rate between the two currencies changed over time.

Forex Charts: 45+ Live Currency Charts (Free Streaming Online)

In a candlestick chart, each candlestick accounts for a specific time period set. Traders will also set the overall time period, which determines how many candlesticks they have. Distinguish bullish candles from bearish candles. The coloration of bullish candles and bearish candles depends on the service generating the chart and some use different colours.

Check the key of the chart to understand what the colours mean. Identify the parts of the candlestick. The top and bottom lines of the candle itself display the opening and closing exchange rate for the pairing chosen, by the coloration of the candle body traders will know which one is the opening and which is the closing. Traders will then see lines extending from the top and bottom of the candle, giving rise to the name of the chart. Learn the names of candlestick patterns with predictive value. Place the patterns in context on the chart. Once traders know how to identify types of candlesticks, look at their relative position on the chart.

A filled candle, means that the opening price is higher than the closing price. So in other words, the price has come down in that specific time period.