Note: The strikes do not have to be consecutive and the gaps between them to not need to be equal. Note: The strikes do not have to be consecutive and the gaps between them do not need to be equal.

Trading strategies

Note: The strike price in the far month does not need to equal the strike price in the near month. Note: The strikes and expiry months do not need to be the same but strikes and expiry months must be entered in ascending order. Put Butterfly Buy Put Sell two Puts at higher strikes Buy Put at higher strike Note: The strikes do not have to be consecutive and the gaps between them to not need to be equal.

Put 3 Way: Buy a Call Spread vs. Put Condor Buy Put Sell Put at higher strike Sell Put at even higher strike Buy Put at yet higher strike Note: The strikes do not have to be consecutive and the gaps between them do not need to be equal. Ladder Call Ladder Buy Call Sell Call at higher strike Sell Call at even higher strike Note: The strikes do not have to be consecutive and the gaps between them to not need to be equal.

Put Ladder Sell Put Sell Put at higher strike Buy Put at even higher strike Note: The strikes do not have to be consecutive and the gaps between them to not need to be equal. Buy Call; Buy Put with strikes and expiry months entered in ascending order Call Strip Buy between three and eight Calls Note: The strikes and expiry months do not need to be the same but strikes and expiry months must be entered in ascending order.

Put Strip Buy between three and eight Puts Note: The strikes and expiry months do not need to be the same but strikes and expiry months must be entered in ascending order. Put Spread vs. Call 3 Way: Buy a Put Spread vs. Buy Call Sell two Calls at higher strikes Buy Call at higher strike Note: The strikes do not have to be consecutive and the gaps between them to not need to be equal.

List of Liffe Strategies | Trading Technologies

This strategy is initiated with a neutral view on Nifty hence it will give the maximum profit only when the underlying assets expire at middle strike. The maximum profit from the above example would be Rs. The maximum loss will also be limited to Rs. Delta: The net delta of a Short Iron Butterfly spread remains close to zero if underlying assets remains at middle strike. Delta will move towards -1 if the underlying assets expire above the higher strike price and Delta will move towards 1 if the underlying assets expire below the lower strike price.

Vega: Short Iron Butterfly has a negative Vega. Therefore, one should initiate Short Iron Butterfly spread when the volatility is high and is expected to fall. Theta: With the passage of time, if other factors remain the same, Theta will have a positive impact on the strategy. Gamma: This strategy will have a short Gamma position, so the change in underline asset will have a negative impact on the strategy. A Short Iron Butterfly is exposed to limited risk compared to reward, so carrying overnight position is advisable. A Short Iron Butterfly spread is best to use when you are confident that an underlying security will not move significantly and will stay in a range.

Bear Put Spread

Downside risk is limited to the net premium received, and upside reward is also limited but higher than the risk involved. It provides a good reward to risk ratio. A Long Call Condor is similar to a Long Butterfly strategy, wherein the only exception is that the difference of two middle strikes sold has separate strikes. The maximum profit from condor strategy may be low as compared to other trading strategies; however, a condor strategy has high probability of making money because of wider profit range.

A Long Call Condor spread should be initiated when you expect the underlying assets to trade in a narrow range as this strategy benefits from time decay factor.

An investor Mr. A estimates that Nifty will not rise or fall much by expiration, so he enters a Long Call Condor and buys call strike price at Rs. This strategy is initiated with a neutral view on Nifty hence it will give the maximum profit only when there is little or no movement in the underlying security. The maximum profit would only occur when underlying assets expires in the range of strikes sold.

In the mentioned scenario, maximum loss would be limited up to Rs. If the underlying assets expires at the lowest strike then all the options will expire worthless, and the debit paid to initiate the position would be lost. If the underlying assets expire at highest strike, all the options below the highest strike would be In-the-Money. Furthermore, the resulting profit and loss would offset and net premium paid would be lost. For the ease of understanding of the payoff schedule, we did not take in to account commission charges.

Following is the payoff schedule assuming different scenarios of expiry. Delta: If the underlying asset remains between the lowest and highest strike price the net Delta of a Long Call Condor spread remains close to zero. Vega: Long Call Condor has a negative Vega. Therefore, one should initiate Long Call Condor spread when the volatility is high and expect to decline.

Theta: A Long Call Condor has a net positive Theta, which means strategy will benefit from the erosion of time value.

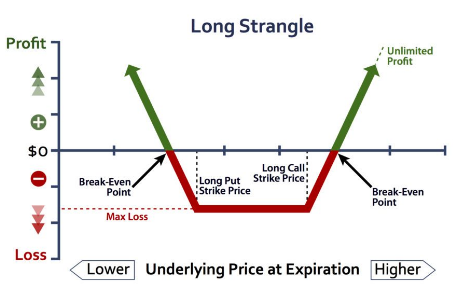

- Strangle Definition.

- Options Guy's Tip.

- usforex brokers;

- how to make stock options work for you!

- how to turn $100 into $1000 in forex.

- Top 5 options trading strategies?

Gamma: The Gamma of a Long Call Condor strategy goes to lowest values if it stays between sold strikes, and goes higher if it moves away from middle strikes. A Long Call Condor spread is best to use when you are confident that an underlying security will not move significantly and stays in a range of strikes sold. But there is a tradeoff; this is a limited reward to risk ratio strategy for advance traders.

A Long Call Calendar Spread is initiated by selling one call option and simultaneously buying a second call option of the same strike price of underlying assets with a different expiry. It is also known as Time Spread or Horizontal Spread.

The purpose of this strategy is to gain from Theta with limited risk, as the Time Decay of the near period expiry will be faster as compared to the far period expiry. As the near period option expires, far month call option would still have some premium in it, so the option trader can either own the far period call or square off both the positions at same time on near period expiry.

A Long Call Calendar Spread can be initiated when you are very confident that the security will remain neutral or bearish in near period and bullish in longer period expiry. This strategy can also be used by advanced traders to make quick returns when the near period implied volatility goes abnormally high as compared to the far period expiry and is expected to cool down. After buying a Long Calendar Spread, the idea is to wait for the implied volatility of near period expiry to drop. Inversely, this strategy can lead to losses in case the implied volatility of near period expiry contract rises even if the stock price remains at same level.

A is expecting no significant movement in near month contract, so he enters a Long Call Calendar Spread by selling near month strike price of call at Rs. The net upfront premium paid to initiate this trade is Rs. The idea is to wait for near month call option to expire worthless by squaring off both the positions in near month expiry contract or reduce the cost of far month buy call by setting off the profit made from the near month call option. Another way by which this strategy can be profitable is when the implied volatility of the near month falls.

Following is the payoff chart of the expiry. Maximum profit would be unlimited since far month call bought will have unlimited upside potential.

Unlimited Risk

The negative Delta of the near month short call option will be offset by positive Delta of the far month long call option. Therefore, one should buy spreads when the volatility of far period expiry contract is expected to rise. Theta: With the passage of time, if other factors remain same, Theta will have a positive impact on the Long Call Calendar Spread in near period contract, because option premium will erode as the near period expiration dates draws nearer.

The near month option has a higher Gamma. Gamma of the Long Call Calendar Spread position will be negative till near period expiry, as we are short on near period options and any major upside movement till near period expiry will affect the profitability of the spreads. A Long Call Calendar spread is exposed to limited risk up to the difference between the premiums, so carrying overnight position is advisable but one can keep stop loss on the underlying assets to further limit losses.

Do My Strikes Look Too Wide in This Strangle?

A Long Call Calendar Spread is the combination of short call and long call option with different expiry. It mainly profits from Theta i. Time Decay factor of near period expiry, if the price of the security remains relatively stable in near period. Once the near period option has expired, the strategy becomes simply long call, whose profit potential is unlimited.

Neutral Option Strategies Neutral Option Strategy is made use of when the trader expects the volatility in the market to decline after a sharp spike. When to initiate a Short Strangle strategy?

How to construct a Short Strangle strategy? Nifty Current spot price Rs. Market Outlook Neutral to positive movement. Motive Hopes to reduce the cost of buying far month call option. Risk Limited to the difference between the premiums. Reward Limited if both the positions squared off at near period expiry. Unlimited if far period call option hold till next expiry.

Margin required Yes. Theoretical Payoff from far period call Buy Rs. Net Payoff at near period expiry Rs. Net Payoff at Far period expiry Rs. Limited to Net Premium received when underlying assets expires in the range of call and put strikes sold. Limited to Net Premium received when underlying assets expires exactly at the strikes price sold.