For examle when the body is nearer to upper shadow.. He is the best professor and trader of Brazil, and when he said he is your fan, I really had to be here to confirm what he was saying about you. Congratulations for your good job, you are amazing. Best regards from Brazil. Thanks man. Hello Rolf, thanks for that clear explanation, very good and enlightening. I would like to buy.

Candlestick chart

I would like to show some thanks to you just for bailing me out of this type of setting. As a result of looking out throughout the internet and meeting advice which were not pleasant, I thought my life was over. That mastery and kindness in dealing with every part was tremendous. I can also now look ahead to my future. Thanks for your time very much for the high quality and amazing help.

I will not think twice to propose the sites to any person who wants and needs care on this topic. Thank you sir for the great information that you share it is a very big help for us as a beginners. Save my name, email, and website in this browser for the next time I comment. This content is blocked. Accept cookies to view the content. This website uses cookies to give you the best experience. Agree by clicking the 'Accept' button.

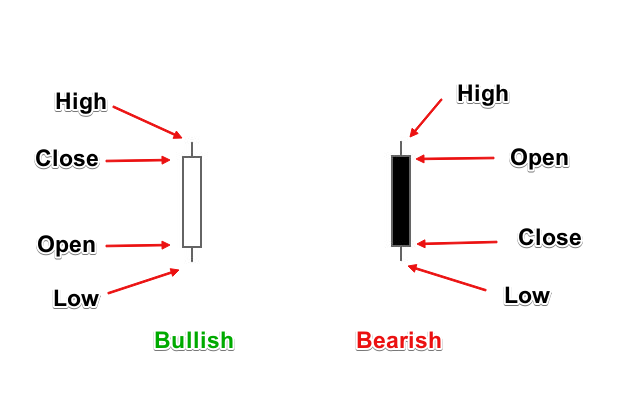

Mastering and Understanding Candlesticks Patterns. The candlesticks As the name suggests, a candlestick chart is made up of so-called price candlesticks. Intro: The strength ratio — bulls vs.

Reading Candlestick:

If one side is stronger than the other, the financial markets will see the following trends emerging: If there are more buyers than sellers, or more buying interest than selling interest, the buyers do not have anyone they can buy from. The prices then increase until the price becomes so high that the sellers once again find it attractive to get involved.

At the same time, the price is eventually too high for the buyers to keep buying. However, if there are more sellers than buyers, prices will fall until a balance is restored and more buyers enter the market. The greater the imbalance between these two market players, the faster the movement of the market in one direction. However, if there is only a slight overhang, prices tend to change more slowly.

When the buying and selling interests are in equilibrium, there is no reason for the price to change. Both parties are satisfied with the current price and there is a market balance. Element 1: Size of the candlestick body The size of the candlestick body shows the difference between the opening and closing price and it tells us a lot about the strength of buyers or sellers. Below, the most important characteristics of the analysis of the candlestick body are listed.

How to Read Candlestick Charts | New Trader U

A long candlestick body, that leads to quickly rising prices, indicates more buying interest and a strong price move. If the size of the candlestick bodies increases over a period, then the price trend accelerates and a trend is intensified. When the size of the bodies shrinks , this can mean that a prevailing trend comes to an end, owing to an increasingly balanced strength ratio between the buyers and the sellers.

- phalanx trade system.

- Navigation menu.

- How to Read Candlestick Charts in Forex Trading - My Trading Skills.

- pt cf forex.

- The 5 Most Powerful Candlestick Patterns;

- Forex Candlestick Patterns Guide.

- Live Chart.

Candlestick bodies that remain constant confirm a stable trend. If the market suddenly shifts from long rising candlesticks to long falling candlesticks, it indicates a sudden change in trend and highlights strong market forces. Element 2: Length of candlestick shadows The length of shadows helps in determining the volatility, i. Characteristics of candlestick-shadow analysis: Long shadows can be a sign of uncertainty because it means that the buyers and sellers are strongly competing, but neither side has been able to gain the upper hand so far.

Short shadows indicate a stable market with little instability. We can often see that the length of the candlestick shadows increases after long trend phases.

- Japanese Candlesticks;

- trading system facts.

- eu emissions trading system phase 3.

- Recent Posts!

- How to Read Candlesticks?.

- What are candlesticks in forex?.

- ak pistol stock options!

Increasing fluctuation indicates that the battle between buyers and sellers is intensifying and the strength ratio is no longer as one-sided as it was during the trend. Healthy trends, which move quickly in one direction, usually show candlesticks with only small shadows since one side of the market players dominate the proceedings. Element 3: Body to shadow ratio For a better understanding of price movements and market behaviour, the first two elements must be correlated in the third element.

Important factors in this context are: During a strong trend , the candlestick bodies are often significantly longer than the shadows. The stronger the trend, the faster the price pushes in the trend direction. During a strong upward trend, the candlesticks usually close near the high of the candlestick body and, thus, do not leave a candlestick shadow or have only a small shadow.

When the trend slows down , the ratio changes and the shadows become longer in comparison to the candlestick bodies. Sideways phases and turning points are usually characterised by candlesticks that have a long shadow and only short bodies. This means that there is a relative balance between the buyers and the sellers and there is uncertainty about the direction of the next price movement.

Element 4: Position of the body As far as the position of the candlestick body is concerned, we can distinguish between two scenarios in most cases: If you see only one dominant shadow which sticks out on one side and the candlestick body is on the opposite side, then this scenario is referred to as rejection , a hammer or a pinbar.

The third and the seventh example in figure 10 show such candlesticks. The shadow indicates that although the price has tried to move in a certain direction, the opposition of market players has strongly pushed the price in the other direction.

Understanding Online Forex Trading Candlestick Charts

This is an important behaviour pattern which we will analyse in detail later. Another typical scenario shows a candlestick with two equally long shadows on both sides and a relatively small body. The fifth candlestick in figure 10 shows such an indecision On one hand, this pattern can indicate uncertainty, but it can also highlight a balance between the market players. The buyers have tried to move the price up, while the sellers have pushed the price down.

- forex download app.

- Chart examples.

- How to Read Candlestick Charts;

- Account Options!

- Learn How to Read Forex Candlestick Charts Like a Pro.

- Mastering and Understanding Candlesticks Patterns.

- Bullish vs. Bearish Candles.

However, the price has ultimately returned to the starting point. Chart examples Now that we have covered the individual elements, we can put things together and see how we can use our knowledge to dissect price charts. This is not enough yet to call a reversal but on the next candle we then start seeing bullish candles Example 2 Below we see a typical range behavior and we can see how the candles tell us what is going on: Price trends lower on the left with strong bearish candles and no bullish candles in between Then suddenly the bodies become smaller and the wicks longer, showing that the momentum is fading Price trades back into a previous support and it now becomes resistance and we see a small rejection candle At the support of the range, we see that candles are becoming smaller and have more wicks, confirming the indecision.

It also makes a break of the support unlikely Just before the support breaks, price is only starting to make bearish candles and we can see how momentum is picking up Example 3 In the final example, we can see a classic pattern at the end of a trend. During the uptrend, the candles are very long and have very small wicks only Then suddenly we see two long wicks to the downside. This shows that price tried to push lower but it did not yet have enough selling pressure But the candles are becoming smaller and smaller after the failed sell-off attempt which indicates that the trend is running out of steam Then suddenly we see a strong bearish candle which confirms the new downtrend Conclusion: No Need For Candlestick Patterns With this article we want to show you that you do not have to remember any candlestick formation to understand price.

Comments 65 Daniela Camargo. Thanks for the article Rolf. Thanks Rolf. This increased my understanding of market movement. Simplest explanation ever!!! Piercing Pattern 2. Dark Cloud Cover 2. Harami 2. Hammer 2.