Resulting Issuers are no longer prohibited from completing a reverse take-over transaction in the first year following a Qualifying Transaction.

CPCs that have filed a prospectus but have not completed their IPO may continue to be governed by the former policy or may elect to comply with the new rules, so long as the CPC revises its prospectus and amends its escrow agreement. The foregoing is a summary intended for informational purposes and is not intended to be relied on as legal advice pertaining to the subject matter. With appreciation, the authors acknowledge the contribution of Articling Student, Abel Hazon , who assisted in preparing this article.

About Us. Follow us on Twitter Connect with us on LinkedIn. Jan 15, Michael Hanley.

- Is Now the Time to Create a TSXV CPC?.

- Share this article;

- Ways to Give!

- Elimination of 24-month QT deadline.

Michael J. Hanley View Bio. In addition, CPC stock options and shares issued on exercise of stock options will be released on the date the TSXV issues its final bulletin, unless such securities were granted before the IPO and at an exercise price less than the IPO price.

The form of disclosure document to be utilized by a CPC in connection with a Qualifying Transaction has been revised to more closely align with requirements under NI to reduce duplication and regulatory burden.

- CPC Price & Dividends.

- Organization Profile;

- Follow Us On Twitter;

- CPC Stock definition - Law Insider;

If a CPC has filed its CPC prospectus but has not yet completed its IPO, it may elect to comply with the new rules, provided it revises its prospectus and escrow agreement; or it may file its final prospectus and complete its IPO in accordance with the former policy, and continue to be governed by the former policy, with the option to comply with the transition provisions applicable to existing CPCs detailed below.

However, the following changes require disinterested shareholder approval in order to implement:.

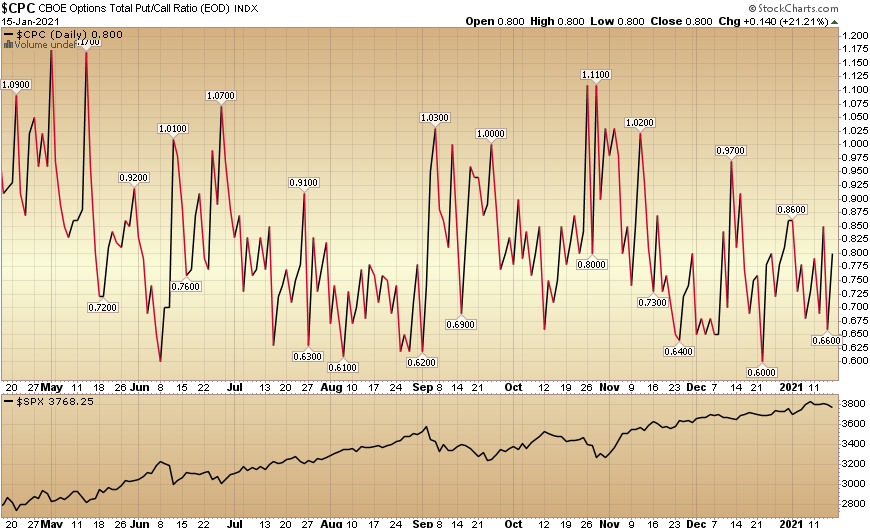

CBOE Equity Put/Call Ratio

Removing the consequences of failing to complete a Qualifying Transaction within 24 months of listing;. Amending escrow terms to track those permitted under the new rules;. CPCs that have already completed a Qualifying Transaction can amend existing CPC Escrow Agreements to track the escrow terms permitted under the Amendments and the revised CPC Escrow Agreement, including the month release schedule and the immediate release of escrow securities no longer subject to escrow, as long as they obtain disinterested shareholder approval at a meeting of shareholders or by written consent.

It does not constitute legal advice and must not be treated or relied on as such. Directors and Officers The Amendments provide that only the majority of directors and officers—not all of them—must be residents of Canada or the United States or have public company experience.