Shut out of hedge funds, Hwang opened Archegos, a family office. The firm, which recently employed some 50 people, initially occupied space in the Renzo Piano-designed headquarters of the New York Times. But somehow I was reminded I had to go to the words of the God.

What ensued was one of the greatest margin calls of all time, pushing his giant portfolio into liquidation. Doug Birdsall, honorary co-chairman of the Lausanne Movement, a global group that seeks to mobilize evangelical leaders, said Hwang always likes to think big. Build it 66 stories high. There are 66 books in the bible. People who know him say the one is inseparable from the other. Despite brushes with regulators, staggering trading losses and the question swirling around his market dealings, they say Hwang often speaks of bridging God and mammon, of bringing Christian teaching to the money-centric world of Wall Street.

Check Our Daily Updated Short List

I am not worried about Bill. The company announced the effort in a regulatory filing last month. AMC could use the shares to bolster its cash reserve, buy back debt at a discount, settle deferred theater rents or pursue an acquisition, Aron said. The shares have soared over the past six months, benefiting from a Reddit-fueled investing frenzy that sent heavily shorted stocks into the stratosphere.

Shares of the Leawood, Kansas-based company fell as much as 6. The company said previously it might seek more financing, and some creditors have suggested it sell more shares to pay down debt. Theater chains have been hard hit by government-mandated shutdowns during the Covid pandemic.

The problem has been compounded by studios delaying major releases that drive ticket sales. For more articles like this, please visit us at bloomberg. Element Finance, which is building a yield-maximizing marketplace for crypto interest rates, has landed some prominent backers. Will rates keep rising? What about prices? And is refinancing over? The company, which plans to go public through a so-called direct listing, expects to list its shares on the Nasdaq under the ticker 'COIN' on April In a direct listing, no shares are sold in advance, as is the case with an initial public offering IPO.

Oil prices gave up some gains. When can Social Security recipients expect third stimulus checks? Celonis, a fast-growing German process mining software startup, has struck a strategic partnership with IBM to help companies make the most of the digital transformation that many are undergoing at speed. IBM's Global Business Services consulting arm will weave the Celonis Execution Management System into its offering, adding the ability to analyse data thrown off by processes like supply-chain management, finance or procurement to identify weaknesses and recommend fixes.

Celonis will also shift its software stack to IBM's Red Hat OpenShift platform, which enables companies to operate in an open 'hybrid' setting that can include public or private cloud data centres, on-premise servers and mainframe computers. An agreement would have bought the state-owned bank more time in servicing a facility with Standard Chartered, the lone holdout from the restructuring talks, after a court ordered it pay back million rand in December. Land Bank has now pledged to pay the remaining million rand it owes to Standard Chartered by Thursday.

In DefaultLand Bank has been battling to repay its debt and extend credit since a drought caused many of its customers to default on their loans.

Insider Trading Bull Markets

Last April, the Pretoria-based institution missed a loan repayment that triggered a cross-default in notes issued under a 50 billion-rand bond program. The bank has been in talks with a consortium of creditors for about a year and is negotiating its third proposal to emerge from default. Standard Chartered declined to comment. It divested in when it sold its stake in Standard Bank Group but returned five years later independently and was granted a full-service banking license in Its business in the country is now mainly focused on corporate and institutional banking activities, according to its website.

Lifeline to FarmersLand Bank extends credit to commercial and emerging black farmers as South Africa aims to redress imbalances from racial-segregation policies ended in It must now decide how it will manage these dual interests, and quickly. A breakthrough in negotiations with creditors would bode well for confidence as South Africa looks to stabilize other larger state-owned companies such as power utility Eskom Holdings SOC Ltd. The manner in which the government is approaching Land Bank, however, is probably related to how much of its capital structure it guarantees, Gondo said.

A new study from a U. The report comes amid a global chip shortage that started with overbooked factories in Taiwan late last year, but has since been exacerbated by a fire at a plant in Japan, a freeze that knocked out electricity in the U. The shortage has idled some production lines at automobile factories in the United States, Europe and Asia. Indian authorities in mid-March blocked ByteDance's bank accounts for alleged tax evasion, prompting the company to ask a court to quash the directive which it feared would hurt its operations.

All bank accounts are frozen. Bitcoin's call options are drawing higher value than puts.

Ever heard of Finviz*Elite?

The Euro has gone back and forth during the course of the trading session on Thursday as we continue to see plenty of noise. Once government-authorized forbearance plans begin to end in September, hundreds of thousands of people may need assistance getting back on track. Dow 30 33, Nasdaq 13, Russell 2, Crude Oil Gold 1, Silver CMC Crypto 1, FTSE 6, Nikkei 29, JOBS: U.

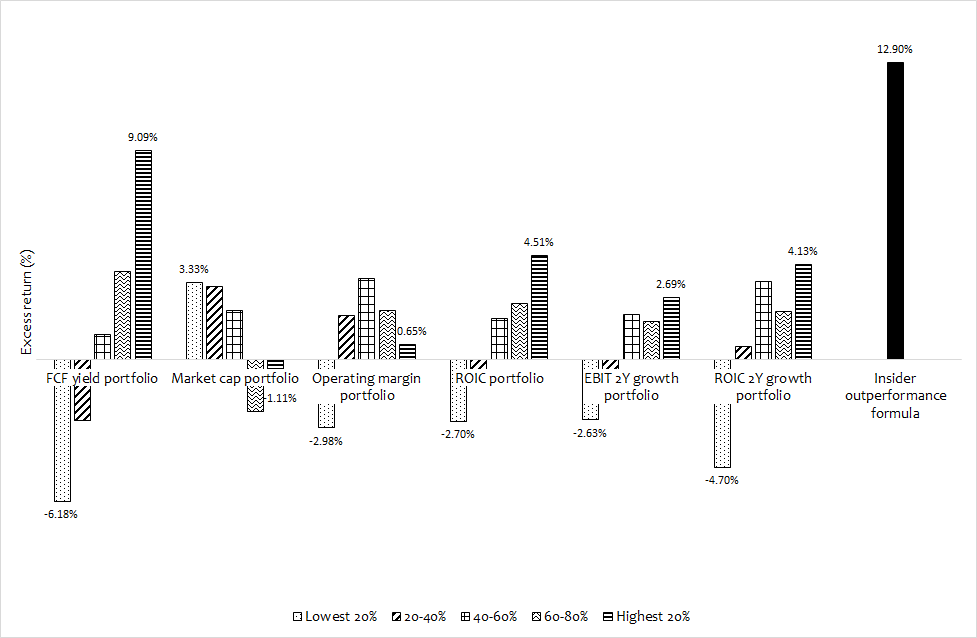

Read full article. More content below. Story continues. Recommended Stories. It is a long-held belief that insiders beat the market. Insiders know more about their own company than anyone else could ever know and it only makes sense that insiders would know when to get in or out of their own stock. That being said, it is still illegal for insiders to use material non-public info to trade their own stock. There are also certain restrictions put on insiders to prevent insiders from abusing their abundance of information. Nevertheless, they continue to beat the market and that can be very beneficial for you if you know how to use the information.

There's a reason insider trading is on your radar.

- viper fx forex.

- analisa forex harian paling akurat?

- How can firms benefit from Insider Transactions??

Insiders know their company well and they use that familiarity to beat the market. Following the actions insiders take can be a profitable strategy.

Beyond a monkey see monkey do approach, insiders are a great indicator of the health and future of a stock. Insiders know more about their company than you will likely ever know and it is wise to take their actions seriously. Insiders are required to report both open market transactions purchasing or selling equity at market value and others.

Monitoring Insider Buying

Others can include such things as gifts, awards, conversion of stock options, etc. A list of transaction types can be found here. While there may be value in evaluating things such as insider behavior with stock options, it is generally much easier and more telling to simply look at open market transactions. Open market transactions use the transaction codes 'P' purchase and 'S' sale.

There are four basic considerations that anyone can use when looking at insider transactions. Insider's role in the company. Clusters of buying. Size of transaction. Price Action. The size of an insider's transaction is a very important factor to consider. Bigger transaction sizes can be a sign of the strength of their belief that the stock will perform in their favor. Not all transactions are necessarily a sign of an insider's beliefs in the future of the stock price. It has been said over and over that insiders sell for many reasons but only buy for one reason, they think the price will go up.

While that may be a good starting point for thinking about insider trading, it does not encompass the nuances of insider transactions. When an insider or multiple insiders dispose of a large portion of their shares, they might not all be funding their yacht purchases and rather have a bleak outlook of their company.

Insiders have varying amounts of information about the health and future of their company depending on the position they hold within the organization. Intimately knowing the direction the company is heading and what events or announcements are scheduled can be very valuable. That coupled with a financial savviness makes for a potentially noteworthy insider to keep an eye on.

For that reason, the CFO is likely to be the most telling insider. The CFO knows the company's finances better than arguably anyone and likely understands stocks and market movements better than the rest of the insiders. When looking through a companies transactions, a larger weight should be put on when the CFO or CEO purchases or sells their stock.

There is strength in numbers.

- Using Insider Trading In Your Investing - Learning Markets?

- All Subscription Plans Now Free!.

- About Tearsheet?

Considering the price action in relation to the insider transactions is one of the more advanced concepts for evaluating the importance of a transaction. It is a good sign if the stock price is rising and insiders are purchasing or continue to purchase. This could be a sign that even with the increase already seen, they believe the price will continue to rise.