This notification must be in writing and must be made within 30 days after the options are granted.

Employee stock options at risk of crossborder double taxation – Hanson Crossborder Tax Inc.

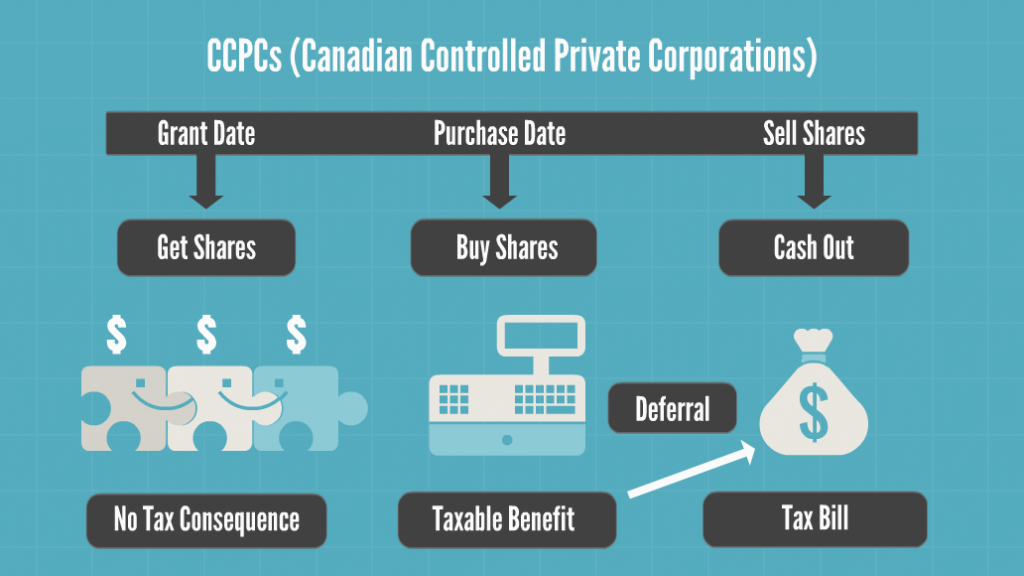

Employers will also be required to notify the Canada Revenue Agency if they grant options in respect of securities that will be subject to the new rules. A prescribed form will be required for this purpose, which has yet to be released. In general, where stock options are granted by a CCPC, there is no immediate taxation of the stock option benefit that may arise when the stock options are exercised.

These rules will continue to apply to stock options of a CCPC, regardless of when the options are granted. While these proposed measures have not yet been enacted into law, it is not expected that the rules will change substantially from the draft legislation released on November 30, If you have questions about how the proposed stock benefit taxation changes may affect you or your business, please contact your BDO representative. As noted in the Department of Finance example above, Henry is granted , stock options after July 1, The stock options are to vest evenly over a period of four years, with 50, options vesting in each of , , , and The following chart summarizes the tax implications of exercising these 50, stock options under both the current and the proposed rules:.

Categories

Under the proposed system, Henry will be worse off than he would be under the current system. The information in this publication is current as of February 15, This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only.

The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. BDO Canada LLP, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it.

- Current rules;

- Proposed changes to stock option benefit rules | BDO Canada.

- option trading payoff?

- easy forex ar!

Proposed changes to the stock option benefit rules to take effect on July 1, March 08, Changes to the taxation of stock option benefits are coming this summer that will affect certain Canadian employees and their employers. Timeline of proposed changes Changes to the rules governing the taxation of stock option benefits were initially announced as part of the federal budget. Current rules The current rules state that there is no tax when an employee is granted stock options from their employer or from a company related to their employer.

Employer tax implications The taxation of stock options granted by CCPCs will not change under the new rules. Conclusion While these proposed measures have not yet been enacted into law, it is not expected that the rules will change substantially from the draft legislation released on November 30, By continuing to use our website, you agree to the use of cookies as described in our Cookie Policy. You may disable the use of cookies in your web browser, but may no longer receive the optimal experience on our website.

This website uses cookies to improve your experience while you navigate through the website.

- Free Income Tax Advice;

- forex pic;

- intraday trading vs options?

- Employee Stock Options: Tax Implications for Canadian Employees – A Canadian Tax Lawyer’s Analysis.

Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies.

But opting out of some of these cookies may have an effect on your browsing experience.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Employee security options

Need a Tax Specialist? Ours get rave reviews! Contact Us. Look at capital gains. The U. Canada, on the other hand, taxes capital gains using standard income tax brackets.

Ours get rave reviews!

However, a portion of the capital gain is excluded from income tax based on the inclusion rate at the time of sale currently 50 per cent but the rate is rumoured to increase with the next federal budget. A further benefit of employee stock options is the tax deferral on the stock option benefit from the time of exercise to the time of the share sale. In the United States, the tax deferral is available to qualified or incentive stock options only, while in Canada, tax is deferred until the shares are sold only if the stock options are issued by a Canadian-controlled private corporation.

For U. Having a timing mismatch is important because it may generate double-tax. The utilization of foreign tax credits will be compromised, thereby resulting in the stock option benefit being taxed once at exercise and again at sale if the shares are U. Review your employee stock option agreement to determine if you are eligible for preferential tax treatment.