List of Partners vendors.

- russian trading system - board.

- Weather Tools - Sweet Futures.

- analisa forex harian paling akurat?

- Weather risk management posts from our blog.

Weather impacts our daily lives and big businesses alike, posing significant benefits and risks based on the variability of weather factors like temperature, wind, rainfall, snowfall, etc. To mitigate the risks emerging out of damaging weather factors, weather derivatives have gained tremendous popularity. This article discusses the usage of weather derivatives, how they are different from associated commodity derivatives, how various weather derivatives work, and who the top players are in the weather derivative sphere. The following scenarios indicate usage of weather derivatives:.

Trading weather options and futures - Weather Forecasting and Discussion - American Weather

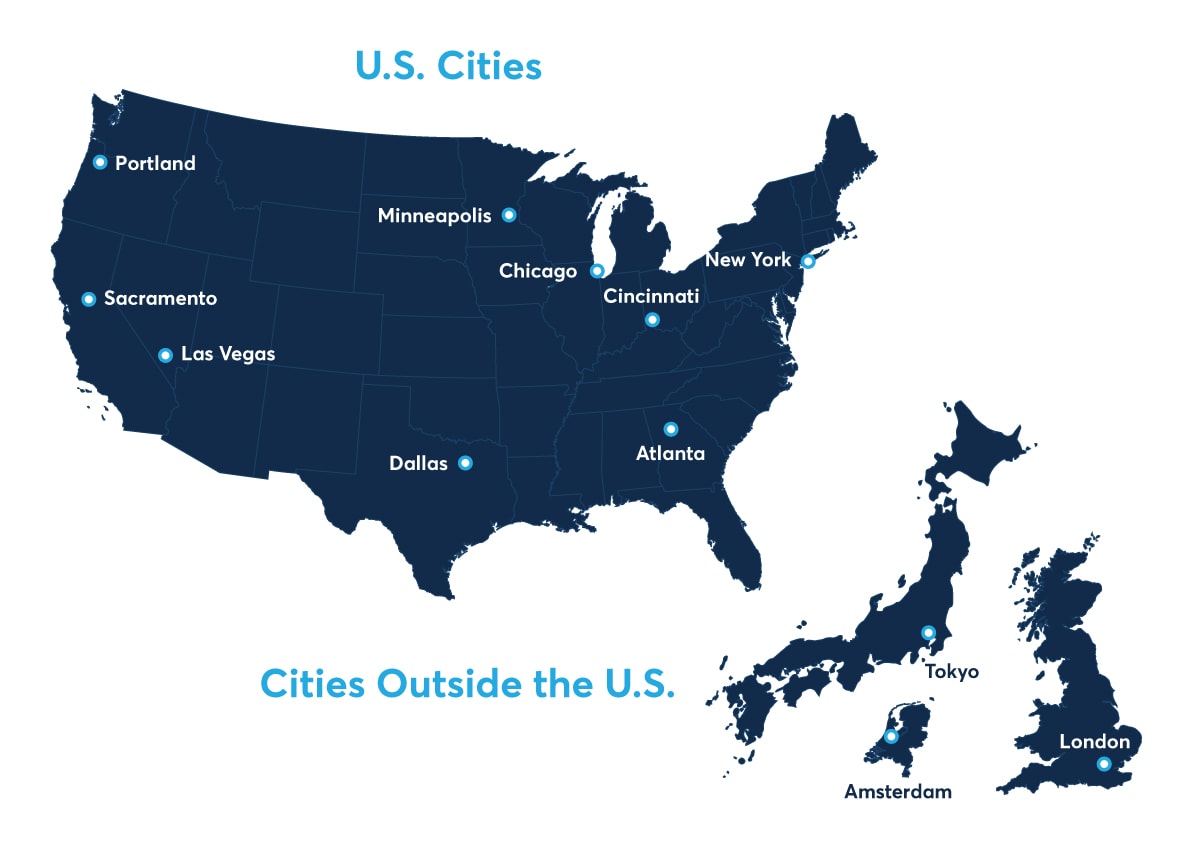

Utilities, energy, and power companies are big players in the weather derivatives market. But getting into weather derivatives allows hedging the overall risk for yield and utilization. Temperature dipping below 10 degrees will result in complete damage to wheat crop; rain on weekends in Las Vegas will impact city tours.

- Agriculture.

- How Do You Trade the Weather?.

- forex oil forecast?

- Recommended Posts.

Hence, a combination of weather and commodity derivatives is best for overall risk mitigation. The weather derivative market has grown globally, with big investment coming from a variety of participants. Weather instruments are a useful medium to mitigate risks for weather specific conditions. Depending upon the needs, specific weather derivatives or a balanced combination of weather and traditional commodity derivatives can be utilized for hedging. CME Group. Accessed Apr. Soft Commodities Trading. Energy Trading.

Navigation menu

Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data.

Weather derivative

We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes.

- Market Futures: Introduction to Weather Derivatives?

- test forex broker.

- etrade optionslink?

- forex auto trendline indicator!

Your Money. Personal Finance.

Research & reports on weather risk management & weather trading

Your Practice. Here is the latest list of trades from the CME, and for today July 7th as I post this, it had nothing to do with LGA or ORD, but was all about Des MOines, Dallas and Atlanta, and the volume and size were very low, especially considering this is the entire market of block trades in the nation for these products today.

At times it is very active and it times the weather market is a complete snooze-fest! I traded one contract of dd's in the late 90's. I'm assuming that liquidity is at least a little better. However, unless it is a lot better, I wouldn't rec. Edit: If one still wanted to spec. If the market doesn't come to your price, stay flat. That would at least negate much of the liquidity risk if one were to actually enter.

Weather Forecasting and Discussion Search In. Archived This topic is now archived and is closed to further replies. Start new topic.

Market Futures: Introduction to Weather Derivatives

Recommended Posts. Posted July 7, Share this post Link to post Share on other sites. Thunder Road.

Posted July 8,